Question: G HOME ( 2 ) PROFILE Back to Assignment Attempts Their Valuation Search this course Search this course 7 . Problem 9 . 1 7

G HOME

PROFILE

Back to Assignment

Attempts

Their Valuation

Search this course

Search this course

Problem

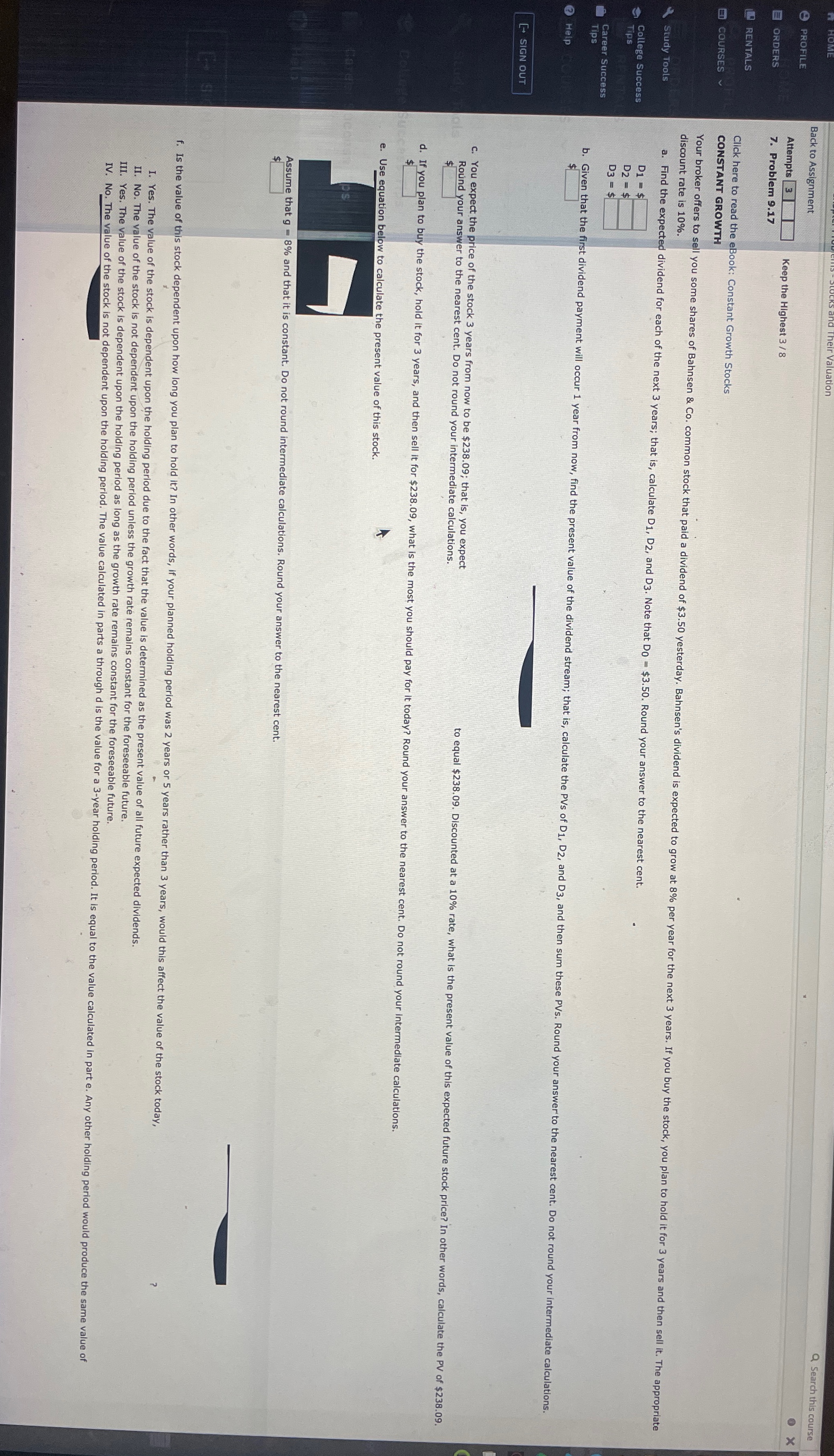

Click here to read the eBook: Constant Growth Stocks

COURSES

study Tools

G

College Success

Colte

Tips

Career Success

Tips

Help

SIGN OUT

c You expect the price of the stock years from now to be $; that is you expect $ Round your answer to the nearest cent. Do not round your intermediate calculations. to equal $ Discounted at a rate, what is the present value of this expected future stock price? In other words, calculate the PV of $

e Use equation below to calculate the present value of this stock.

$ Assume that and that it is constant. Do not round intermediate calculations. Round your answer to the nearest cent.

$

I. Yes. The value of the stock is dependent upon the holding period due to the fact that the value is determined as the present value of all future expected dividends.

II No The value of the stock is not dependent upon the holding period unless the growth rate remains constant for the foreseeable future.

III. Yes. The value of the stock is dependent upon the holding period as long as the growth rate remains constant for the foreseeable future.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock