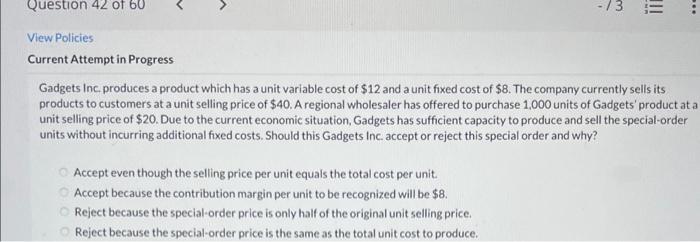

Question: Gadgets Inc, produces a product which has a unit variable cost of $12 and a unit fixed cost of $8. The company currently sells its

Gadgets Inc, produces a product which has a unit variable cost of $12 and a unit fixed cost of $8. The company currently sells its products to customers at a unit selling price of $40. A regional wholesaler has offered to purchase 1,000 units of Gadgets' product at a unit selling price of $20. Due to the current economic situation, Gadgets has sufficient capacity to produce and sell the special-order units without incurring additional fuxed costs. Should this Gadgets Inc. accept or reject this special order and why? Accept even though the selling price per unit equals the total cost per unit. Accept because the contribution margin per unit to be recognized will be $8. Reject because the special-order price is only half of the original unit selling price. Reject because the special-order price is the same as the total unit cost to produce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts