Question: GAP ANALYSIS is a process that banks use to determine their exposure to interest-rate risk. Banks borrow funds at one rate and loan the money

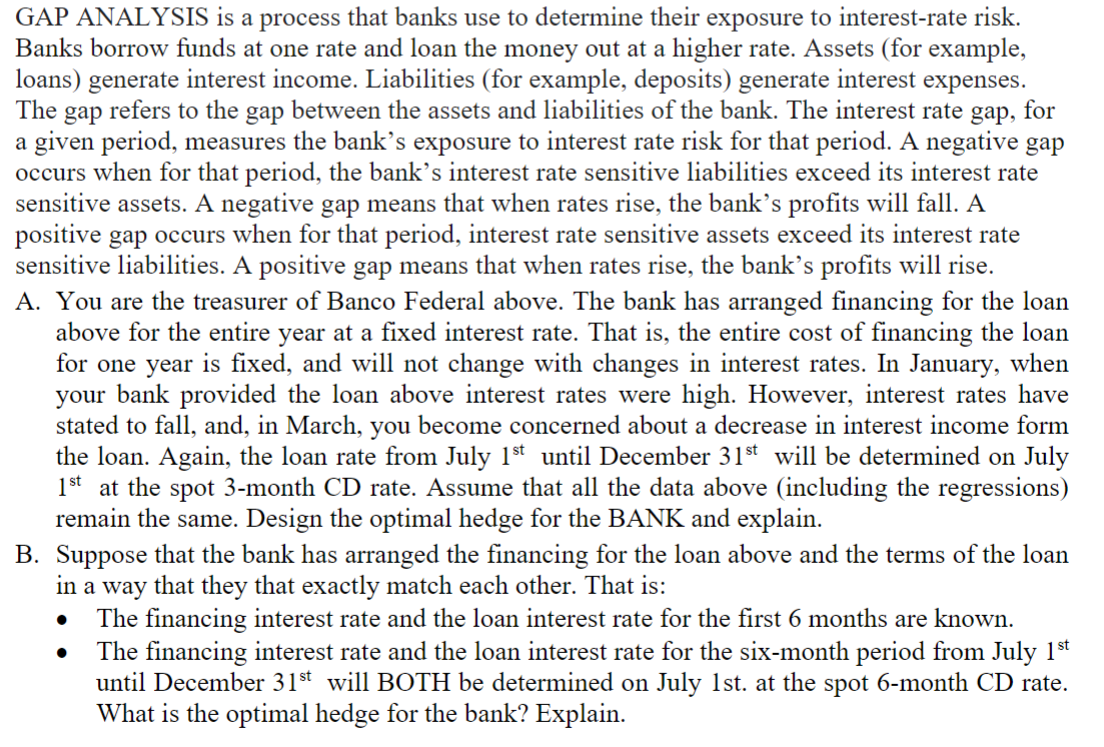

GAP ANALYSIS is a process that banks use to determine their exposure to interest-rate risk. Banks borrow funds at one rate and loan the money out at a higher rate. Assets (for example, loans) generate interest income. Liabilities (for example, deposits) generate interest expenses. The gap refers to the gap between the assets and liabilities of the bank. The interest rate gap, for a given period, measures the bank's exposure to interest rate risk for that period. A negative gap occurs when for that period, the bank's interest rate sensitive liabilities exceed its interest rate sensitive assets. A negative gap means that when rates rise, the bank's profits will fall. A positive gap occurs when for that period, interest rate sensitive assets exceed its interest rate sensitive liabilities. A positive gap means that when rates rise, the bank's profits will rise. A. You are the treasurer of Banco Federal above. The bank has arranged financing for the loan above for the entire year at a fixed interest rate. That is, the entire cost of financing the loan for one year is fixed, and will not change with changes in interest rates. In January, when your bank provided the loan above interest rates were high. However, interest rates have stated to fall, and, in March, you become concerned about a decrease in interest income form the loan. Again, the loan rate from July 1st until December 31st will be determined on July 1st at the spot 3-month CD rate. Assume that all the data above (including the regressions) remain the same. Design the optimal hedge for the BANK and explain. B. Suppose that the bank has arranged the financing for the loan above and the terms of the loan in a way that they that exactly match each other. That is: - The financing interest rate and the loan interest rate for the first 6 months are known. - The financing interest rate and the loan interest rate for the six-month period from July 1st until December 31st will BOTH be determined on July 1st. at the spot 6-month CD rate. What is the optimal hedge for the bank? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts