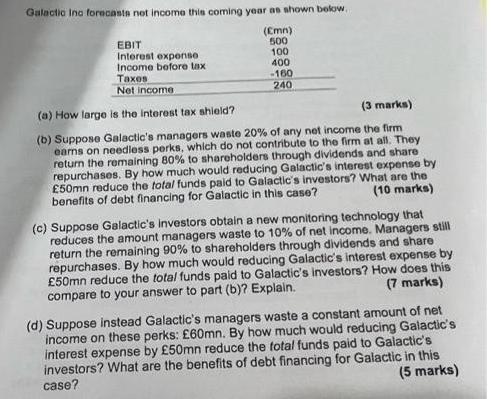

Question: Galactic Inc forecasts not income this coming year as shown below. (Emn) 500 100 400 -160 240 EBIT Interest expense Income before tax Taxes

Galactic Inc forecasts not income this coming year as shown below. (Emn) 500 100 400 -160 240 EBIT Interest expense Income before tax Taxes Net income (a) How large is the interest tax shield? (3 marks) (b) Suppose Galactic's managers waste 20% of any net income the firm earns on needless perks, which do not contribute to the firm at all. They return the remaining 80% to shareholders through dividends and share repurchases. By how much would reducing Galactic's interest expense by 50mn reduce the total funds paid to Galactic's investors? What are the (10 marks) benefits of debt financing for Galactic in this case? (c) Suppose Galactic's investors obtain a new monitoring technology that reduces the amount managers waste to 10% of net income. Managers still return the remaining 90% to shareholders through dividends and share repurchases. By how much would reducing Galactic's interest expense by 50mn reduce the total funds paid to Galactic's investors? How does this (7 marks) compare to your answer to part (b)? Explain. (d) Suppose instead Galactic's managers waste a constant amount of net income on these perks: 60mn. By how much would reducing Galactic's interest expense by 50mn reduce the total funds paid to Galactic's investors? What are the benefits of debt financing for Galactic in this case? (5 marks)

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

It seems you have an image with a question about the financials of a company called Galactic Inc For this task Ill break down the information and the subquestions accordingly From the image the data p... View full answer

Get step-by-step solutions from verified subject matter experts