Question: g Enabled: MH Lab 3: Relevant Costing i Saved Help Save & Santosh Plastics Inc. purchased a new machine one year ago at a cost

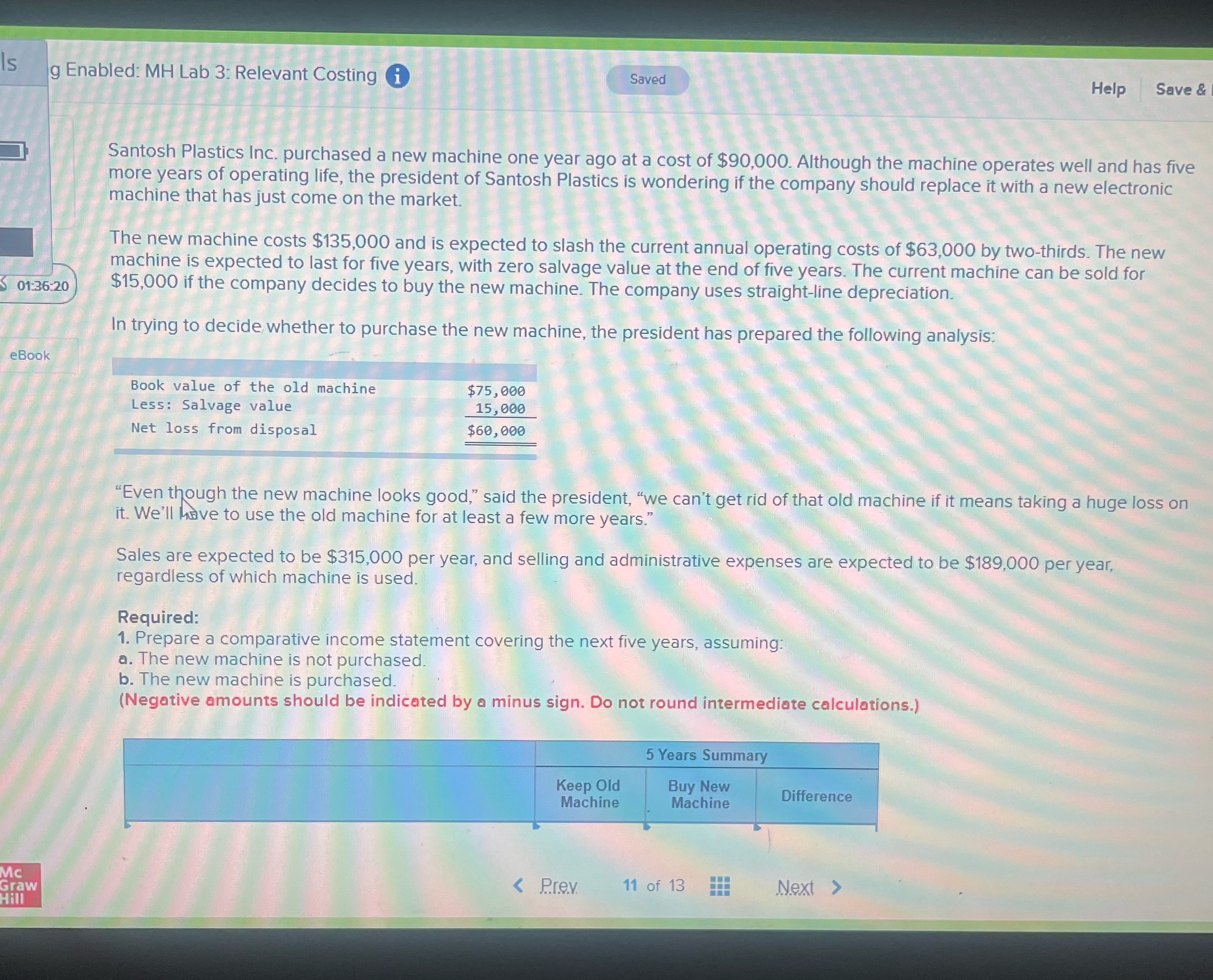

g Enabled: MH Lab 3: Relevant Costing i Saved Help Save & Santosh Plastics Inc. purchased a new machine one year ago at a cost of $90,000. Although the machine operates well and has five more years of operating life, the president of Santosh Plastics is wondering if the company should replace it with a new electronic machine that has just come on the market. The new machine costs $135,000 and is expected to slash the current annual operating costs of $63,000 by two-thirds. The new machine is expected to last for five years, with zero salvage value at the end of five years. The current machine can be sold for 01:36:20 $15,000 if the company decides to buy the new machine. The company uses straight-line depreciation. In trying to decide whether to purchase the new machine, the president has prepared the following analysis: eBook Book value of the old machine $75, 000 Less: Salvage value 15, 000 Net loss from disposal $60, 000 "Even though the new machine looks good," said the president, "we can't get rid of that old machine if it means taking a huge loss on it. We'll have to use the old machine for at least a few more years." Sales are expected to be $315,000 per year, and selling and administrative expenses are expected to be $189,000 per year, regardless of which machine is used. Required: 1. Prepare a comparative income statement covering the next five years, assuming: a. The new machine is not purchased. b. The new machine is purchased. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) 5 Years Summary Keep Old Buy New Machine Machine Difference MIC Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts