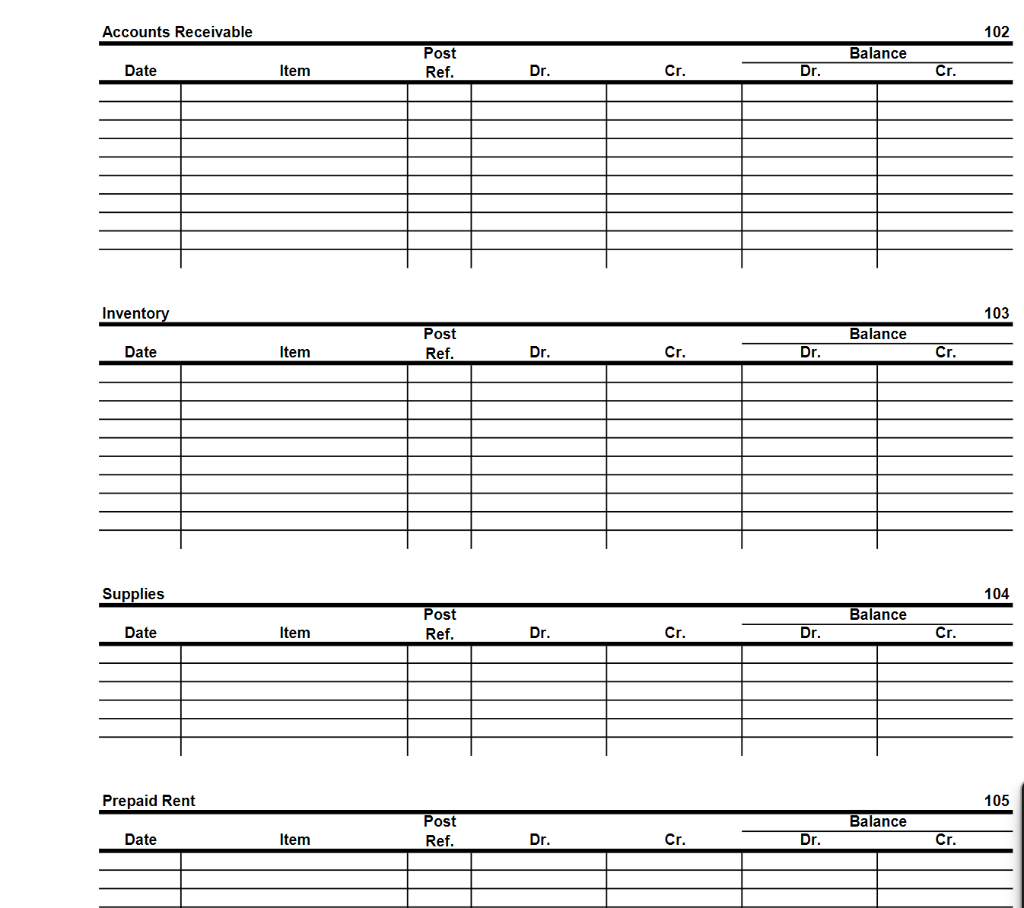

Question: General Ledger using this information and set-up from excel. (Note: on the picture it just shows four categories to put in the ledger. However, I

General Ledger using this information and set-up from excel. (Note: on the picture it just shows four categories to put in the ledger. However, I need cash, accounts receivable, inventory, supplies, prepaid rent, prepaid insurance, furniture, accumulated deprec. furniture, salon chair 1, accumulated deprec. salon chair 1, salon chair 2, accumulated deprec. salon chair 2, accounts payable, salaries payable, unearned fees, utilities payable, capital stock, retained earnings, dividends, income summary, fees earned, gain (or loss) on scale, sales, cost of merchandise sold, salaries expense, rent expense, supplies expense, depreciation expense, insurance expense, utilities expense, advertising expense, legal expenses, and miscellaneous. Please.

Transactions for Jan. 2022 Use the following transactions to complete the first month of Misty's salon. Jan. 1 Misty's salon organized the salon as a corporation and invested his savings of $50,000 cash in the business in return for capital stock. 1 Paid cash for two salon chairs. The first chair (Salon Chair #1) cost $2,600. The second chair (Salon Chair #2) cost $1,600. *See ledger for account titles. 1 Paid cash for a one-year insurance policy $3,000. 1 Purchased supplies for cash, $160. 1 Signed a contract to lease a building for $1,950 per month. Misty paid cash for the first 4 months in advance. 10 Purchased additional supplies on account, $750. 15 The salon provided 275 customers haircuts at $20/haircut during the first two weeks of business. The customers paid cash. 15 The salon provided 20 customers haircuts at $20/haircut during the first two weeks of business. The customers agreed to pay in the future. 15 Paid part-time worker (hair dresser) cash of $1,200 for the first two weeks of wages. 21 Collected $100 from a costumer for haircuts that will be provided for an appointment on January 28th. 22 Paid cash for a local newspaper advertisement, $180. 26 Collected cash of $260 from costumers on account. 28 Provided haircuts for costumers that paid on January 21 st. 29 Paid part-time worker (hair stylist) cash of $1,200 for the last two weeks of wages. 31 The salon provided haircuts to a total of 300 customers at $20/haircut during the last two weeks of business. The customers paid cash. 31 The salon provided 24 customers haircuts at $20/haircut during the first two weeks of business. The customers agreed to pay in the future. 31 Paid $420 of the amount owed on account. 31 The salon paid Misty a salary of $2,500 as he is the primary worker at the salon. The salon also paid Misty a dividend of $300. ADJUSTMENT INFORMATION at January 31, 2022 1. Record one month of depreciation on the fixed assets. The fixed assets are depreciated using the straight-line depreciation method AND have the following residual values and useful lives: Residual Value Useful Life Salon Chair #1 $200 10 years Salon Chair #2 $100 5 years 2. The hair stylist had worked for 2 days (January 30th and 31st ) at $100 per day since last pay day, but will not be paid for these days until next month. 3. A physical count of supplies revealed that $130 remains in supplies. 4. Utility bills that have been received but not paid totaled $475. 5. Dont forget to record an adjustment for the expired insurance and rent.

Maraiente Danaierabla

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts