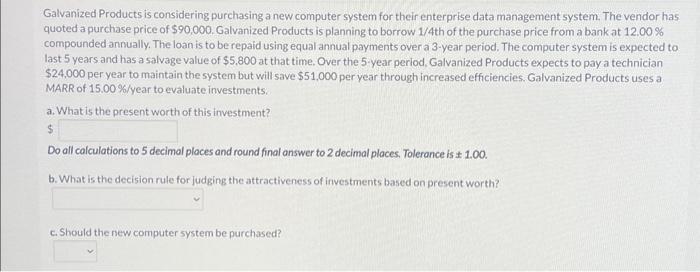

Question: Galvanized Products is considering purchasing a new computer system for their enterprise data management system. The vendor has quoted a purchase price of $90,000. Galvanized

Galvanized Products is considering purchasing a new computer system for their enterprise data management system. The vendor has quoted a purchase price of $90,000. Galvanized Products is planning to borrow 1/4 th of the purchase price from a bank at 12.00% compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer system is expected to last 5 years and has a salvage value of $5,800 at that time, Over the 5 -year period, Galvanized Products expects to pay a technician $24,000 per year to maintain the system but will save $51,000 per year through increased efficiencies. Galvanized Products uses a MARR of 15.00%/ year to evaluate investments. a. What is the present worth of this investment? $ Do all calculations to 5 decimal ploces and round final answer to 2 decimal ploces. Tolerance is \pm 1.00 . b. What is the decision rule for judging the attractiveness of investments based on present worth? c. Should the new computer system be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts