Question: Gary, Greg and Glenda each own a one - third interest in a business known as G - Force Partners which was formed in 2

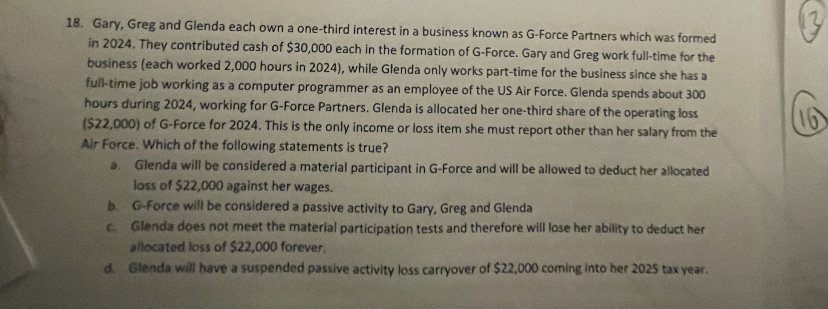

Gary, Greg and Glenda each own a onethird interest in a business known as GForce Partners which was formed in They contributed cash of $ each in the formation of GForce. Gary and Greg work fulltime for the business each worked hours in while Glenda only works parttime for the business since she has a fulltime job working as a computer programmer as an employee of the US Air Force. Glenda spends about hours during working for GForce Partners. Glenda is allocated her onethird share of the operating loss $ of Force for This is the only income or loss item she must report other than her salary from the Air Force. Which of the following statements is true?

a Glenda will be considered a material participant in GForce and will be allowed to deduct her allocated loss of $ against her wages.

b Gforce will be considered a passive activity to Gary, Greg and Glenda

C Glenda does not meet the material participation tests and therefore will lose her ability to deduct her allocated loss of $ forever.

Glenda will have a suspended passive activity loss carryover of $ coming into her tax year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock