Question: Gamma Project: $350,000 at EOY1 increasing annually by 1% to EOY5; EOY5 revenues INCREASING by 0.5% annually from EOY6 to EOY10 (=$373,408). The revenues given

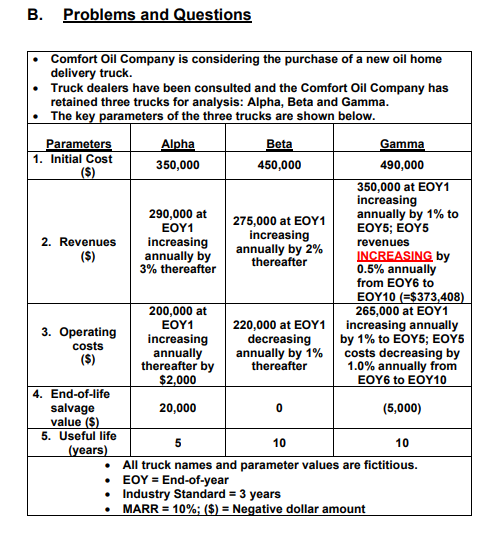

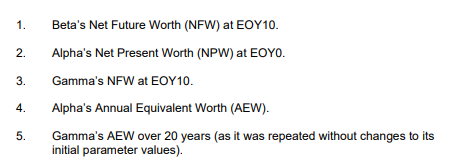

Gamma Project: $350,000 at EOY1 increasing annually by 1% to EOY5; EOY5 revenues INCREASING by 0.5% annually from EOY6 to EOY10 (=$373,408). The revenues given for EOY10 were correct. B. Problems and Questions Comfort Oil Company is considering the purchase of a new oil home delivery truck. Truck dealers have been consulted and the Comfort Oil Company has retained three trucks for analysis: Alpha, Beta and Gamma. The key parameters of the three trucks are shown below. Parameters Alpha Beta Gamma 1. Initial Cost 350,000 450,000 490,000 ($) 350,000 at EOY1 increasing 290,000 at 275,000 at EOY1 annually by 1% to EOY1 2. Revenues EOY5; EOY5 increasing increasing revenues ($) annually by annually by 2% thereafter INCREASING by 3% thereafter 0.5% annually from EOY6 to EOY10 (=$373,408) 200,000 at 265,000 at EOY1 EOY1 220,000 at EOY1 increasing annually 3. Operating increasing decreasing by 1% to EOY5; EOY5 costs ($) annually annually by 1% costs decreasing by thereafter by thereafter 1.0% annually from $2,000 EOY6 to EOY10 4. End-of-life salvage 20,000 0 (5,000) value (5) 5. Useful life 5 10 10 (years) All truck names and parameter values are fictitious. EOY = End-of-year Industry Standard = 3 years MARR = 10%; ($) = Negative dollar amount 1. 2. 3. Beta's Net Future Worth (NFW) at EOY10. Alpha's Net Present Worth (NPW) at EOYO. Gamma's NFW at EOY10. Alpha's Annual Equivalent Worth (AEW). Gamma's AEW over 20 years (as it was repeated without changes to its initial parameter values). 4. . 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts