g Enabled: Final Exam

Saved

Help

Save & Exit

Required information

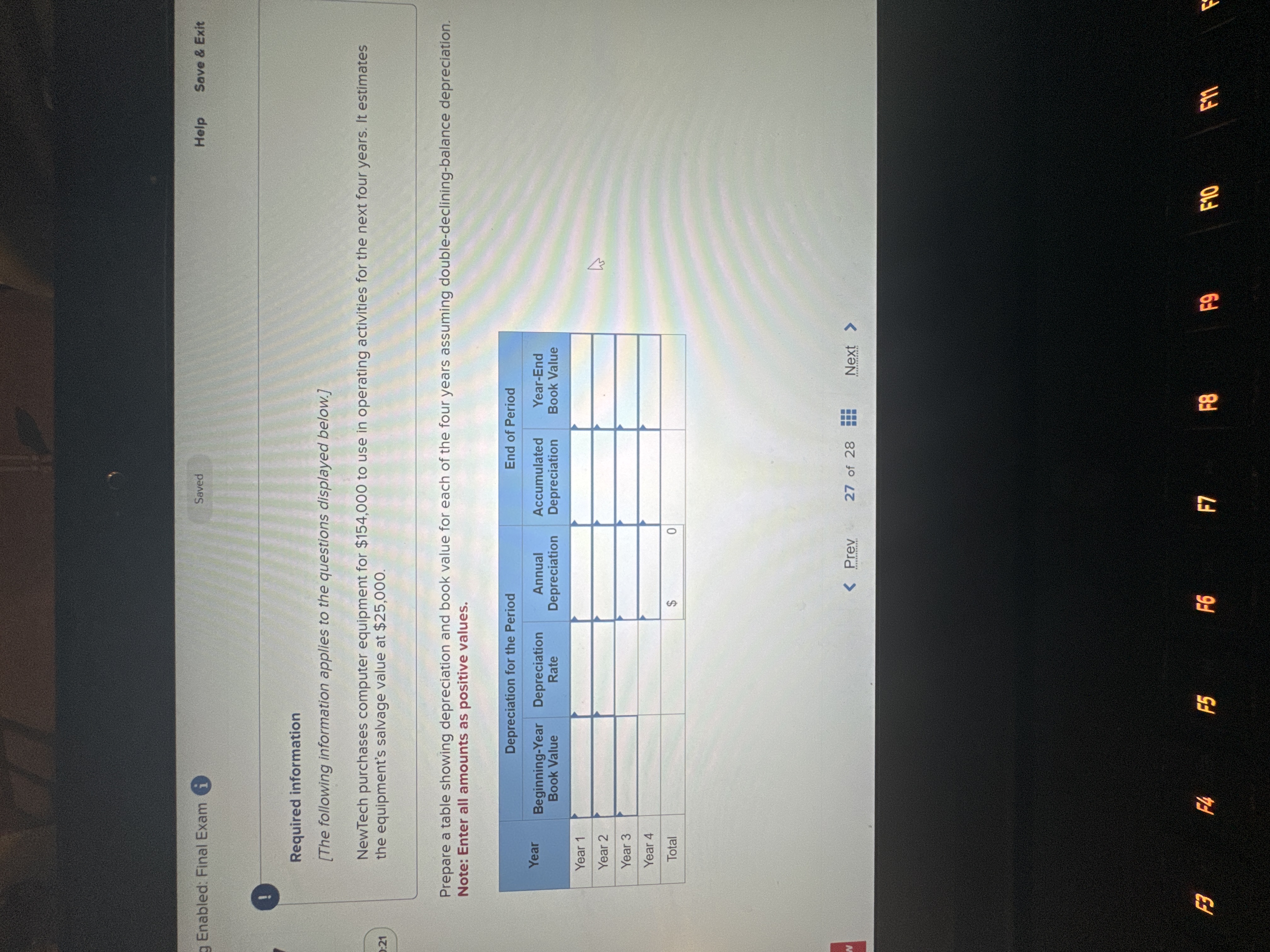

The following information applies to the questions displayed below.

NewTech purchases computer equipment for $ to use in operating activities for the next four years. It estimates the equipment's salvage value at $

Prepare a table showing depreciation and book value for each of the four years assuming doubledecliningbalance depreciation.

Note: Enter all amounts as positive values.

begintabularcccccc

hline & multicolumnc Depreciation for the Period & multicolumnc End of Period

hline Year & begintabularc

BeginningYear

Book Value

endtabular & begintabularc

Depreciation

Rate

endtabular & begintabularc

Annual

Depreciation

endtabular & begintabularc

Accumulated

Depreciation

endtabular & begintabularc

YearEnd

Book Value

endtabular

hline Year & & & & &

hline Year & & & & &

hline Year & & & & &

hline Year & & & & &

hline Total & & & $ & &

hline

endtabular

Prev

of

Next