Question: G) Financial Statement Analysis. Projected Statement of Cash Flows. Predict a years of projected statements starting with the most recent year after the companys last

- G) Financial Statement Analysis.

- Projected Statement of Cash Flows.

- Predict a years of projected statements starting with the most recent year after the companys last issued report.

- Other information relating to projected tabs:

- Projections should be based on research performed on your company and its industry. Use historical, trend, ratio data and current and future economic projections as well as information from the companys MD&A to aid in preparing projections.

- Clearly state your assumptions in a text box at the bottom of each tab. Cite sources for assumptions based on research.

- Other information relating to projected tabs:

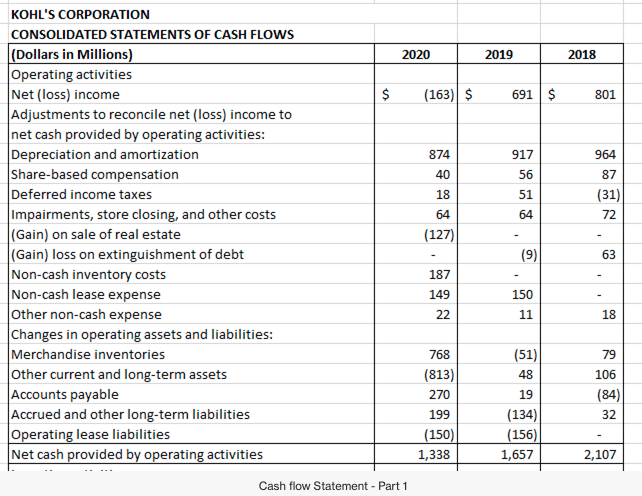

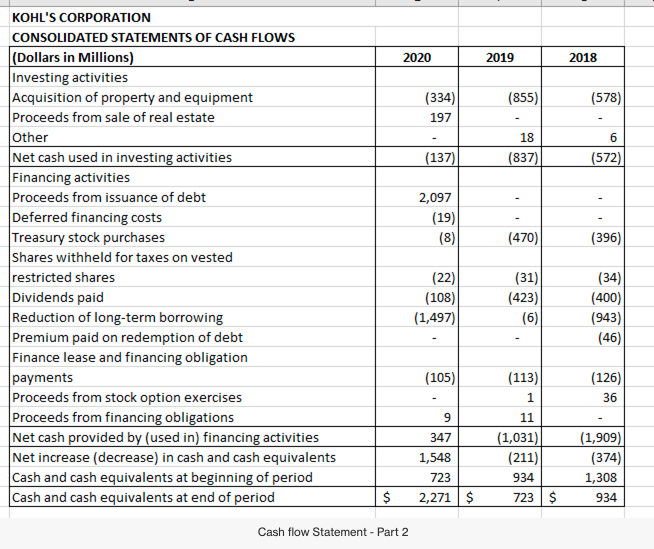

2020 2019 2018 $ $ (163) $ 691 $ 801 917 964 874 40 56 18 51 87 (31) 72 64 64 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in Millions) Operating activities Net (loss) income Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization Share-based compensation Deferred income taxes Impairments, store closing, and other costs (Gain) on sale of real estate (Gain) loss on extinguishment of debt Non-cash inventory costs Non-cash lease expense Other non-cash expense Changes in operating assets and liabilities: Merchandise inventories Other current and long-term assets Accounts payable Accrued and other long-term liabilities Operating lease liabilities Net cash provided by operating activities (127) (9) 63 187 149 22 150 11 18 (51) 48 79 106 (84) 19 768 (813) 270 199 (150) 1,338 32 (134) (156) 1,657 2,107 Cash flow Statement - Part 1 2020 2019 2018 (855) (578) (334) 197 18 6 (137) (837) (572) 2,097 (19) (8) (470) (396) KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in Millions) Investing activities Acquisition of property and equipment Proceeds from sale of real estate Other Net cash used in investing activities Financing activities Proceeds from issuance of debt Deferred financing costs Treasury stock purchases shares withheld for taxes on vested restricted shares Dividends paid Reduction of long-term borrowing Premium paid on redemption of debt Finance lease and financing obligation payments Proceeds from stock option exercises Proceeds from financing obligations Net cash provided by (used in) financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (22) (108) (1,497) (31) (423) (34) (400) (943) (46) (6) (105) (113) 1 (126) 36 9 11 347 1,548 723 2,271 $ (1,031) (211) 934 723$ (1,909) (374) 1,308 934 $ Cash flow Statement - Part 2 2020 2019 2018 $ $ (163) $ 691 $ 801 917 964 874 40 56 18 51 87 (31) 72 64 64 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in Millions) Operating activities Net (loss) income Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization Share-based compensation Deferred income taxes Impairments, store closing, and other costs (Gain) on sale of real estate (Gain) loss on extinguishment of debt Non-cash inventory costs Non-cash lease expense Other non-cash expense Changes in operating assets and liabilities: Merchandise inventories Other current and long-term assets Accounts payable Accrued and other long-term liabilities Operating lease liabilities Net cash provided by operating activities (127) (9) 63 187 149 22 150 11 18 (51) 48 79 106 (84) 19 768 (813) 270 199 (150) 1,338 32 (134) (156) 1,657 2,107 Cash flow Statement - Part 1 2020 2019 2018 (855) (578) (334) 197 18 6 (137) (837) (572) 2,097 (19) (8) (470) (396) KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in Millions) Investing activities Acquisition of property and equipment Proceeds from sale of real estate Other Net cash used in investing activities Financing activities Proceeds from issuance of debt Deferred financing costs Treasury stock purchases shares withheld for taxes on vested restricted shares Dividends paid Reduction of long-term borrowing Premium paid on redemption of debt Finance lease and financing obligation payments Proceeds from stock option exercises Proceeds from financing obligations Net cash provided by (used in) financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (22) (108) (1,497) (31) (423) (34) (400) (943) (46) (6) (105) (113) 1 (126) 36 9 11 347 1,548 723 2,271 $ (1,031) (211) 934 723$ (1,909) (374) 1,308 934 $ Cash flow Statement - Part 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts