Question: Gamma Ltd ( Gamma ) and Extreme Ltd ( Extreme ) are both entities in the retail clothing sector. Gamma has

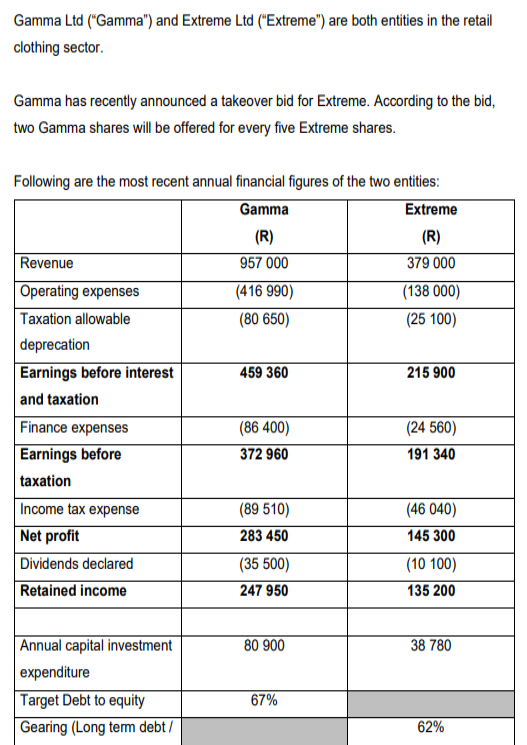

Gamma Ltd Gamma and Extreme Ltd Extreme are both entities in the retail clothing sector. Gamma has recently announced a takeover bid for Extreme. According to the bid, two Gamma shares will be offered for every five Extreme shares. Following are the most recent annual financial figures of the two entities:Gamma RExtreme RTaxation allowable deprecationEarnings before interest and taxationEarnings before taxationAnnual capital investment expenditure

Expected annual growth

rate in sales, operating

expenses including

depreciation capital

investments and

dividends for the next

years.

Expected annual growth

rate in sales, operating

expenses including

depreciation capital

investments and

dividends after the next

years.

Additional information:

The market premium in the retail clothing sector is

The South African year bonds offer a return of

The EBIT Margin will remain constant for all years.

Gamma will take over responsibility of the debt obligations of Extreme.

The South African Income Tax rate applicable to companies, is

The takeover is expected to result in savings in distribution and storage costs,

and consequently reduce Gamma's operating expenses including

depreciation to of revenue. The operating expenses of Extreme are also The operating expenses of Extreme are also expected to be of revenue after the merge. The growth rate of the combined entity is expected to be per year for three years and stabilize at per year thereafter. It may be assumed that revenue and costs relevant to the decision are in cash terms

Perform a free cash flow valuation and determine the current value of each Gamma Ltd ordinary share. Round to two decimal places if applicable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock