Question: g. Prepare the income statement and a retained earnings statement for March and a classified statement of financial position at March 31. h. Journalize and

g. Prepare the income statement and a retained earnings statement for March and a classified statement of financial position at March 31. h. Journalize and post closing entries and complete the closing process.

g. Prepare the income statement and a retained earnings statement for March and a classified statement of financial position at March 31. h. Journalize and post closing entries and complete the closing process.

i. Prepare a post-closing trial balance at March 31.

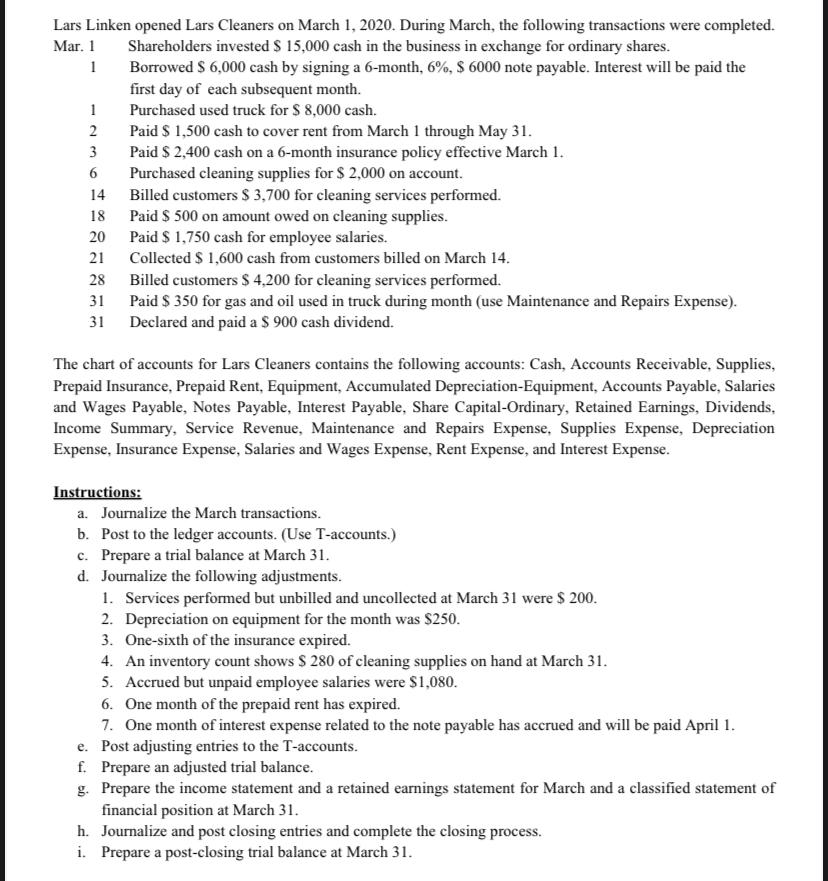

Lars Linken opened Lars Cleaners on March 1, 2020. During March, the following transactions were completed. Mar. 1 Shareholders invested $15,000 cash in the business in exchange for ordinary shares. 1 Borrowed $6,000 cash by signing a 6-month, 6%,$6000 note payable. Interest will be paid the first day of each subsequent month. 1 Purchased used truck for $8,000 cash. 2 Paid $1,500 cash to cover rent from March 1 through May 31 . 3 Paid $2,400 cash on a 6-month insurance policy effective March 1. 6 Purchased cleaning supplies for $2,000 on account. 14 Billed customers $3,700 for cleaning services performed. 18 Paid $500 on amount owed on cleaning supplies. 20 Paid $1,750 cash for employee salaries. 21 Collected \$1,600 cash from customers billed on March 14 . 28 Billed customers $4,200 for cleaning services performed. 31 Paid $350 for gas and oil used in truck during month (use Maintenance and Repairs Expense). 31 Declared and paid a $900 cash dividend. The chart of accounts for Lars Cleaners contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable, Notes Payable, Interest Payable, Share Capital-Ordinary, Retained Earnings, Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Rent Expense, and Interest Expense. Instructions: a. Journalize the March transactions. b. Post to the ledger accounts. (Use T-accounts.) c. Prepare a trial balance at March 31 . d. Journalize the following adjustments. 1. Services performed but unbilled and uncollected at March 31 were $200. 2. Depreciation on equipment for the month was $250. 3. One-sixth of the insurance expired. 4. An inventory count shows $280 of cleaning supplies on hand at March 31 . 5. Accrued but unpaid employee salaries were $1,080. 6. One month of the prepaid rent has expired. 7. One month of interest expense related to the note payable has accrued and will be paid April 1 . e. Post adjusting entries to the T-accounts. f. Prepare an adjusted trial balance. g. Prepare the income statement and a retained earnings statement for March and a classified statement of financial position at March 31. h. Journalize and post closing entries and complete the closing process. i. Prepare a post-closing trial balance at March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts