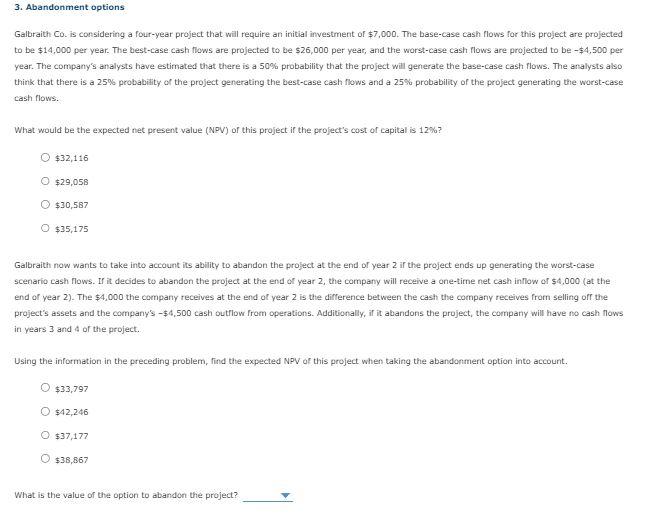

Question: Galbraith Co. is considering a four-year project that will require an initial investment of $7,000. The base-case cash flows for this praject are projected to

Galbraith Co. is considering a four-year project that will require an initial investment of $7,000. The base-case cash flows for this praject are projected to be $14,000 per year. The best-case cash flows are projected to be $26,000 per year, and the worst-case cash flows are projected to be - $4,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% prabability of the project generating the worst-case cash flows. What would be the expected net present value (NDV) of this project if the project's cost of capital is 12% ? $32,116$29,058$30,587$35,175 Galbraith now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project at the end or year 2 , the company will receive a one-time net cash inllow of $4, ooo (at the end of year 2 ). The $4,000 the company receives at the end of year 2 is the difference between the cast the company receives from selling off the project's assets and the company's $4,500 cash outflow from operations. Additionally, if it abandons the project, the company will have no cash flows in years 3 and it of the project. Using the information in the preceding problem, find the expected NPV of this project when taking the abandonment option into account. $33,797$42,246$37,177$36,867 What is the value of the option to abandon the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts