Question: g . Double declining balance method. Compute depreciation for all 3 years of the asset's life using the double declining balance method. Round the rate

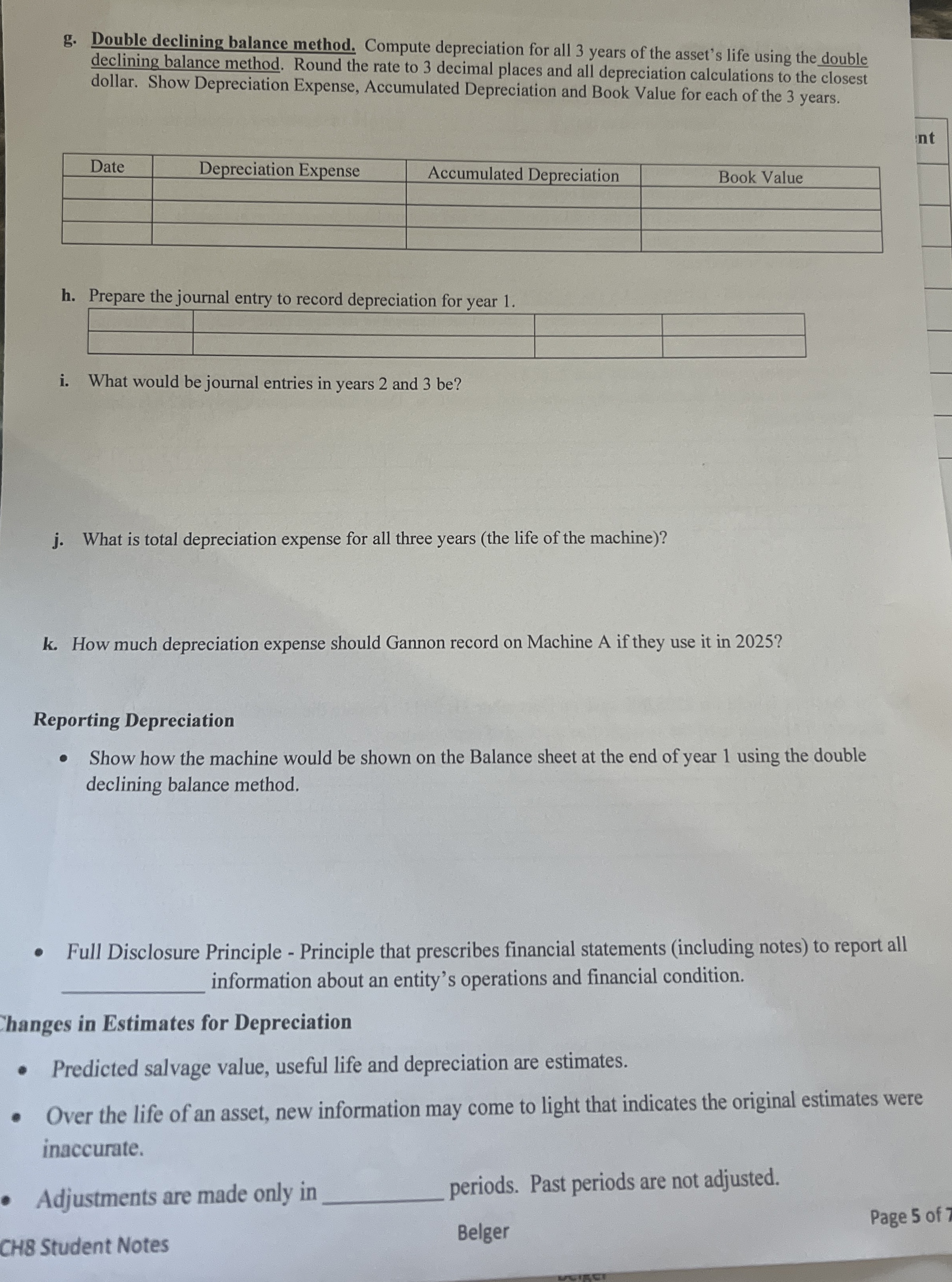

g Double declining balance method. Compute depreciation for all years of the asset's life using the double declining balance method. Round the rate to decimal places and all depreciation calculations to the closest dollar. Show Depreciation Expense, Accumulated Depreciation and Book Value for each of the years.

tableDateDepreciation Expense,Accumulated Depreciation,Book Value

h Prepare the iournal entry to record denreciation for viana

i What would be journal entries in years and be

j What is total depreciation expense for all three years the life of the machine

k How much depreciation expense should Gannon record on Machine A if they use it in

Reporting Depreciation

Show how the machine would be shown on the Balance sheet at the end of year using the double declining balance method.

Full Disclosure Principle Principle that prescribes financial statements including notes to report all information about an entity's operations and financial condition.

Thanges in Estimates for Depreciation

Predicted salvage value, useful life and depreciation are estimates.

Over the life of an asset, new information may come to light that indicates the original estimates were inaccurate.

Adjustments are made only in periods. Past periods are not adjusted.

CH Student Notes

Belger

Page of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock