Question: G Determine the equipment's book value. Equipment book value = 3 $ % EU More info a. The business has interest expense of $3,900

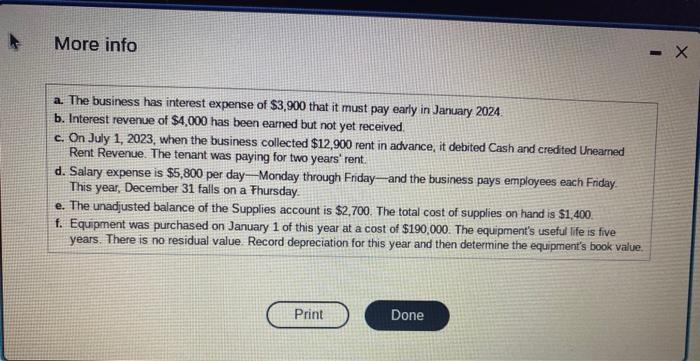

G Determine the equipment's book value. Equipment book value = 3 $ % EU More info a. The business has interest expense of $3,900 that it must pay early in January 2024 b. Interest revenue of $4,000 has been earned but not yet received. c. On July 1, 2023, when the business collected $12,900 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years' rent. d. Salary expense is $5,800 per day-Monday through Friday and the business pays employees each Friday. This year, December 31 falls on a Thursday. e. The unadjusted balance of the Supplies account is $2,700. The total cost of supplies on hand is $1,400. f. Equipment was purchased on January 1 of this year at a cost of $190,000. The equipment's useful life is five years. There is no residual value. Record depreciation for this year and then determine the equipment's book value. Print Done - X

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

SOLUTION To determine the equipments book value we need to consider the depreciation expense for the ... View full answer

Get step-by-step solutions from verified subject matter experts