Question: g . On December 3 1 , PPSS had $ 4 , 7 0 0 of pool cleaning supplies on hand after purchasing supplies costing

g On December PPSS had $ of pool cleaning supplies on hand after purchasing supplies costing $

during the year from Pool Corporation, Incorporated.

h PPSS estimated that depreciation on its buildings and equipment was $ for the year.

i At December $ of interest on investments was earned that will be received in the next year.

j The company's income tax rate for the year was percent. Prepare an income statement including earnings per share

Note: Do not round intermediate calculations. Round "Earnings per share" to decimal places.Balance Sheet

On December

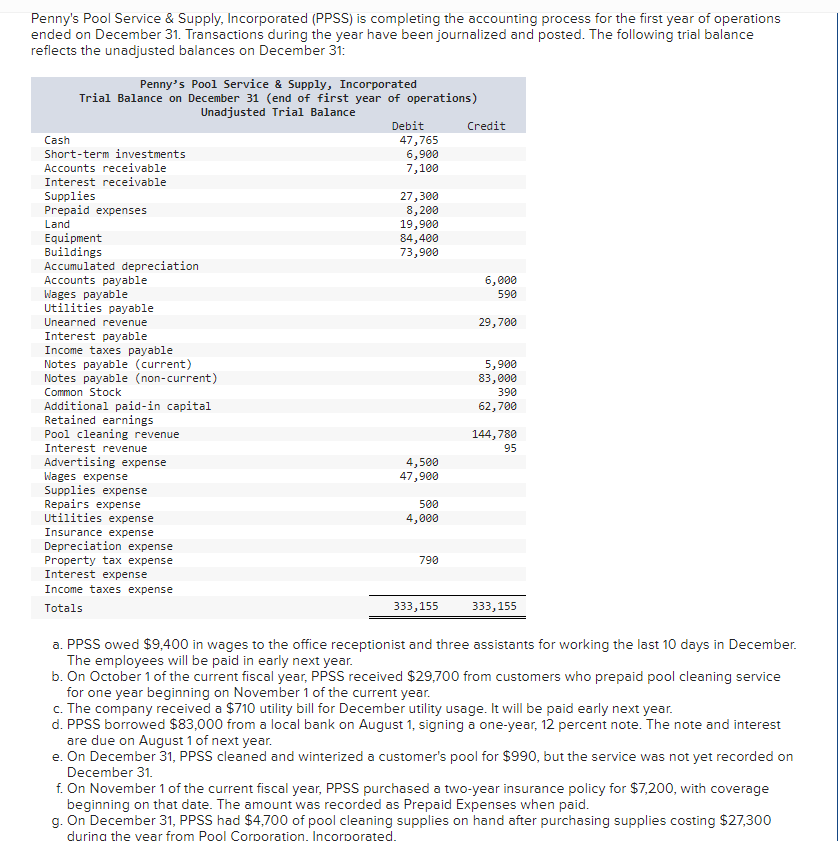

tableAssetsCurrent Assets:CashShortterm investments,?,Accounts receivable,rInterest receivable,SuppliesPrepaid expenses,?,Total current assets,,LandEquipmentBuildingsAccumulated depreciation,?,Net property and equipment,,Total Assets,$Liabilities and Stockholder's EquityCurrent Liabilities:Accounts payable,?,Wages payable,Utilities payable,,Unearned revenue,,Interest payable,,Income taxes payable,,Notes payable currentPTotal current liabilities,,Notes payable noncurrentPTotal liabilities,,Stockholders equityCommon stock,,Additional paidin capital,,Retained earnings,,Total stockholder's equity,,Total Liabilities and Stockholder's Equity,$Pennys Pool Service & Supply, Incorporated PPSS is completing the accounting process for the first year of operations

ended on December Transactions during the year have been journalized and posted. The following trial balance

reflects the unadjusted balances on December :

a PPSS owed $ in wages to the office receptionist and three assistants for working the last days in December.

The employees will be paid in early next year.

b On October of the current fiscal year, PPSS received $ from customers who prepaid pool cleaning service

for one year beginning on November of the current year.

c The company received a $ utility bill for December utility usage. It will be paid early next year.

d PPSS borrowed $ from a local bank on August signing a oneyear, percent note. The note and interest

are due on August of next year.

e On December PPSS cleaned and winterized a customer's pool for $ but the service was not yet recorded on

December

f On November of the current fiscal year, PPSS purchased a twoyear insurance policy for $ with coverage

beginning on that date. The amount was recorded as Prepaid Expenses when paid.

g On December PPSS had $ of pool cleaning supplies on hand after purchasing supplies costing $

durina the vear from Pool Corboration. Incorborated.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock