Question: General Instructions: Please provide step - by - step derivations for your answers to all computational questions. Submitting only the final answers without showing intermediate

General Instructions:

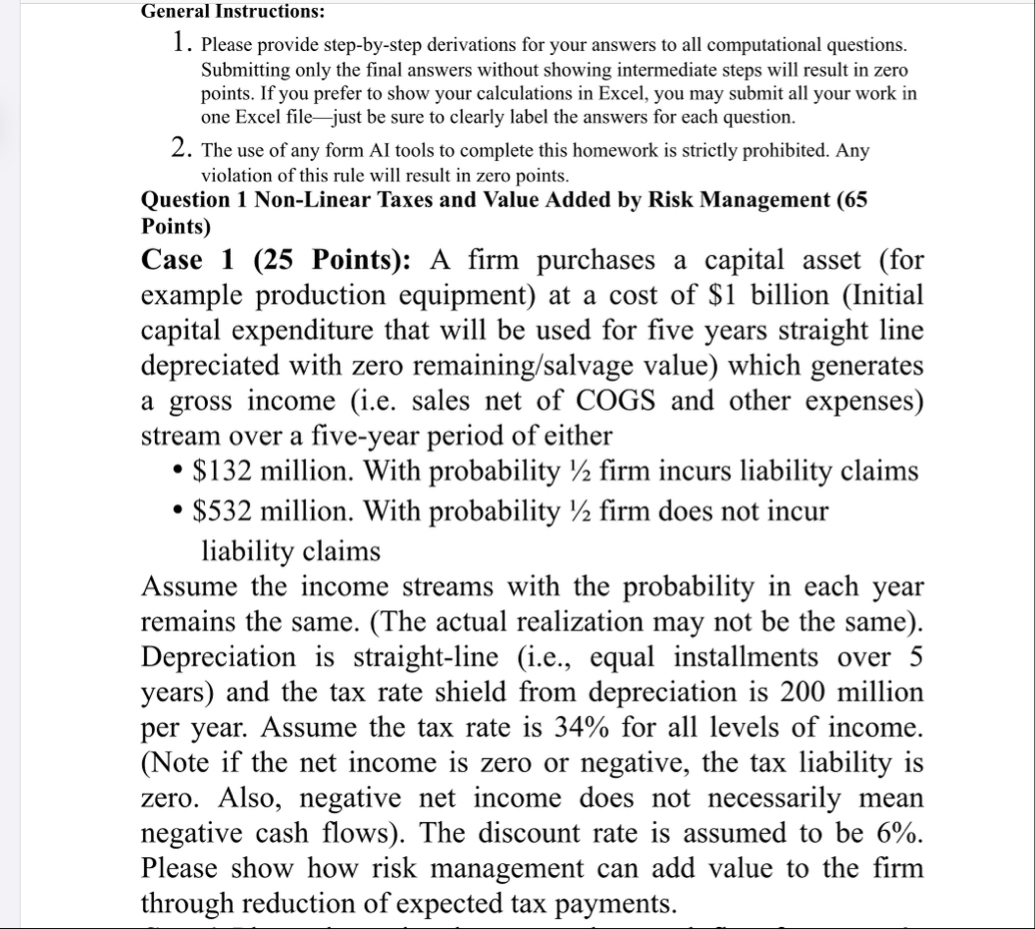

Please provide stepbystep derivations for your answers to all computational questions. Submitting only the final answers without showing intermediate steps will result in zero points. If you prefer to show your calculations in Excel, you may submit all your work in one Excel filejust be sure to clearly label the answers for each question.

The use of any form AI tools to complete this homework is strictly prohibited. Any violation of this rule will result in zero points.

Question NonLinear Taxes and Value Added by Risk Management Points

Case Points: A firm purchases a capital asset for example production equipment at a cost of $ billion Initial capital expenditure that will be used for five years straight line depreciated with zero remainingsalvage value which generates a gross income ie sales net of COGS and other expenses stream over a fiveyear period of either

$ million. With probability firm incurs liability claims

$ million. With probability firm does not incur liability claims

Assume the income streams with the probability in each year remains the same. The actual realization may not be the same Depreciation is straightline ie equal installments over years and the tax rate shield from depreciation is million per year. Assume the tax rate is for all levels of income. Note if the net income is zero or negative, the tax liability is zero. Also, negative net income does not necessarily mean negative cash flows The discount rate is assumed to be Please show how risk management can add value to the firm through reduction of expected tax payments.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock