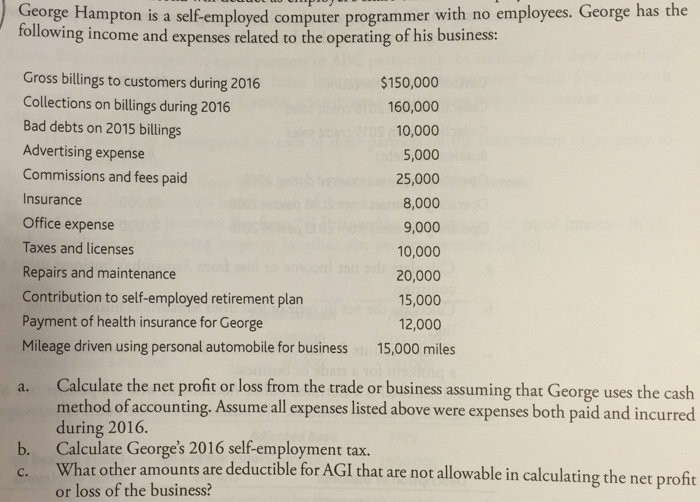

Question: George Hampton is a self-employed computer programmer with no employees. George has the following income and expenses related to the operating of his business: __a.

George Hampton is a self-employed computer programmer with no employees. George has the following income and expenses related to the operating of his business: __a. Calculate the net profit or loss from the trade or business assuming that George uses the cash method of accounting. Assume all expenses listed above were expenses both paid and incurred during 2016. b. Calculate George's 2016 self-employment tax c. What other amounts are deductible for AGI that are not allowable in calculating the net profit or loss of the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts