Question: G6 A B Hiteck Electronics sells a diagnostic machine to a hospital with a four-year payment plan. The company would like to estimate the bad

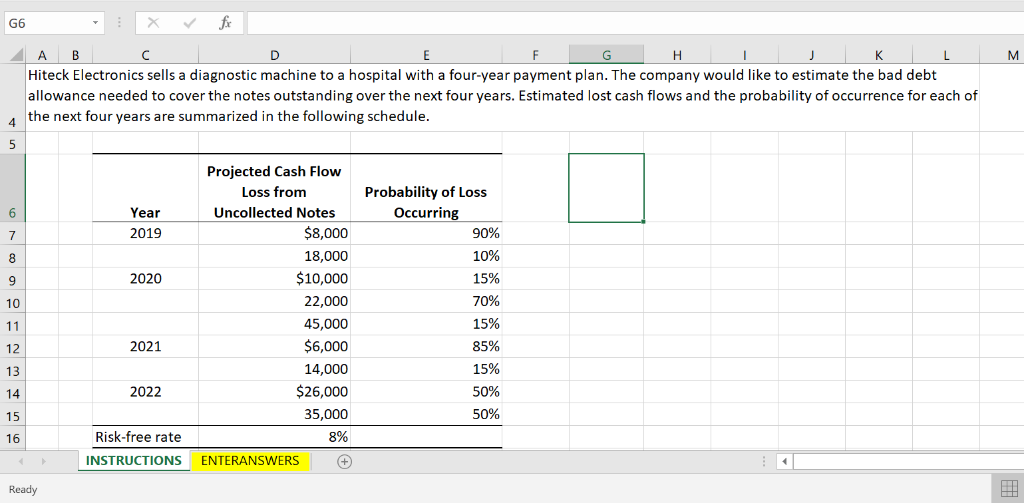

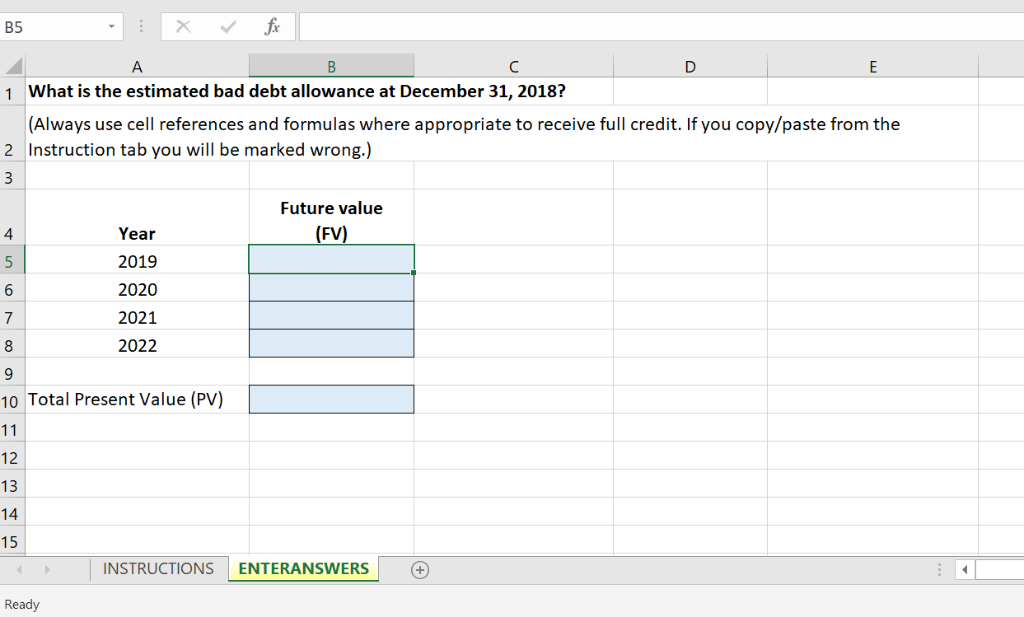

G6 A B Hiteck Electronics sells a diagnostic machine to a hospital with a four-year payment plan. The company would like to estimate the bad debt allowance needed to cover the notes outstanding over the next four years. Estimated lost cash flows and the probability of occurrence for each of the next four years are summarized in the following schedule Projected Cash Flow Loss from Uncollected Notes Probability of Loss Occurring Year $8,000 18,000 $10,000 22,000 45,000 $6,000 14,000 26,000 35,000 8% 90% 10% 15% 70% 15% 85% 15% 50% 50% 2019 2020 10 2021 12 13 14 15 16 2022 Risk-free rate INSTRUCTIONS ENTERANSWERS B5 What is the estimated bad debt allowance at December 31, 2018? (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong.) 1 2 Future value FV Year 2019 2020 2021 2022 4 10 Total Present Value (PV) 12 13 15 INSTRUCTIONS ENTERANSWERS Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts