Question: General Meters is considering two mergers. The first is with Firm A in its own volatile industry, the auto speedometer industry, while the second is

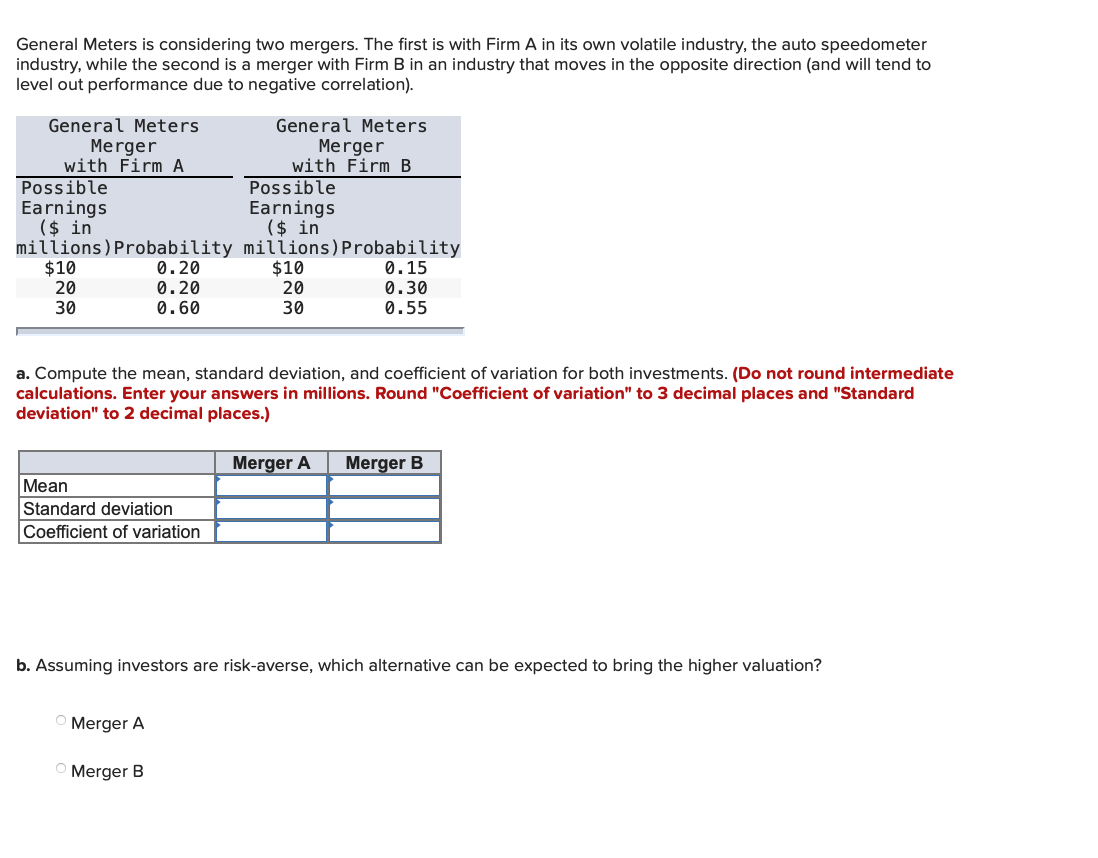

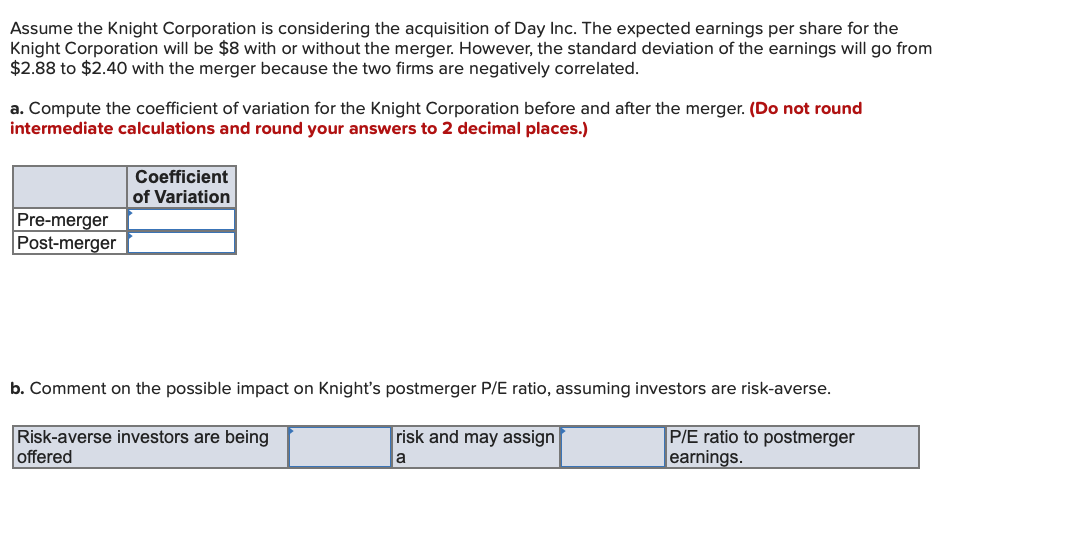

General Meters is considering two mergers. The first is with Firm A in its own volatile industry, the auto speedometer industry, while the second is a merger with Firm B in an industry that moves in the opposite direction (and will tend to level out performance due to negative correlation). General Meters General Meters Merger Merger with Firm A with Firm B Possible Possible Earnings Earnings ($ in ($ in millions) Probability millions) Probability $10 0.20 $10 0.15 20 0.20 20 0.30 30 0.60 30 0.55 a. Compute the mean, standard deviation, and coefficient of variation for both investments. (Do not round intermediate calculations. Enter your answers in millions. Round "Coefficient of variation" to 3 decimal places and "Standard deviation" to 2 decimal places.) Merger A Merger Mean Standard deviation Coefficient of variation b. Assuming investors are risk-averse, which alternative can be expected to bring the higher valuation? Merger A Merger B Assume the Knight Corporation is considering the acquisition of Day Inc. The expected earnings per share for the Knight Corporation will be $8 with or without the merger. However, the standard deviation of the earnings will go from $2.88 to $2.40 with the merger because the two firms are negatively correlated. a. Compute the coefficient of variation for the Knight Corporation before and after the merger. (Do not round intermediate calculations and round your answers to 2 decimal places.) Coefficient of Variation Pre-merger Post-merger b. Comment on the possible impact on Knight's postmerger P/E ratio, assuming investors are risk-averse. Risk-averse investors are being offered risk and may assign a P/E ratio to postmerger earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts