Question: GENERAL JOURNAL ENTRY DROP DOWN OPTIONS: No journal entry required Accumulated depreciation Buildings Cash Common stock Cost of goods sold Deferred rent revenue Depreciation expense

GENERAL JOURNAL ENTRY DROP DOWN OPTIONS:

- No journal entry required

- Accumulated depreciation

- Buildings

- Cash

- Common stock

- Cost of goods sold

- Deferred rent revenue

- Depreciation expense

- Dividends

- Equipment

- Income tax expense

- Income tax payable

- Insurance expense

- Interest expense

- Interest payable

- Interest revenue

- Inventory

- Notes payable

- Operating expenses

- Paid-in capital - excess of par

- Patent

- Prepaid insurance

- Rent revenue

- Retained earnings

- Salaries expense

- Salaries payable

- Treasury stock

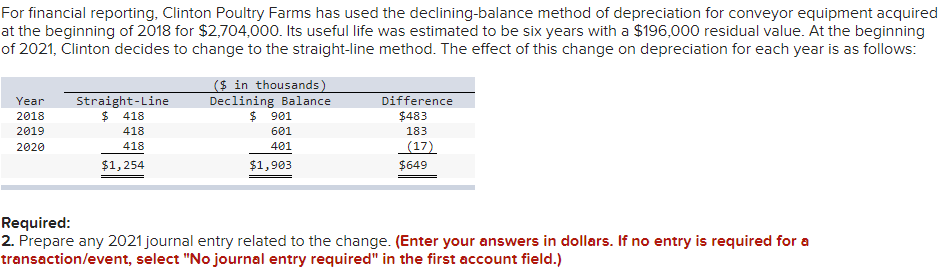

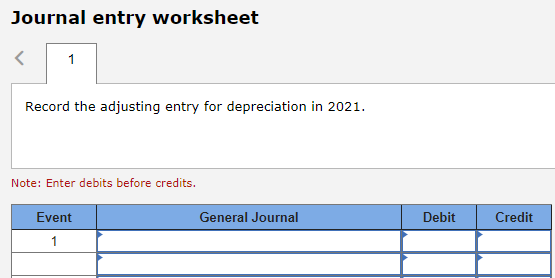

For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2018 for $2,704,000. Its useful life was estimated to be six years with a $196,000 residual value. At the beginning f 2021, Clinton decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows: Required: 2. Prepare any 2021 journal entry related to the change. (Enter your answers in dollars. If no entry is required for a ransaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the adjusting entry for depreciation in 2021. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts