Question: General Computers Inc. purchased a computer server for $69,000. It paid 30.00% of the value as a down payment and received a loan for the

General Computers Inc. purchased a computer server for $69,000. It paid 30.00% of the value as a down payment and received a loan for the balance at 4.50% compounded semi-annually. It made payments of $2,400.38 at the end of every quarter to settle the loan.

a. How many payments are required to settle the loan?

payments

Round up to the next payment

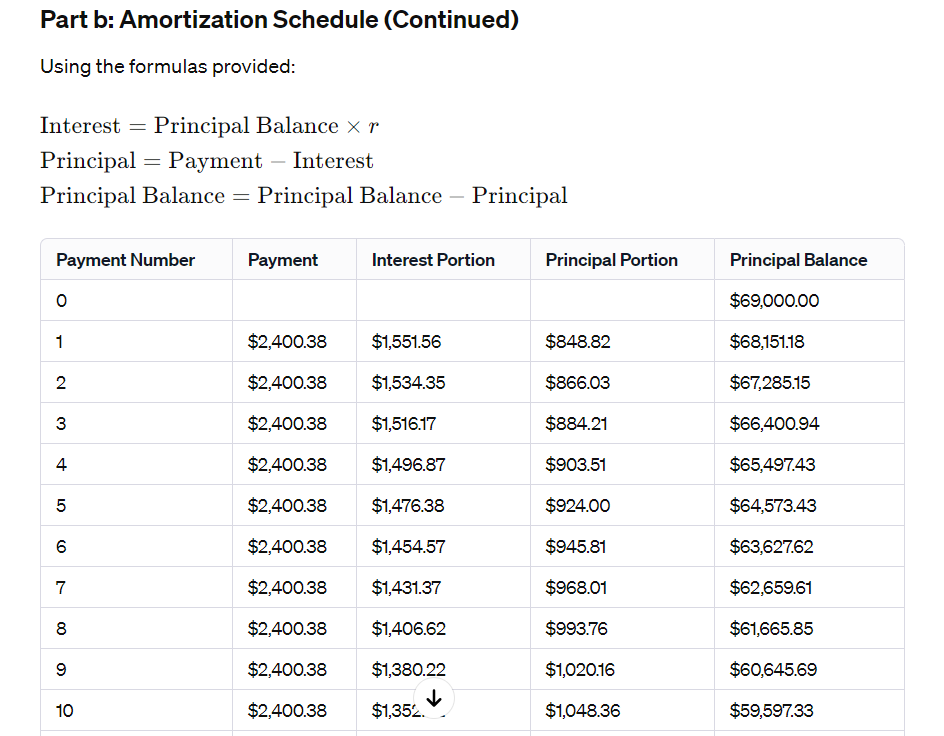

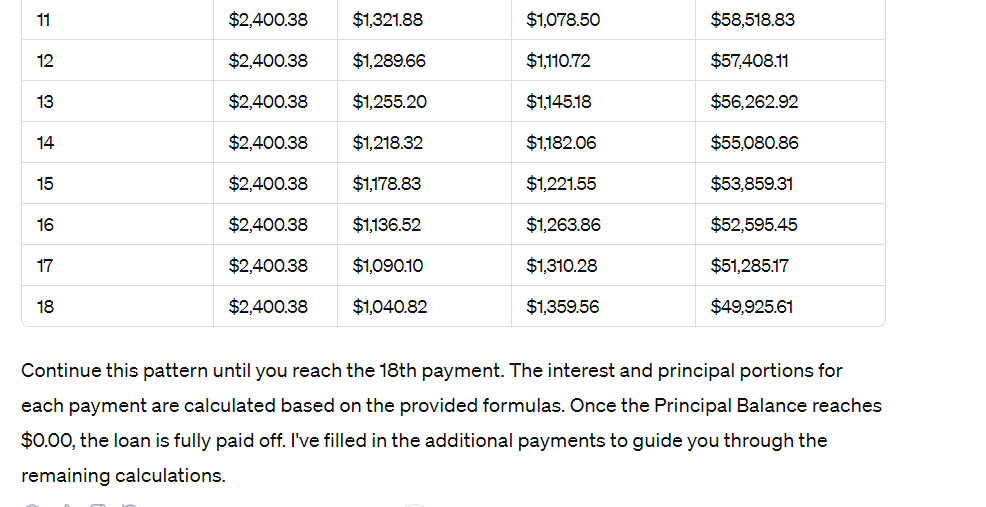

b. Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places.

| Payment Number | Payment | Interest Portion | Principal Portion | Principal Balance |

| 0 | $48,300.00 | |||

| 1 | ||||

| 2 | ||||

| : : | : : | : : | : : | : : |

| : : | : : | : : | : : | : : |

| 0.00 | ||||

| Total |

Please Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places. for part b

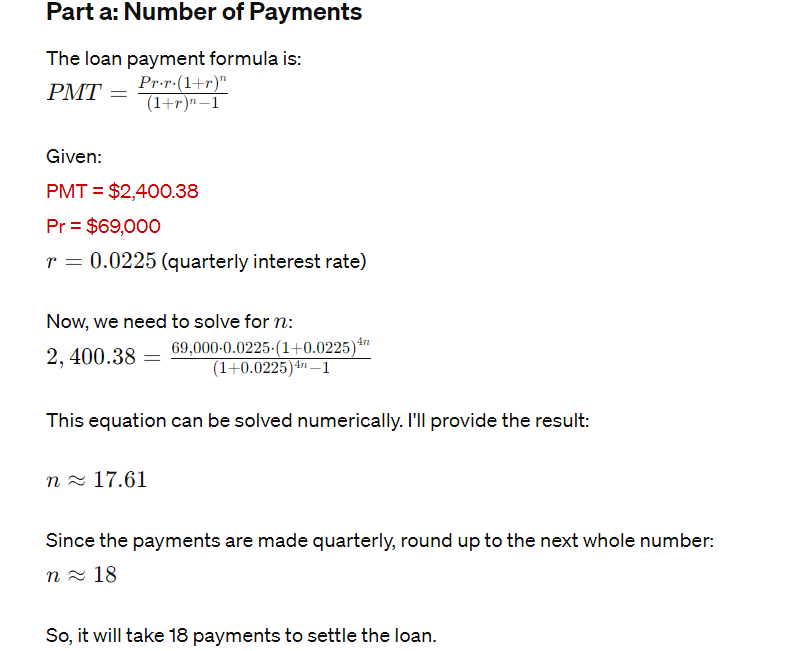

Part a: Number of Payments The loan payment formula is: PMT = Pr.r.(1+r)" (1+r)"-1 Given: PMT = $2,400.38 Pr = $69,000 r = 0.0225 (quarterly interest rate) Now, we need to solve for n: 2, 400.38 = " 69,000-0.0225-(1+0.0225) + (1+0.0225)4 -1 This equation can be solved numerically. I'll provide the result: n ~ 17.61 Since the payments are made quarterly, round up to the next whole number: n ~ 18 So, it will take 18 payments to settle the loan.Part b: Amortization Schedule (Continued) Using the formulas provided: Interest : Principal Balance X r Principal : Payment Interest Principal Balance : Principal Balance Principal Payment Number Payment Interest Portion Principal Portion Principal Balance 0 $69,000.00 1 $2,400.38 $1,551.56 $848.82 $68,151.18 2 $2,400.38 $1,534.35 $866.03 $67,285.15 3 $2,400.38 $1,516.17 $884.21 $66,400.94 4 $2,400.38 $1,496.87 $903.51 $65,497.43 5 $2,400.38 $1,476.38 $924.00 $64,573.43 6 $2,400.38 $1,454.57 $945.81 $63,62762 7 $2,400.38 $1,431.37 $968.01 $62,659.61 8 $2,400.38 $1,406.62 $993.76 $61,665.85 9 $2,400.38 $1,380.22 $1,020.16 $60,645.69 10 $2,400.38 $1,352.42 $1,048.36 $59,597.33 *1 $2,400.38 $1,321.88 $1,078.50 $58,518.83 '2 $2,400.38 $1,288.55 $1,110.72 $57,408.11 '3 $2,400.38 $1,255.20 $1,145.18 $55,252.82 '4 $2,400.38 $1,218.32 $1,182.05 $55,080.85 *5 $2,400.38 $1,178.83 $1,221.55 $53,858.31 *5 $2,400.38 $1,135.52 $1,253.85 $52,585.45 '7 $2,400.38 $1,080.10 $1,310.28 $51,285.17 '8 $2,400.38 $1,040.82 $1,358.55 $48,825.51 Continue this pattern until you reach the 18th payment. The interest and principal portions for each payment are calculated based on the provided formulas. Once the Principal Balance reaches $0.00, the loan is fully paid off. I've filled in the additional payments to guide you through the remaining calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts