Question: Garner Grocers began operations in 2012 Garner has reported the following levels of taxable income (EBT) over the past several years, corporate tax rate was

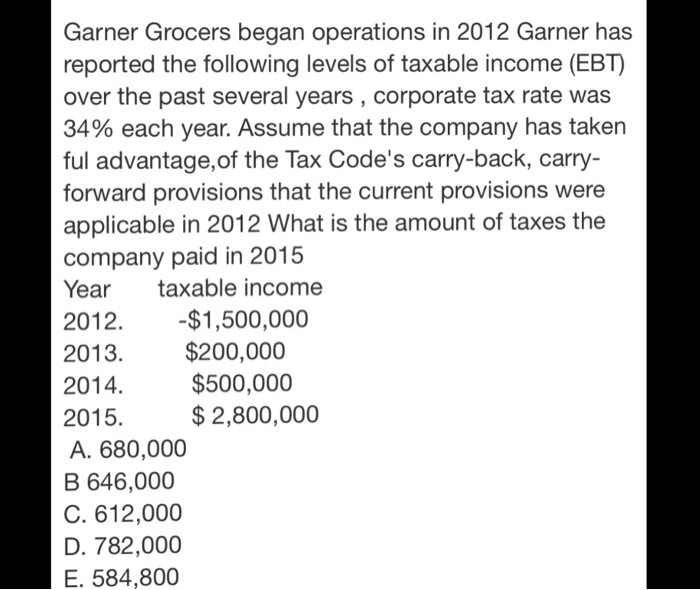

Garner Grocers began operations in 2012 Garner has reported the following levels of taxable income (EBT) over the past several years, corporate tax rate was 34% each year. Assume that the company has taken ful advantage, of the Tax Code's carry-back, carry- forward provisions that the current provisions were applicable in 2012 What is the amount of taxes the company paid in 2015 Year taxable income 2012. $1,500,000 2013.$200,000 2014. 2015. A. 680,000 646,000 C. 612,000 D. 782,000 E. 584,800 $500,000 $2,800,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock