Question: general mills sec 10 -k Chapter 3: Notes to the Financial Statements-Ouestion ! How does your company define cash and cash equivalents? General Mills contiden

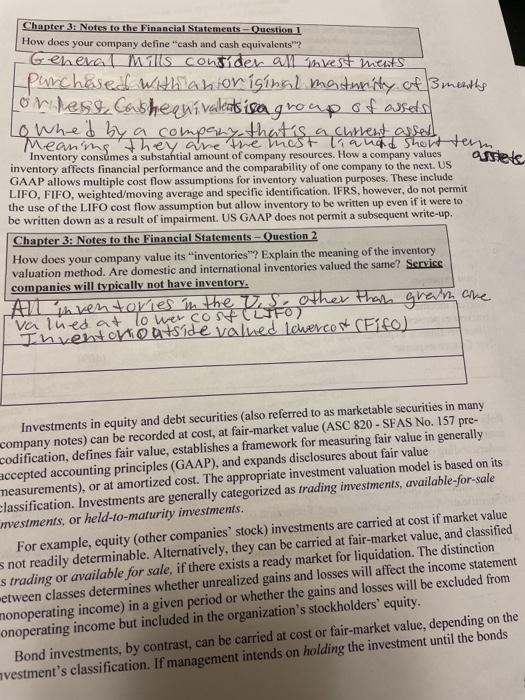

Chapter 3: Notes to the Financial Statements-Ouestion ! How does your company define "cash and cash equivalents"? General Mills contiden all investments purchased with an original maturity of marts On lese, Cashequivalents is a group of assets To whed by a company that is a current assed Meaning they are the most lianad short term, astele Inventory consumes a substantial amount of company resources. How a company values inventory affects financial performance and the comparability of one company to the next. US GAAP allows multiple cost flow assumptions for inventory valuation purposes. These include LIFO, FIFO, weighted/moving average and specific identification, IFRS, however, do not permit the use of the LIFO cost flow assumption but allow inventory to be written up even if it were to be written down as a result of impairment. US GAAP does not permit a subsequent write-up. Chapter 3: Notes to the Financial Statements - Question 2 How does your company value its "inventories? Explain the meaning of the inventory valuation method. Are domestic and international inventories valued the same? Service companies will typically not have inventory. All inventories in the to other than grain are Inventorio atside valued Icerco (Fifa) Investments in equity and debt securities (also referred to as marketable securities in many company notes) can be recorded at cost, at fair-market value (ASC 820 - SFAS No. 157 pre- codification, defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements), or at amortized cost. The appropriate investment valuation model is based on its classification. Investments are generally categorized as trading investments, available-for-sale rivestments, or held-to-maturity investments. For example, equity (other companies' stock) investments are carried at cost if market value s not readily determinable. Alternatively, they can be carried at fair-market value, and classified s trading or available for sale, if there exists a ready market for liquidation. The distinction metween classes determines whether unrealized gains and losses will affect the income statement monoperating income) in a given period or whether the gains and losses will be excluded from onoperating income but included in the organization's stockholders' equity. Bond investments, by contrast, can be carried at cost or fair-market value, depending on the nvestment's classification. If management intends on holding the investment until the bonds Chapter 3: Notes to the Financial Statements-Ouestion ! How does your company define "cash and cash equivalents"? General Mills contiden all investments purchased with an original maturity of marts On lese, Cashequivalents is a group of assets To whed by a company that is a current assed Meaning they are the most lianad short term, astele Inventory consumes a substantial amount of company resources. How a company values inventory affects financial performance and the comparability of one company to the next. US GAAP allows multiple cost flow assumptions for inventory valuation purposes. These include LIFO, FIFO, weighted/moving average and specific identification, IFRS, however, do not permit the use of the LIFO cost flow assumption but allow inventory to be written up even if it were to be written down as a result of impairment. US GAAP does not permit a subsequent write-up. Chapter 3: Notes to the Financial Statements - Question 2 How does your company value its "inventories? Explain the meaning of the inventory valuation method. Are domestic and international inventories valued the same? Service companies will typically not have inventory. All inventories in the to other than grain are Inventorio atside valued Icerco (Fifa) Investments in equity and debt securities (also referred to as marketable securities in many company notes) can be recorded at cost, at fair-market value (ASC 820 - SFAS No. 157 pre- codification, defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements), or at amortized cost. The appropriate investment valuation model is based on its classification. Investments are generally categorized as trading investments, available-for-sale rivestments, or held-to-maturity investments. For example, equity (other companies' stock) investments are carried at cost if market value s not readily determinable. Alternatively, they can be carried at fair-market value, and classified s trading or available for sale, if there exists a ready market for liquidation. The distinction metween classes determines whether unrealized gains and losses will affect the income statement monoperating income) in a given period or whether the gains and losses will be excluded from onoperating income but included in the organization's stockholders' equity. Bond investments, by contrast, can be carried at cost or fair-market value, depending on the nvestment's classification. If management intends on holding the investment until the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts