Question: General journal entry options: No Journal Entry Required Accounts Payable Accounts Receivable Accumulated Amortization Accumulated DepreciationBuildings Accumulated DepreciationEquipment Accumulated DepreciationVehicles Accumulated Other Comprehensive Income Additional

General journal entry options:

- No Journal Entry Required

- Accounts Payable

- Accounts Receivable

- Accumulated Amortization

- Accumulated DepreciationBuildings

- Accumulated DepreciationEquipment

- Accumulated DepreciationVehicles

- Accumulated Other Comprehensive Income

- Additional Paid-In Capital, Common Stock

- Additional Paid-In Capital, Preferred Stock

- Additional Paid-In Capital, Treasury Stock

- Advertising Expense

- Allowance for Doubtful Accounts

- Amortization Expense

- Bad Debt Expense

- Bonds Payable

- Building

- Cash

- Cash Equivalents

- Cash Overage

- Cash Shortage

- Charitable Contributions Payable

- Common Stock

- Copyrights

- Cost of Goods Sold

- Deferred Revenue

- Delivery Expense

- Depreciation Expense

- Discount on Bonds Payable

- Dividends

- Dividends Payable

- Donation Revenue

- Equipment

- FICA Payable

- Franchise Rights

- Gain on Bond Retirement

- Gain on Disposal

- Goodwill

- Impairment Loss

- Income Tax Expense

- Income Tax Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventories

- Inventory - Estimated Returns

- Land

- Legal Expense

- Licensing Rights

- Logo and Trademarks

- Loss on Bond Retirement

- Loss on Disposal

- Natural Resource Assets

- Notes Payable (long-term)

- Notes Payable (short-term)

- Notes Receivable (long-term)

- Notes Receivable (short-term)

- Office Expenses

- Other Current Assets

- Other Current Liabilities

- Other Noncurrent Assets

- Other Noncurrent Liabilities

- Other Operating Expenses

- Other Revenue

- Patent

- Payroll Tax Expense

- Petty Cash

- Preferred Stock

- Premium on Bonds Payable

- Prepaid Advertising

- Prepaid Insurance

- Prepaid Rent

- Refund Liability

- Rent Expense

- Rent Revenue

- Repairs and Maintenance Expense

- Restricted Cash (long-term)

- Restricted Cash (short-term)

- Retained Earnings

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Sales Tax Payable

- Service Revenue

- Short-term Investments

- Software

- Subscription Revenue

- Supplies

- Supplies Expense

- Travel Expense

- Treasury Stock

- Unemployment Tax Payable

- Utilities Expense

- Vehicle

- Withheld Income Taxes Payable

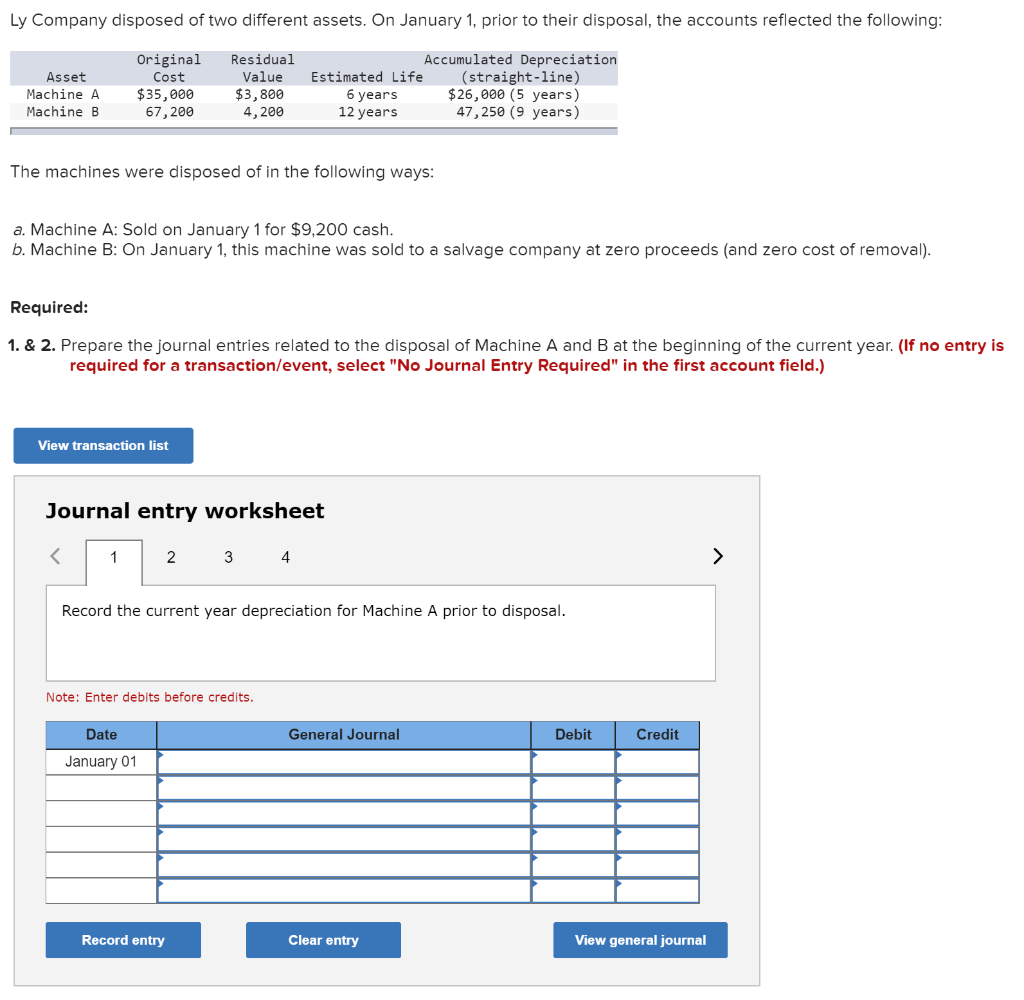

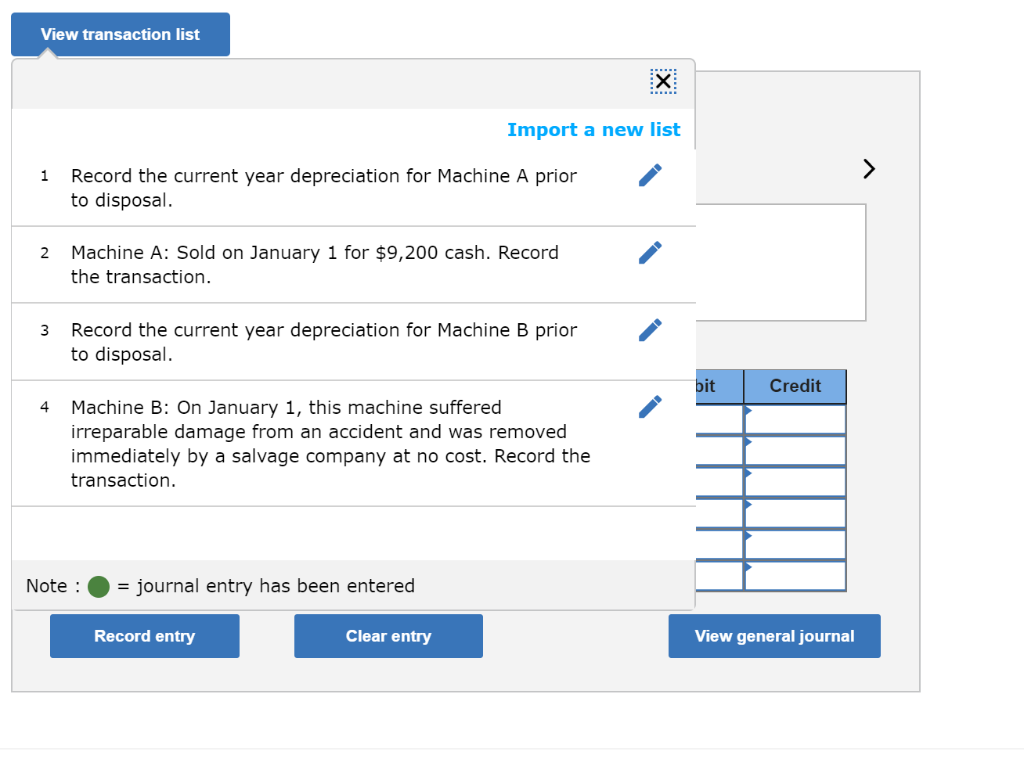

Ly Company disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following Original Residual Accumulated Depreciation Asset Machine A Machine B Value Estimated Life (straight-line) Cost $35,000 67,200 $3,800 $26,000 (5 years) 47,250 (9 years) 6 years 12 years 4,200 The machines were disposed of in the following ways a. Machine A: Sold on January 1 for $9,200 cash b. Machine B: On January 1, this machine was sold to a salvage company at zero proceeds (and zero cost of removal) Required: 1. & 2. Prepare the journal entries related to the disposal of Machine A and B at the beginning of the current year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 4 Record the current year depreciation for Machine A prior to disposal Note: Enter debits before credits Date Debit Credit General Journal January 01 Record entry Clear entry View general journal View transaction list Import a new list 1 Record the current year depreciation for Machine A prior to disposal. 2 Machine A: Sold on January 1 for $9,200 cash. Record the transaction. Record the current year depreciation for Machine B prior to disposal. 3 bit Credit 4 Machine B: On January 1, this machine suffered irreparable damage from an accident and was removed immediately by a salvage company at no cost. Record the transaction. Note : -journal entry has been entered Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts