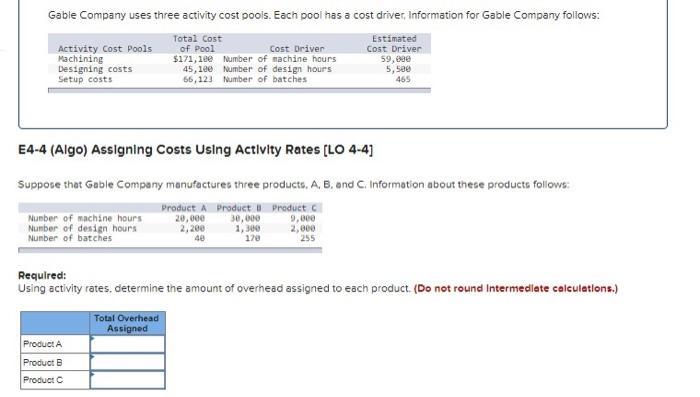

Question: Gable Company uses three activity cost pools. Each pool has a cost driver, Information for Gable Company follows: Estimated Cost Driver 59,000 5,500 465

![E4-5 (Algo) Assigning Costs Using Actlvity Proportlons [LO 4-5, 4-6]Suppose that Gable Company manufactures three products,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/12/6389b1a5a17fa_1669968592793.png)

Gable Company uses three activity cost pools. Each pool has a cost driver, Information for Gable Company follows: Estimated Cost Driver 59,000 5,500 465 Activity Cost Pools Machining Designing costs Setup costs E4-4 (Algo) Assigning Costs Using Activity Rates [LO 4-4] Suppose that Gable Company manufactures three products, A, B, and C. Information about these products follows: Product C Product A Product 20,000 30,000 9,000 2,200 1,300 2,000 40 170 255 Number of machine hours Number of design hours Number of batches Total Cost Cost Driver of Pool $171,100 Number of machine hours 45,100 Number of design hours 66,123 Number of batches Required: Using activity rates, determine the amount of overhead assigned to each product. (Do not round Intermediate calculations.) Product A Product B Product C Total Overhead Assigned Gable Company uses three activity cost pools. Each pool has a cost driver. Information for Gable Company follows: Estimated Cost Driver 59,000 5,500 465 Activity Cost Pools Machining Designing costs Setup costs E4-5 (Algo) Assigning Costs Using Activity Proportions [LO 4-5, 4-6] Number of machine hours Number of design hours Number of batches Total Cost of Pool Suppose that Gable Company manufactures three products, A, B, and C. Information about these products follows: Cost Driver $171,100 Number of machine hours 45,100 Number of design hours 66,123 Number of batches Product A Product B Product C Total Overhead Assigned Product A Product B Product C 30,000 20,000 2,200 40 1,300 170 Required: 1. Using activity proportions, determine the amount of overhead assigned to each product. (Do not round your intermediate calculations. Round your final answers to nearest whole number.) 9,000 2,000 255

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

The correct answer is Total Overhead Assigned Product A 81728 Product B 121834 Product C 78761 Note ... View full answer

Get step-by-step solutions from verified subject matter experts