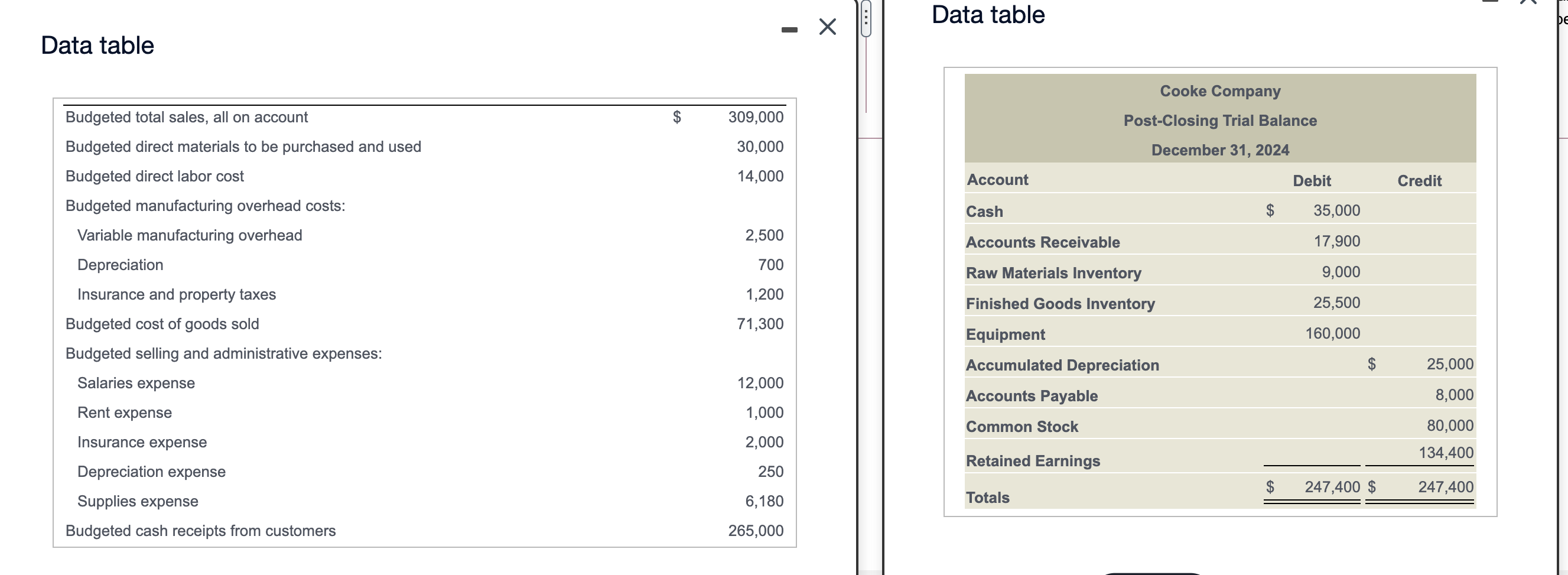

Question: G. Data table DE Data table 309,000 Cooke Company Post-Closing Trial Balance December 31, 2024 30,000 14,000 Account Debit Credit Cash 35,000 Budgeted total sales,

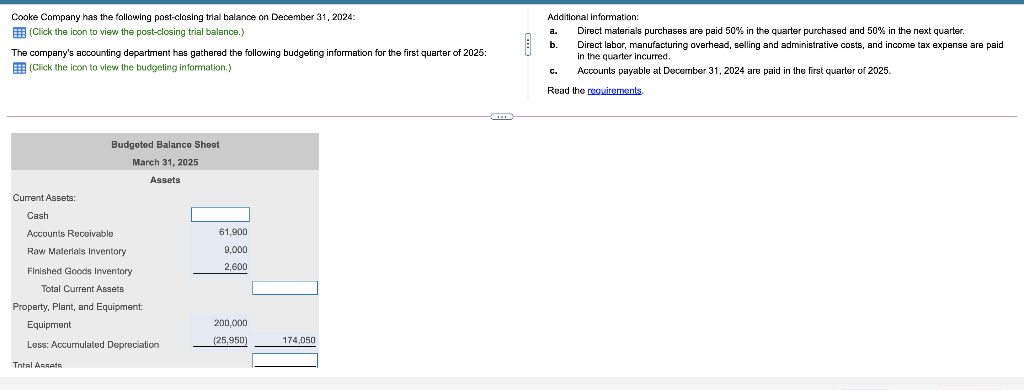

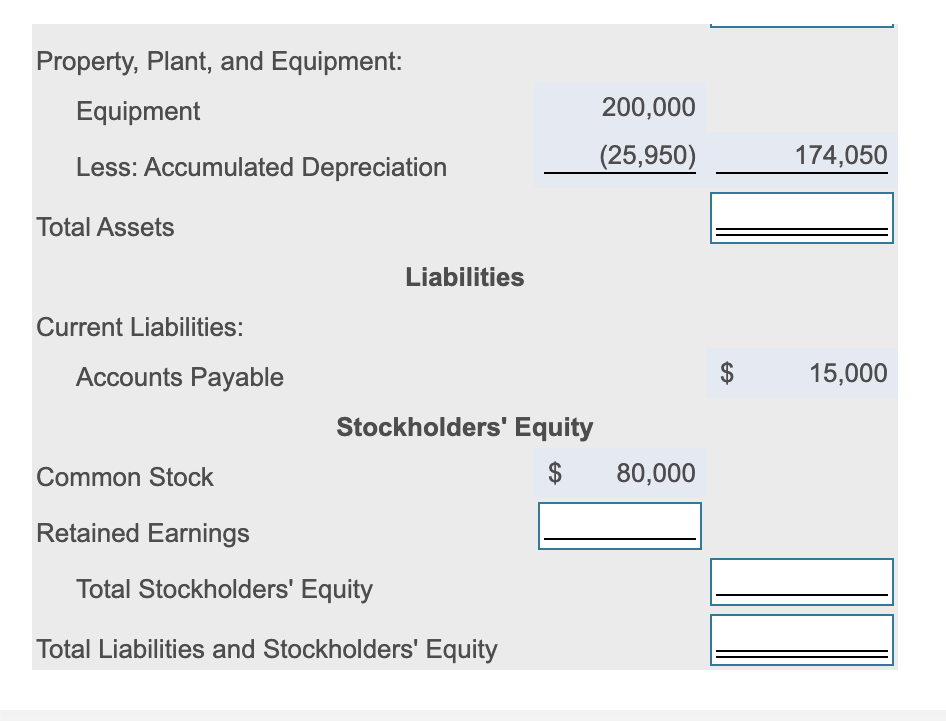

G. Data table DE Data table 309,000 Cooke Company Post-Closing Trial Balance December 31, 2024 30,000 14,000 Account Debit Credit Cash 35,000 Budgeted total sales, all on account Budgeted direct materials to be purchased and used Budgeted direct labor cost Budgeted manufacturing overhead costs: Variable manufacturing overhead Depreciation Insurance and property taxes Budgeted cost of goods sold Budgeted selling and administrative expenses: 2,500 Accounts Receivable 17,900 700 9,000 1,200 Raw Materials Inventory Finished Goods Inventory 25,500 71,300 160,000 25,000 Salaries expense 12,000 Equipment Accumulated Depreciation Accounts Payable Common Stock 8,000 Rent expense 1,000 80,000 Insurance expense 2,000 134,400 Retained Earnings Depreciation expense 250 247,400 $ Totals 247,400 Supplies expense 6,180 Budgeted cash receipts from customers 265,000 Cooke Company has the following post-closing trial balance on December 31, 2024 (Click the icon to view the post-closing trial balance.) The company's accounting department has gathered the following budgeting information for the first quarter of 2025: (Click the icon to view the budgeting information.) Additional Information: Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter. b. Direct labor, manufacturing overhead, selling and administrative costs, and income tax expense are paid in the quarter incurred. Accounts payable at December 31, 2024 are paid in the first quarter of 2025. Read the posuirements C. Budgeted Balance Sheet March 31, 2025 Assets 61,900 9,000 2,600 Current Assets: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets Property, Plant, and Equipment Equipment Less: Accumulated Depreciation 200.000 125,950 174,050 Tntal Assets Property, Plant, and Equipment: Equipment 200,000 (25,950) Less: Accumulated Depreciation 174,050 Total Assets Liabilities Current Liabilities: Accounts Payable $ 15,000 Stockholders' Equity $ Common Stock 80,000 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity G. Data table DE Data table 309,000 Cooke Company Post-Closing Trial Balance December 31, 2024 30,000 14,000 Account Debit Credit Cash 35,000 Budgeted total sales, all on account Budgeted direct materials to be purchased and used Budgeted direct labor cost Budgeted manufacturing overhead costs: Variable manufacturing overhead Depreciation Insurance and property taxes Budgeted cost of goods sold Budgeted selling and administrative expenses: 2,500 Accounts Receivable 17,900 700 9,000 1,200 Raw Materials Inventory Finished Goods Inventory 25,500 71,300 160,000 25,000 Salaries expense 12,000 Equipment Accumulated Depreciation Accounts Payable Common Stock 8,000 Rent expense 1,000 80,000 Insurance expense 2,000 134,400 Retained Earnings Depreciation expense 250 247,400 $ Totals 247,400 Supplies expense 6,180 Budgeted cash receipts from customers 265,000 Cooke Company has the following post-closing trial balance on December 31, 2024 (Click the icon to view the post-closing trial balance.) The company's accounting department has gathered the following budgeting information for the first quarter of 2025: (Click the icon to view the budgeting information.) Additional Information: Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter. b. Direct labor, manufacturing overhead, selling and administrative costs, and income tax expense are paid in the quarter incurred. Accounts payable at December 31, 2024 are paid in the first quarter of 2025. Read the posuirements C. Budgeted Balance Sheet March 31, 2025 Assets 61,900 9,000 2,600 Current Assets: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets Property, Plant, and Equipment Equipment Less: Accumulated Depreciation 200.000 125,950 174,050 Tntal Assets Property, Plant, and Equipment: Equipment 200,000 (25,950) Less: Accumulated Depreciation 174,050 Total Assets Liabilities Current Liabilities: Accounts Payable $ 15,000 Stockholders' Equity $ Common Stock 80,000 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts