Question: General Systems and Fast Works Merger General Systems, a computer manufacturer, announces that it will be acquiring FastWorks Software. You know the following - General

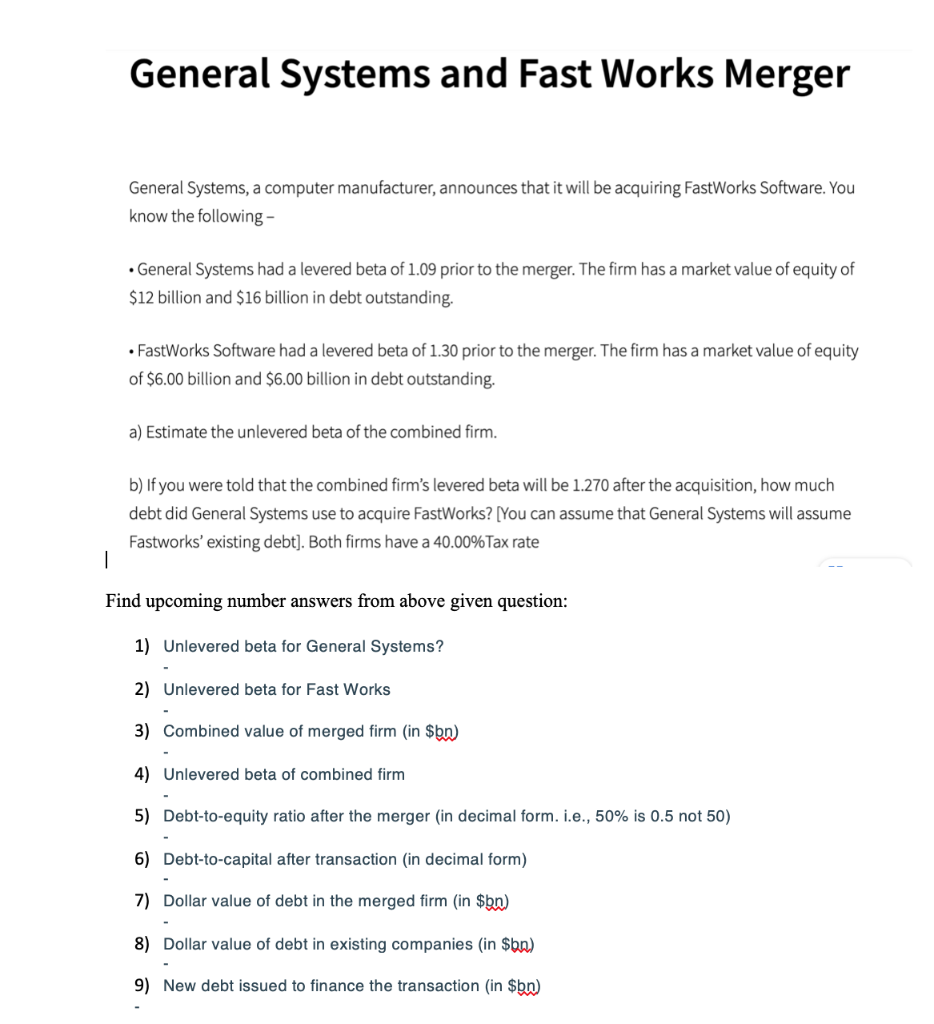

General Systems and Fast Works Merger General Systems, a computer manufacturer, announces that it will be acquiring FastWorks Software. You know the following - General Systems had a levered beta of 1.09 prior to the merger. The firm has a market value of equity of $12 billion and $16 billion in debt outstanding. FastWorks Software had a levered beta of 1.30 prior to the merger. The firm has a market value of equity of $6.00 billion and $6.00 billion in debt outstanding. a) Estimate the unlevered beta of the combined firm. b) If you were told that the combined firm's levered beta will be 1.270 after the acquisition, how much debt did General Systems use to acquire FastWorks? [You can assume that General Systems will assume Fastworks' existing debt). Both firms have a 40.00%Tax rate Find upcoming number answers from above given question: 1) Unlevered beta for General Systems? 2) Unlevered beta for Fast Works 3) Combined value of merged firm (in $bn) 4) Unlevered beta of combined firm 5) Debt-to-equity ratio after the merger (in decimal form. i.e., 50% is 0.5 not 50) 6) Debt-to-capital after transaction (in decimal form) 7) Dollar value of debt in the merged firm (in $bn) 8) Dollar value of debt in existing companies in $bn) 9) New debt issued to finance the transaction (in $bo)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts