Question: General Journal entry options: No Journal Entry Required Accounts Payable Accounts Receivable Accumulated DepreciationEquip. Advertising Expense Cash Common Stock Depreciation Expense Dividends Equipment Income Tax

General Journal entry options:

- No Journal Entry Required

- Accounts Payable

- Accounts Receivable

- Accumulated DepreciationEquip.

- Advertising Expense

- Cash

- Common Stock

- Depreciation Expense

- Dividends

- Equipment

- Income Tax Expense

- Income Taxes Payable

- Interest Revenue

- Rent Expense

- Retained Earnings

- Salaries and Wages Expense

- Service Revenue

- Supplies Expense

- Unearned Revenue

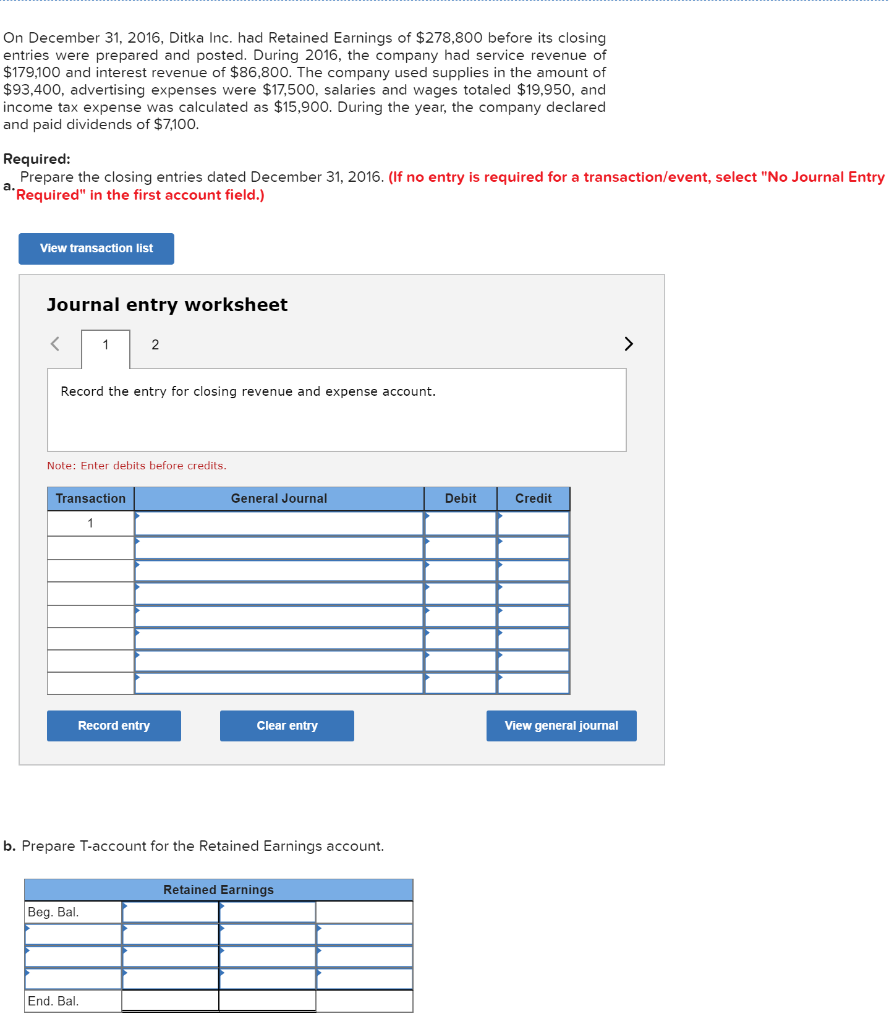

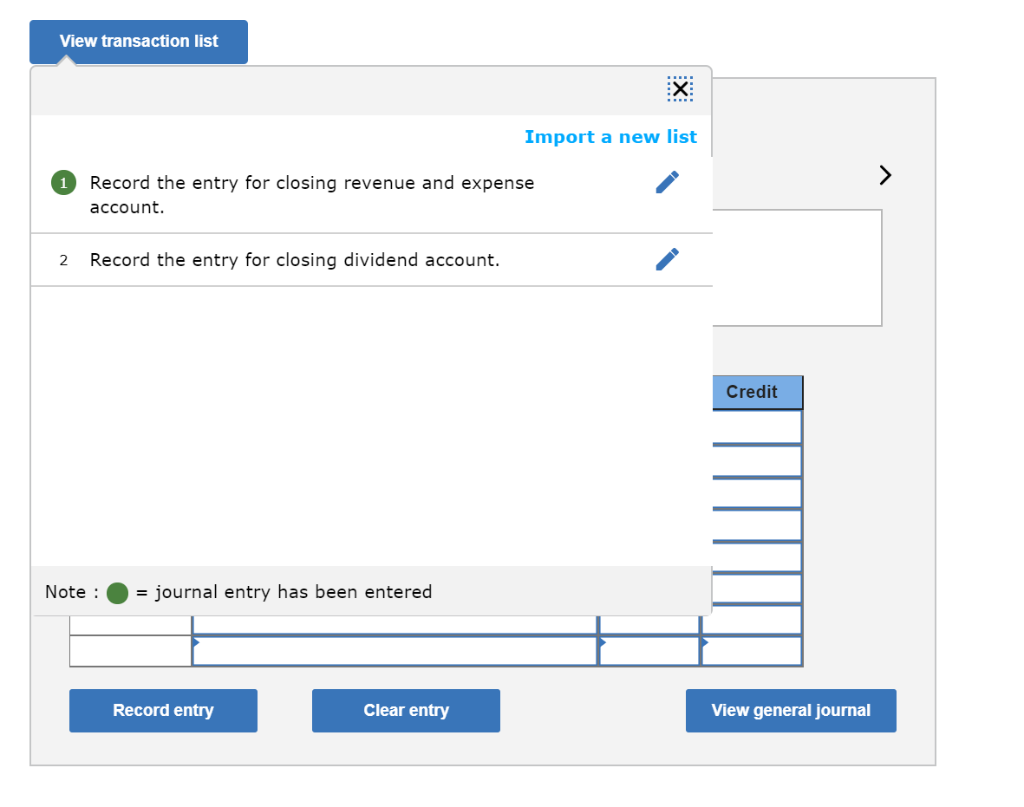

On December 31, 2016, Ditka Inc. had Retained Earnings of $278,800 before its closing entries were prepared and posted. During 2016, the company had service revenue of $179,100 and interest revenue of $86,800. The company used supplies in the amount of $93,400, advertising expenses were $17,500, salaries and wages totaled $19,950, and income tax expense was calculated as $15,900. During the year, the company declared and paid dividends of $7100. Required: Prepare the closing entries dated December 31, 2016. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the entry for closing revenue and expense account. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal b. Prepare T-account for the Retained Earnings account. Retained Earnings Beg. Bal End. Bal View transaction list X: Import a new list 1 Record the entry for closing revenue and expense account. 2 Record the entry for closing dividend account. Credit Note:journal entry has been entered Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts