Question: General instruction for Question 1 and Question 2: Use only the C-E-A-D-I approach to complete the consolidation worksheet. Other approaches will not be accepted for

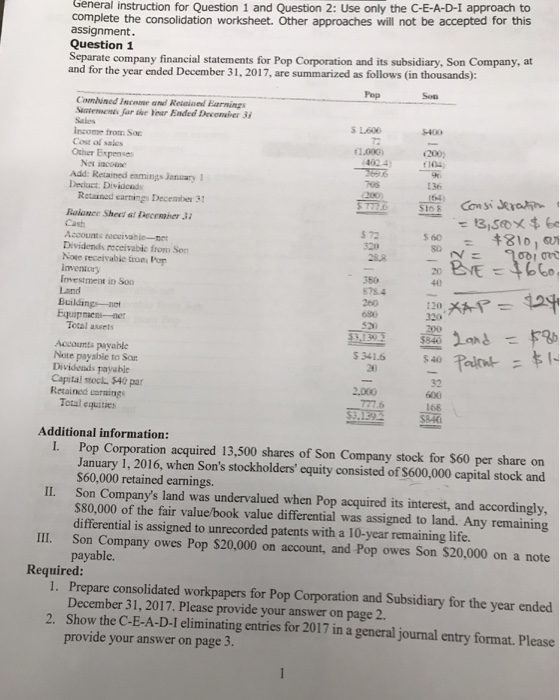

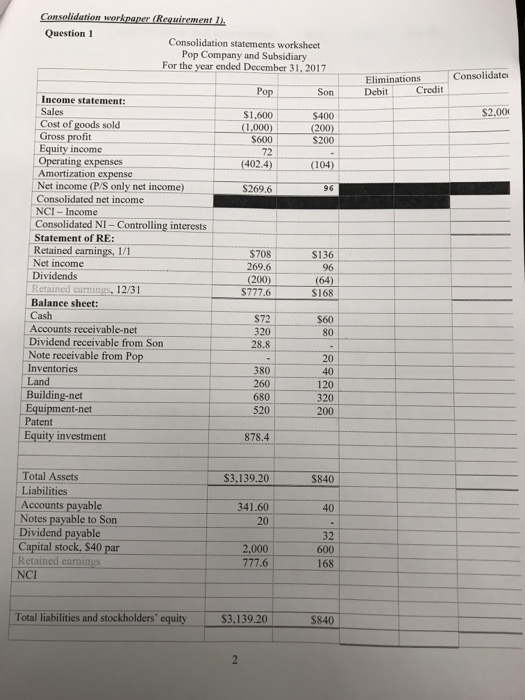

General instruction for Question 1 and Question 2: Use only the C-E-A-D-I approach to complete the consolidation worksheet. Other approaches will not be accepted for this assignment. Question 1 Separate company financial statements for Pop Corporation and its subsidiary, Son Company, at and for the year ended December 31, 2017, are summarized as follows (in thousands): Pop Son Comiined Income and Reiained Earnings Suitements far e iear Ended December 3i S L600 inzome from Soc Cost of sales 11.000 200) Other Expenses 4024) Add: Retaimed eamings anuary I Deciuct: Dividends 136 Retained earnings December 3 Boiance Shect af Eeceher 3 Cash Accounts recuivabie- Dividendls roceivabic from Son Noee receivabie trom or 5 72 80 350 878.4 40 Land :20 320 quipmen-ne Total assets 52) Accoumts payable Note payabie to So 5 3416 20 Dividends payabie Capital stoch $40 par Retained carning 32 770.6 168 Total equities Additional information: Pop Corporation acquired 13,500 shares of Son Company stock for $60 per share on January 1, 2016, when Son's stockholders' equity consisted of S600,000 capital stock and $60,000 retained earnings. L. IL. Son Company's land was undervalued when Pop acquired its interest, and accordingly, $80,000 of the fair value/book value differential was assigned to land. Any remaining differential is assigned to unrecorded patents with a 10-year remaining life. Son Company owes Pop $20,000 on account, and Pop owes Son $20,000 on a note payable. III. Required: 1. Prepare consolidated workpapers for Pop Corporation and Subsidiary for the year ended 2. Show the C-E-A-D-I eliminating entries for 2017 in a general journal entry format. Please December 31, 2017. Please provide your answer on page 2 provide your answer on page 3. Consolidation worknaper (Requirement 1 Question Consolidation statements worksheet Pop Company and Subsidiary For the year ended December 31, 2017 Eliminations Consolidate Pop $1,600 $600 Son Debit Credit Income statement: Sales S2.00 $400 $200 (104) Cost of goods sold Gross profit Equity income Operating expenses 72 402.4 Amortization expense Net income (P/S only net income) Consolidated net income NCI-Income Consolidated NI- Controlling interests Statement of RE: Retained eamings, 1/1 Net income Dividends Retained earnings, 12/31 Balance sheet: Cash S269.6 96 $708 S136 269.6 96 64) S168 S72 320 28.8 $60 80 Accounts receivable-net Dividend receivable from Son Note receivable from Pop Inventories 380 260 680 520 20 40 120 320 200 Building-net Equipment-net Patent uity investment 878.4 Total Assets Liabilities Accounts payable Notes payable to Son S3,139.20 S840 341.60 20 40 Dividend payable Capital stock, $40 par 32 600 168 2.000 | Retained earnin NCI Total liabilities and stockholders' equity $3,139.20 $840 Journal entries (R Date P/R Account titles and descriptions General instruction for Question 1 and Question 2: Use only the C-E-A-D-I approach to complete the consolidation worksheet. Other approaches will not be accepted for this assignment. Question 1 Separate company financial statements for Pop Corporation and its subsidiary, Son Company, at and for the year ended December 31, 2017, are summarized as follows (in thousands): Pop Son Comiined Income and Reiained Earnings Suitements far e iear Ended December 3i S L600 inzome from Soc Cost of sales 11.000 200) Other Expenses 4024) Add: Retaimed eamings anuary I Deciuct: Dividends 136 Retained earnings December 3 Boiance Shect af Eeceher 3 Cash Accounts recuivabie- Dividendls roceivabic from Son Noee receivabie trom or 5 72 80 350 878.4 40 Land :20 320 quipmen-ne Total assets 52) Accoumts payable Note payabie to So 5 3416 20 Dividends payabie Capital stoch $40 par Retained carning 32 770.6 168 Total equities Additional information: Pop Corporation acquired 13,500 shares of Son Company stock for $60 per share on January 1, 2016, when Son's stockholders' equity consisted of S600,000 capital stock and $60,000 retained earnings. L. IL. Son Company's land was undervalued when Pop acquired its interest, and accordingly, $80,000 of the fair value/book value differential was assigned to land. Any remaining differential is assigned to unrecorded patents with a 10-year remaining life. Son Company owes Pop $20,000 on account, and Pop owes Son $20,000 on a note payable. III. Required: 1. Prepare consolidated workpapers for Pop Corporation and Subsidiary for the year ended 2. Show the C-E-A-D-I eliminating entries for 2017 in a general journal entry format. Please December 31, 2017. Please provide your answer on page 2 provide your answer on page 3. Consolidation worknaper (Requirement 1 Question Consolidation statements worksheet Pop Company and Subsidiary For the year ended December 31, 2017 Eliminations Consolidate Pop $1,600 $600 Son Debit Credit Income statement: Sales S2.00 $400 $200 (104) Cost of goods sold Gross profit Equity income Operating expenses 72 402.4 Amortization expense Net income (P/S only net income) Consolidated net income NCI-Income Consolidated NI- Controlling interests Statement of RE: Retained eamings, 1/1 Net income Dividends Retained earnings, 12/31 Balance sheet: Cash S269.6 96 $708 S136 269.6 96 64) S168 S72 320 28.8 $60 80 Accounts receivable-net Dividend receivable from Son Note receivable from Pop Inventories 380 260 680 520 20 40 120 320 200 Building-net Equipment-net Patent uity investment 878.4 Total Assets Liabilities Accounts payable Notes payable to Son S3,139.20 S840 341.60 20 40 Dividend payable Capital stock, $40 par 32 600 168 2.000 | Retained earnin NCI Total liabilities and stockholders' equity $3,139.20 $840 Journal entries (R Date P/R Account titles and descriptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts