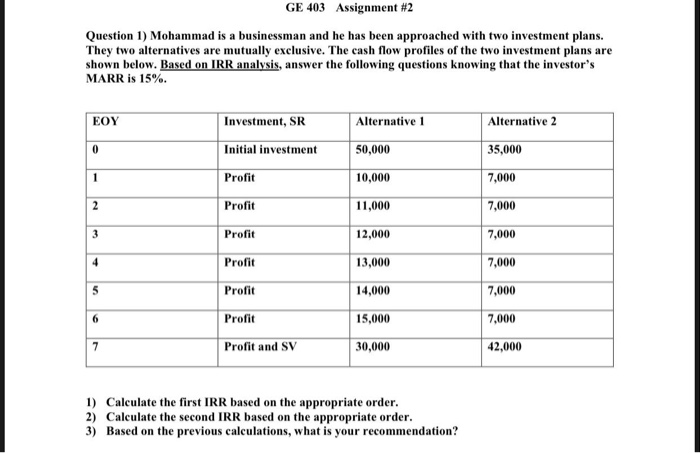

Question: GE 403 Assignment #2 Question 1) Mohammad is a businessman and he has been approached with two investment plans. They two alternatives are mutually exclusive.

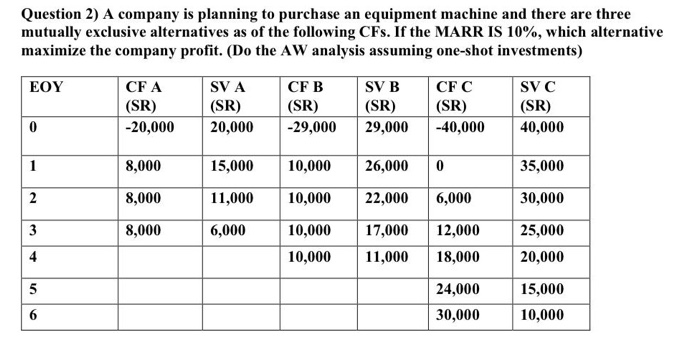

GE 403 Assignment #2 Question 1) Mohammad is a businessman and he has been approached with two investment plans. They two alternatives are mutually exclusive. The cash flow profiles of the two investment plans are shown below. Based on IRR analysis, answer the following questions knowing that the investor's MARR is 15%. EOY Investment, SR Alternative 1 Alternative 2 35,000 0 Initial investment 50,000 Profit 10,000 7,000 2 Profit 11,000 7,000 3 Profit 7,000 12,000 13,000 Profit 7,000 Profit 14,000 7,000 6 Profit Profit and SV 15,000 30,000 7,000 42,000 7 1) Calculate the first IRR based on the appropriate order. 2) Calculate the second IRR based on the appropriate order. 3) Based on the previous calculations, what is your recommendation? Question 2) A company is planning to purchase an equipment machine and there are three mutually exclusive alternatives as of the following CFs. If the MARR IS 10%, which alternative maximize the company profit. (Do the AW analysis assuming one-shot investments) EOY CFA (SR) -20,000 SVA (SR) 20,000 CFB (SR) -29,000 SVB (SR) 29,000 CFC (SR) -40,000 SVC (SR) 40,000 0 1 8,000 15,000 10,000 26,000 0 35,000 2 8,000 11,000 10,000 22,000 6,000 30,000 3 8,000 6,000 10,000 10,000 17,000 11,000 12,000 18,000 25,000 20,000 4 5 24,000 30,000 15,000 10,000 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts