Question: General Journal? Page 1 CH 14 Collaborative Learning Activity--Student Handout Reporting Changes in Shareholders' Equity Nicholas Radomsky, a business student at university, obtained his first

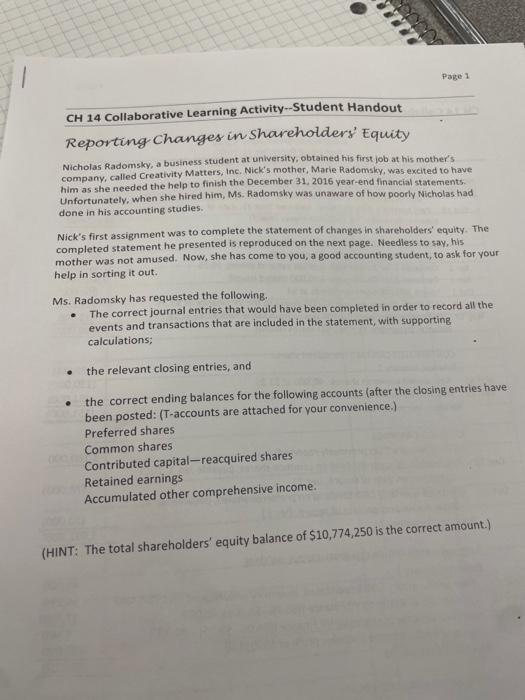

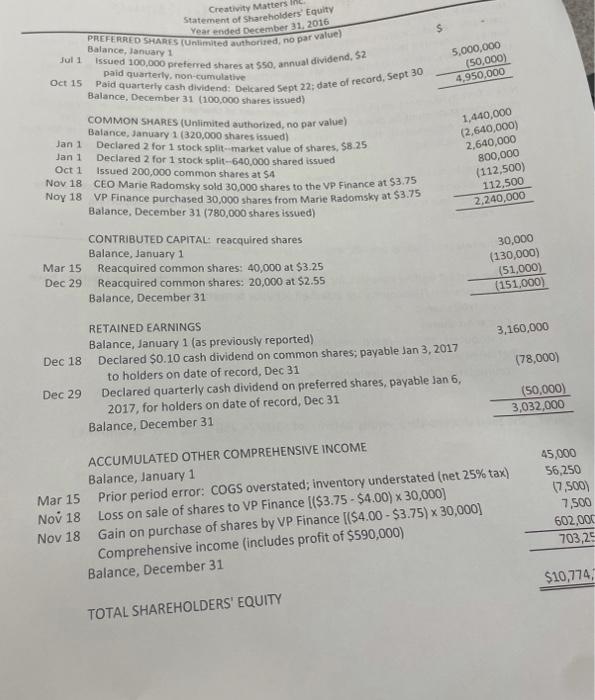

Page 1 CH 14 Collaborative Learning Activity--Student Handout Reporting Changes in Shareholders' Equity Nicholas Radomsky, a business student at university, obtained his first job at his mother's company, called Creativity Matters, Inc. Nick's mother, Marie Radomsky, was excited to have him as she needed the help to finish the December 31, 2016 year-end financial statements. Unfortunately, when she hired him, Ms. Radomsky was unaware of how poorly Nicholas had done in his accounting studies. Nick's first assignment was to complete the statement of changes in shareholders' equity. The completed statement he presented is reproduced on the next page. Needless to say, his mother was not amused. Now, she has come to you, a good accounting student, to ask for your help in sorting it out. Ms. Radomsky has requested the following. . The correct journal entries that would have been completed in order to record all the events and transactions that are included in the statement, with supporting calculations; the relevant closing entries, and the correct ending balances for the following accounts (after the closing entries have been posted: (T-accounts are attached for your convenience.) Preferred shares Common shares Contributed capital-reacquired shares Retained earnings Accumulated other comprehensive income. (HINT: The total shareholders' equity balance of $10,774,250 is the correct amount.) . Creativity Matters In Statement of Shareholders' Equity Year ended December 31, 2016 PREFERRED SHARES (Unlimited authorized, no par value) Balance, January 1 Jul 1 Issued 100,000 preferred shares at $50, annual dividend, $2 paid quarterly, non-cumulative Oct 15 Balance, December 31 (100,000 shares issued) Paid quarterly cash dividend: Delcared Sept 22; date of record, Sept 30 COMMON SHARES (Unlimited authorized, no par value) Balance, January 1 (320,000 shares issued) Jan 1 Declared 2 for 1 stock split-market value of shares, $8.25 Declared 2 for 1 stock split-640,000 shared issued Issued 200,000 common shares at $4 Jan 1 Oct 1 Nov 18 Noy 18 CEO Marie Radomsky sold 30,000 shares to the VP Finance at $3.75 VP Finance purchased 30,000 shares from Marie Radomsky at $3.75 Balance, December 31 (780,000 shares issued) CONTRIBUTED CAPITAL: reacquired shares Balance, January 1 Mar 15 Dec 29 Reacquired common shares: 40,000 at $3.25 Reacquired common shares: 20,000 at $2.55 Balance, December 31 RETAINED EARNINGS Balance, January 1 (as previously reported) Dec 18 Declared $0.10 cash dividend on common shares; payable Jan 3, 2017 to holders on date of record, Dec 31 Dec 29 Declared quarterly cash dividend on preferred shares, payable Jan 6, 2017, for holders on date of record, Dec 31 Balance, December 31 ACCUMULATED OTHER COMPREHENSIVE INCOME Balance, January 1 Prior period error: COGS overstated; inventory understated (net 25% tax) Loss on sale of shares to VP Finance [($3.75 - $4.00) x 30,000] Gain on purchase of shares by VP Finance [($4.00-$3.75) x 30,000] Comprehensive income (includes profit of $590,000) Balance, December 31 TOTAL SHAREHOLDERS' EQUITY Mar 15 Nov 18 Nov 18 5,000,000 (50,000) 4,950,000 1,440,000 (2,640,000) 2,640,000 800,000 (112,500) 112,500 2,240,000 30,000 (130,000) (51,000) (151,000) 3,160,000 (78,000) (50,000) 3,032,000 45,000 56,250 (7,500) 7,500 602,000 703,25 $10,774, Page 1 CH 14 Collaborative Learning Activity--Student Handout Reporting Changes in Shareholders' Equity Nicholas Radomsky, a business student at university, obtained his first job at his mother's company, called Creativity Matters, Inc. Nick's mother, Marie Radomsky, was excited to have him as she needed the help to finish the December 31, 2016 year-end financial statements. Unfortunately, when she hired him, Ms. Radomsky was unaware of how poorly Nicholas had done in his accounting studies. Nick's first assignment was to complete the statement of changes in shareholders' equity. The completed statement he presented is reproduced on the next page. Needless to say, his mother was not amused. Now, she has come to you, a good accounting student, to ask for your help in sorting it out. Ms. Radomsky has requested the following. . The correct journal entries that would have been completed in order to record all the events and transactions that are included in the statement, with supporting calculations; the relevant closing entries, and the correct ending balances for the following accounts (after the closing entries have been posted: (T-accounts are attached for your convenience.) Preferred shares Common shares Contributed capital-reacquired shares Retained earnings Accumulated other comprehensive income. (HINT: The total shareholders' equity balance of $10,774,250 is the correct amount.) . Creativity Matters In Statement of Shareholders' Equity Year ended December 31, 2016 PREFERRED SHARES (Unlimited authorized, no par value) Balance, January 1 Jul 1 Issued 100,000 preferred shares at $50, annual dividend, $2 paid quarterly, non-cumulative Oct 15 Balance, December 31 (100,000 shares issued) Paid quarterly cash dividend: Delcared Sept 22; date of record, Sept 30 COMMON SHARES (Unlimited authorized, no par value) Balance, January 1 (320,000 shares issued) Jan 1 Declared 2 for 1 stock split-market value of shares, $8.25 Declared 2 for 1 stock split-640,000 shared issued Issued 200,000 common shares at $4 Jan 1 Oct 1 Nov 18 Noy 18 CEO Marie Radomsky sold 30,000 shares to the VP Finance at $3.75 VP Finance purchased 30,000 shares from Marie Radomsky at $3.75 Balance, December 31 (780,000 shares issued) CONTRIBUTED CAPITAL: reacquired shares Balance, January 1 Mar 15 Dec 29 Reacquired common shares: 40,000 at $3.25 Reacquired common shares: 20,000 at $2.55 Balance, December 31 RETAINED EARNINGS Balance, January 1 (as previously reported) Dec 18 Declared $0.10 cash dividend on common shares; payable Jan 3, 2017 to holders on date of record, Dec 31 Dec 29 Declared quarterly cash dividend on preferred shares, payable Jan 6, 2017, for holders on date of record, Dec 31 Balance, December 31 ACCUMULATED OTHER COMPREHENSIVE INCOME Balance, January 1 Prior period error: COGS overstated; inventory understated (net 25% tax) Loss on sale of shares to VP Finance [($3.75 - $4.00) x 30,000] Gain on purchase of shares by VP Finance [($4.00-$3.75) x 30,000] Comprehensive income (includes profit of $590,000) Balance, December 31 TOTAL SHAREHOLDERS' EQUITY Mar 15 Nov 18 Nov 18 5,000,000 (50,000) 4,950,000 1,440,000 (2,640,000) 2,640,000 800,000 (112,500) 112,500 2,240,000 30,000 (130,000) (51,000) (151,000) 3,160,000 (78,000) (50,000) 3,032,000 45,000 56,250 (7,500) 7,500 602,000 703,25 $10,774

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts