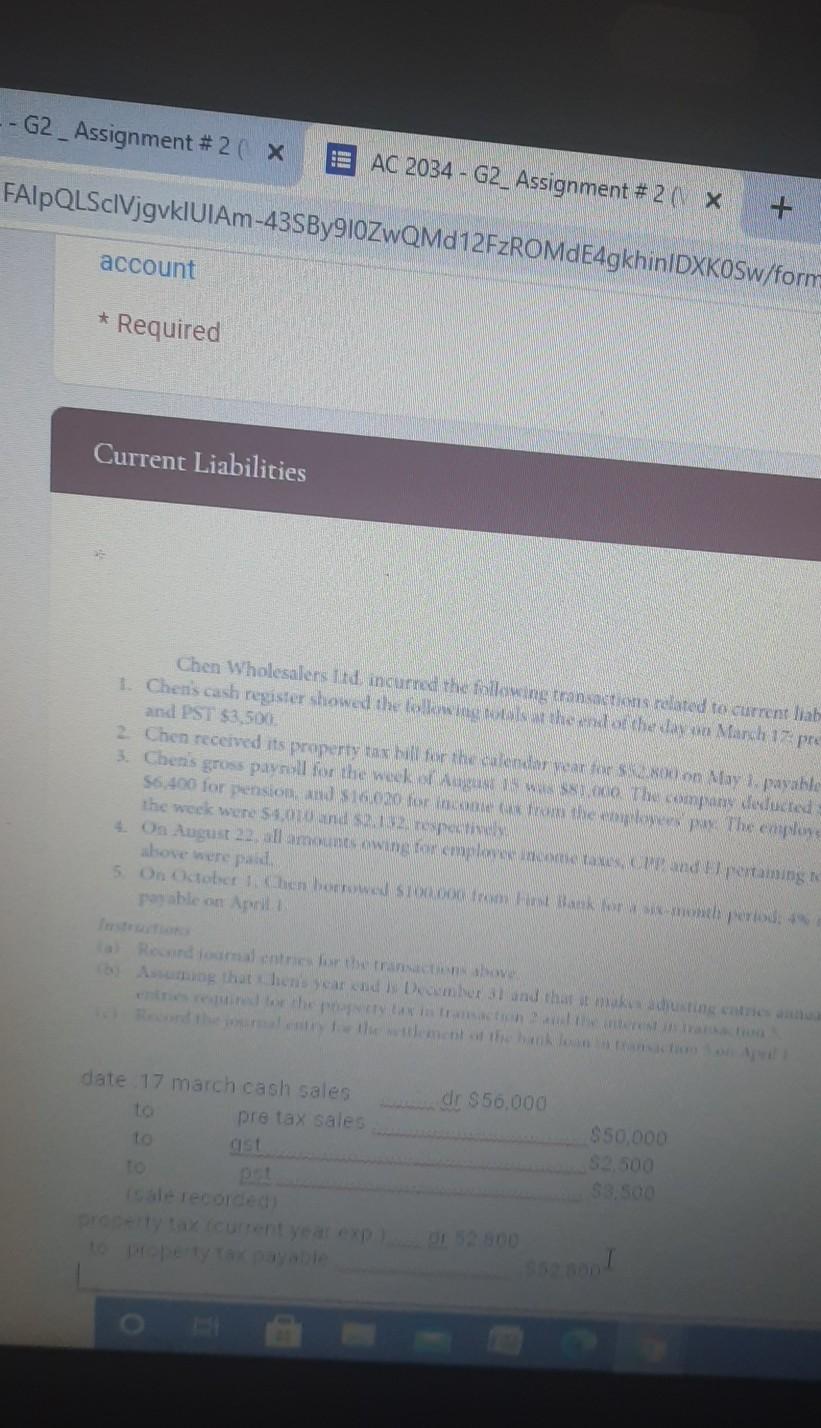

Question: --G2_Assignment #2 ( x AC 2034 - 62_ Assignment # 2 (X FAIpQLSclVjgvkIVIAm-43SBy910ZWQMd12FzROMDE4gkhin|DXKOSw/form + account * Required Current Liabilities Chen Wholesalers itd, ingurned the wine

--G2_Assignment #2 ( x AC 2034 - 62_ Assignment # 2 (X FAIpQLSclVjgvkIVIAm-43SBy910ZWQMd12FzROMDE4gkhin|DXKOSw/form + account * Required Current Liabilities Chen Wholesalers itd, ingurned the wine transactions related to current lab 1. Chen's cash register showed the following them in March pre and PST $3,500 2 Chen received its property tax bill for the car wars May payable 3. Chen's gross paynall for the week of wompany deducted 56.400 for pension, 1600 forinconcie www The employs the week were stand optimal 4. On August 22. alamount winstoneplove and pertaming above were paid 5 On October then boerewed 10 Bank-moliy pable on April by Assuming that hen't year and Dember 3l and that it makusting entries date 17 march cash sales to pre tax sale dr $50,000 $50,000 --G2_Assignment #2 ( x AC 2034 - 62_ Assignment # 2 (X FAIpQLSclVjgvkIVIAm-43SBy910ZWQMd12FzROMDE4gkhin|DXKOSw/form + account * Required Current Liabilities Chen Wholesalers itd, ingurned the wine transactions related to current lab 1. Chen's cash register showed the following them in March pre and PST $3,500 2 Chen received its property tax bill for the car wars May payable 3. Chen's gross paynall for the week of wompany deducted 56.400 for pension, 1600 forinconcie www The employs the week were stand optimal 4. On August 22. alamount winstoneplove and pertaming above were paid 5 On October then boerewed 10 Bank-moliy pable on April by Assuming that hen't year and Dember 3l and that it makusting entries date 17 march cash sales to pre tax sale dr $50,000 $50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts