Question: Geek Inc. has decided to acquire a new Web Server. It has three options. IBM: purchase cost of $344608 and operating costs of $20575 in

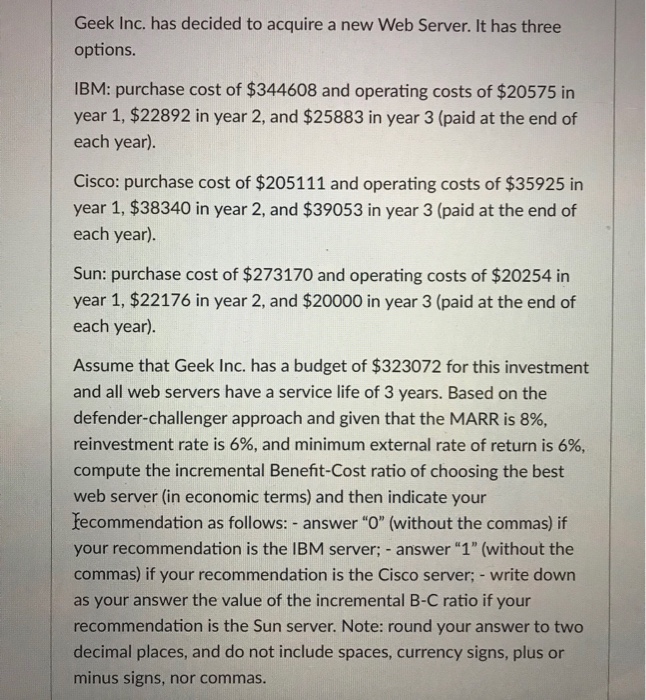

Geek Inc. has decided to acquire a new Web Server. It has three options. IBM: purchase cost of $344608 and operating costs of $20575 in year 1, $22892 in year 2, and $25883 in year 3 (paid at the end of each year). Cisco: purchase cost of $205111 and operating costs of $35925 in year 1, $38340 in year 2, and $39053 in year 3 (paid at the end of each year). Sun: purchase cost of $273170 and operating costs of $20254 in year 1, $22176 in year 2, and $20000 in year 3 (paid at the end of each year). Assume that Geek Inc. has a budget of $323072 for this investment and all web servers have a service life of 3 years. Based on the defender-challenger approach and given that the MARR is 8%, reinvestment rate is 6%, and minimum external rate of return is 6%, compute the incremental Benefit-Cost ratio of choosing the best web server (in economic terms) and then indicate your recommendation as follows: answer "O" (without the commas) if your recommendation is the IBM server; answer "1" (without the commas) if your recommendation is the Cisco server; - write down as your answer the value of the incremental B-C ratio if your recommendation is the Sun server. Note: round your answer to two decimal places, and do not include spaces, currency signs, plus or minus signs, nor commas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts