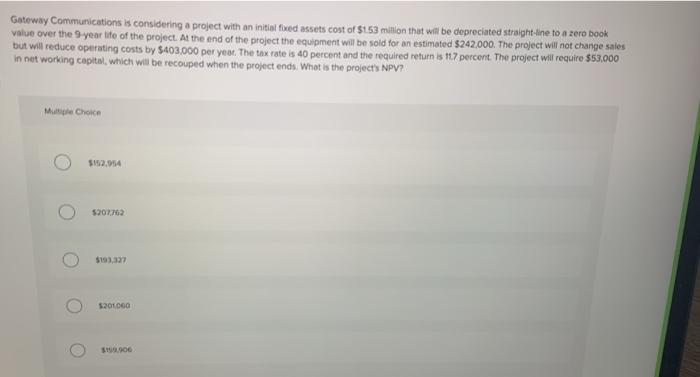

Question: Gateway Communications is considering a project with an initial fixed assets cost of $153 miltion that will be depreciated straight-line to a zero book value

Gateway Communications is considering a project with an initial fixed assets cost of $153 miltion that will be depreciated straight-line to a zero book value over the year life of the project. At the end of the project the equipment will be sold for an estimated $242,000. The project will not change sales but will reduce operating costs by 5403,000 per year. The tax rate is 40 percent and the required return is 11.7 percent. The project will require $53,000 in net working capital, which will be recouped when the project ends. What is the project's NPV?! Me Choice 5162,054 5207,762 $13,327 1201000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock