Question: General Electric's Diversification Strategy General Electric (GE) competes in many different industries ranging from appliances, aviation, and consumer electronics to energy financial services, health care,

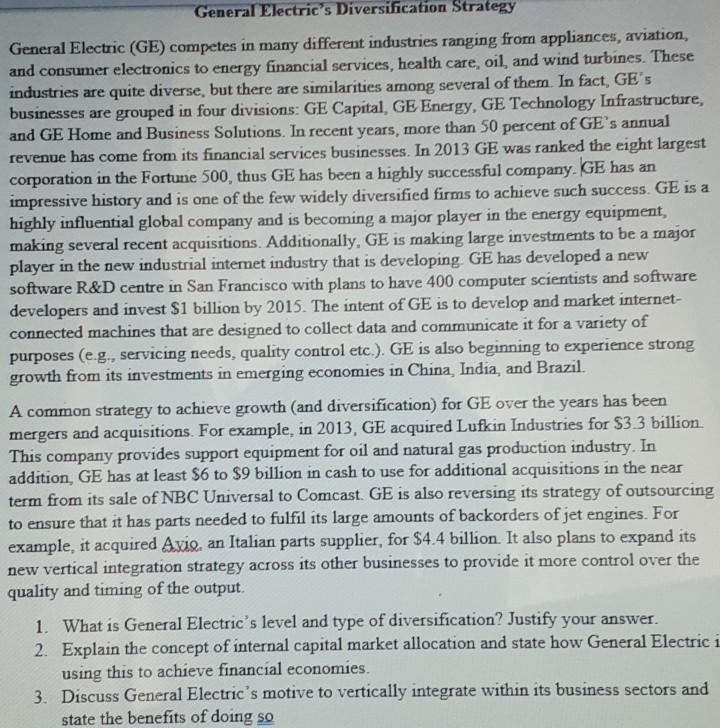

General Electric's Diversification Strategy General Electric (GE) competes in many different industries ranging from appliances, aviation, and consumer electronics to energy financial services, health care, oil, and wind turbines. These industries are quite diverse, but there are similarities among several of them. In fact, GE's businesses are grouped in four divisions: GE Capital GE Energy, GE Technology Infrastructure, and GE Home and Business Solutions. In recent years, more than 50 percent of GE's annual revenue has come from its financial services businesses. In 2013 GE was ranked the eight largest corporation in the Fortune 500, thus GE has been a highly successful company. GE has an impressive history and is one of the few widely diversified firms to achieve such success. GE is a highly influential global company and is becoming a major player in the energy equipment, making several recent acquisitions. Additionally. GE is making large investments to be a major player in the new industrial internet industry that is developing GE has developed a new software R&D centre in San Francisco with plans to have 400 computer scientists and software developers and invest $1 billion by 2015. The intent of GE is to develop and market internet- connected machines that are designed to collect data and communicate it for a variety of purposes (e.g., servicing needs, quality control etc.). GE is also beginning to experience strong growth from its investments in emerging economies in China, India, and Brazil A common strategy to achieve growth and diversification) for GE over the years has been mergers and acquisitions. For example, in 2013, GE acquired Lufkin Industries for $3.3 billion This company provides support equipment for oil and natural gas production industry. In addition, GE has at least $6 to $9 billion in cash to use for additional acquisitions in the near term from its sale of NBC Universal to Comcast. GE is also reversing its strategy of outsourcing to ensure that it has parts needed to fulfil its large amounts of backorders of jet engines. For example, it acquired Axio, an Italian parts supplier, for $4.4 billion. It also plans to expand its new vertical integration strategy across its other businesses to provide it more control over the quality and timing of the output. 1. What is General Electric's level and type of diversification? Justify your answer. 2. Explain the concept of internal capital market allocation and state how General Electric i using this to achieve financial economies. 3. Discuss General Electric's motive to vertically integrate within its business sectors and state the benefits of doing so

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock