Question: General Cambria -12 IUA B Paste Styles Insert Delete Format - Cells .00 Font Number ipboard N18 1 G - H E Alignment fox I

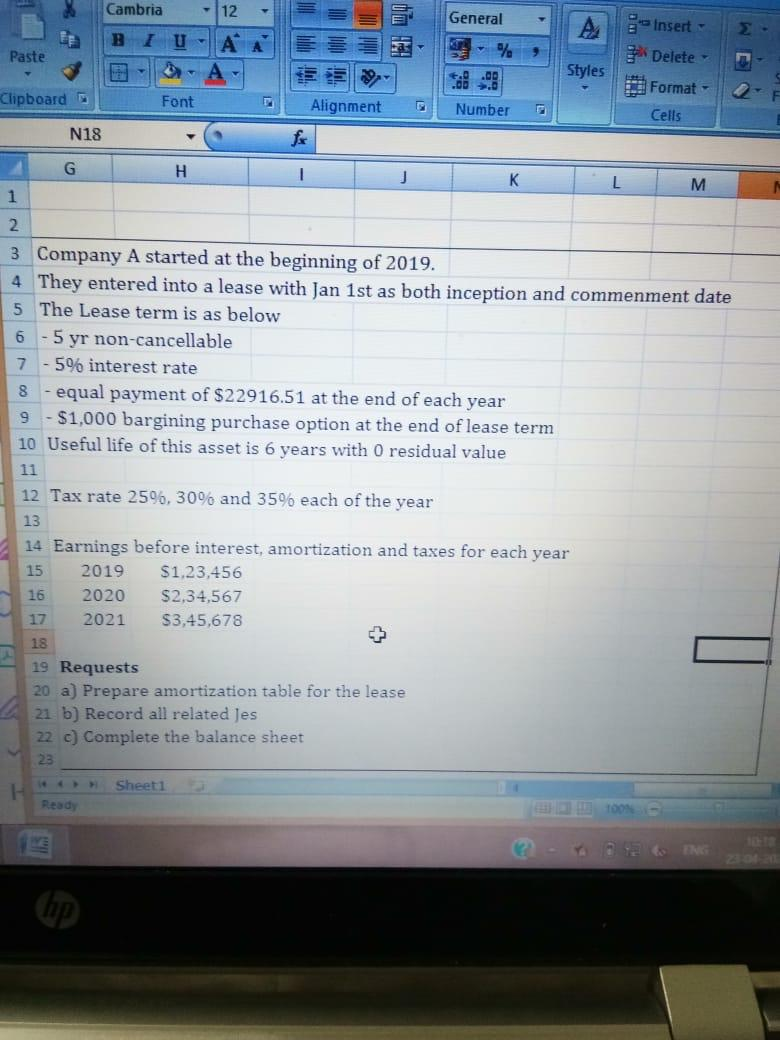

General Cambria -12 IUA B Paste Styles Insert Delete Format - Cells .00 Font Number ipboard N18 1 G - H E Alignment fox I J K L M 2 3 Company A started at the beginning of 2019. 4 They entered into a lease with Jan 1st as both inception and commenment date 5 The Lease term is as below 6 -5 yr non-cancellable 7 -5% interest rate 8 - equal payment of $22916.51 at the end of each year 9 - $1,000 bargining purchase option at the end of lease term 10 Useful life of this asset is 6 years with O residual value 12 Tax rate 2596, 30% and 35% each of the year 13 14 Earnings before interest, amortization and taxes for each year 15 2019 $1,23,456 16 2020 $2,34,567 17 2021 $3,45,678 18 19 Requests 20 a) Prepare amortization table for the lease 21 b) Record all related Jes 22 c) Complete the balance sheet Sheet1 Ready (hp General Cambria -12 IUA B Paste Styles Insert Delete Format - Cells .00 Font Number ipboard N18 1 G - H E Alignment fox I J K L M 2 3 Company A started at the beginning of 2019. 4 They entered into a lease with Jan 1st as both inception and commenment date 5 The Lease term is as below 6 -5 yr non-cancellable 7 -5% interest rate 8 - equal payment of $22916.51 at the end of each year 9 - $1,000 bargining purchase option at the end of lease term 10 Useful life of this asset is 6 years with O residual value 12 Tax rate 2596, 30% and 35% each of the year 13 14 Earnings before interest, amortization and taxes for each year 15 2019 $1,23,456 16 2020 $2,34,567 17 2021 $3,45,678 18 19 Requests 20 a) Prepare amortization table for the lease 21 b) Record all related Jes 22 c) Complete the balance sheet Sheet1 Ready (hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts