Question: ge Learning x + mn/takeAssignment/takeAssignment Main.do?invokere&takeAssignmentSessionLocator &inprogress-false Word Southern University Harmonique Beauty > YouTube Mail - Harmony Lew. Browse Featured Chrome Web Store Hiring Center

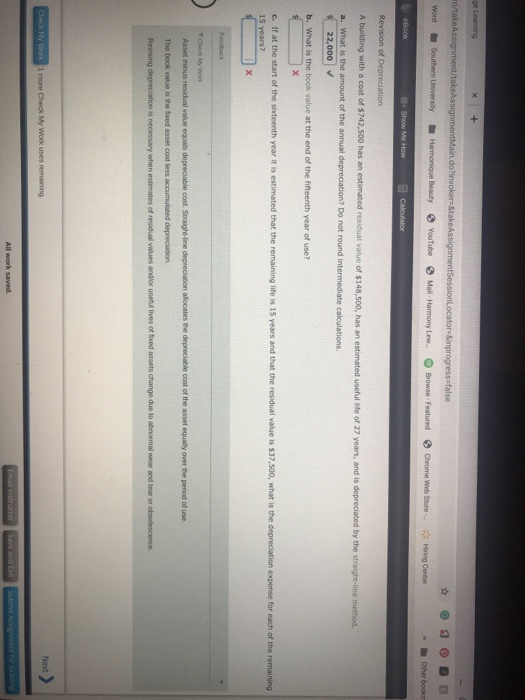

ge Learning x + mn/takeAssignment/takeAssignment Main.do?invokere&takeAssignmentSessionLocator &inprogress-false Word Southern University Harmonique Beauty > YouTube Mail - Harmony Lew. Browse Featured Chrome Web Store Hiring Center Other bookm eBook Show Me How Calculator Revision of Depreciation A building with a cost of $742,500 has an estimated residual value of $148,500, has an estimated useful life of 27 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? Do not round Intermediate calculations $ 22,000 b. What is the book value at the end of the fifteenth year of use? C. If at the start of the sixteenth year it is estimated that the remaining life is 15 years and that the residual value is $37,500, what is the depreciation expense for each of the remaining Check My Work Asset minus residual value equals depreciable cost. Straight line depreciation allocates the depreciable cost of the asset equally over the period of use. The book value is the foxed asset cost less accumulated depreciation Revising depreciation is necessary when estimates of residual values and or useful lives of food assets change due to abnormal wear and tear or obsolescence Check My Work 1 more Check My Work uses remaining All work saved. Email Instructor Save and Ext Sub Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts