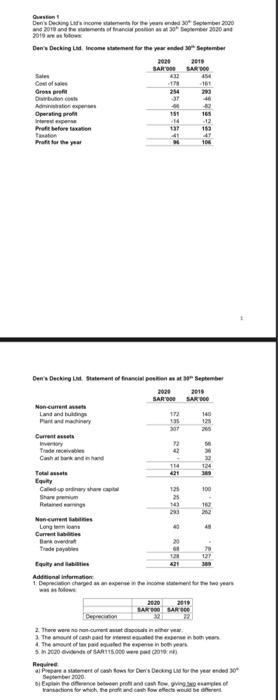

Question: Gestion ! De Donas con for the younded Sember 2000 2018 and the sofandi potember 2010 and 2018 www Den Decking Lind Income statement for

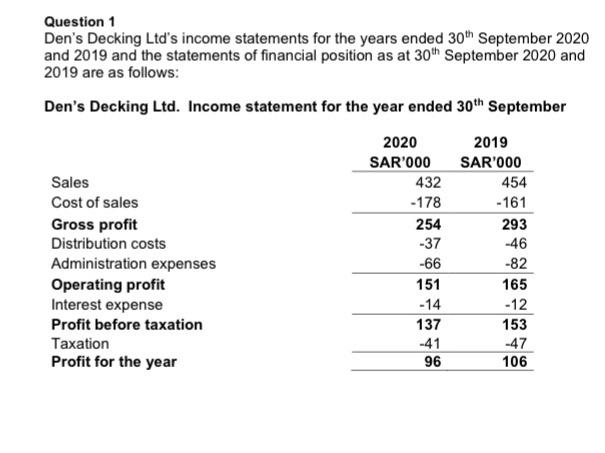

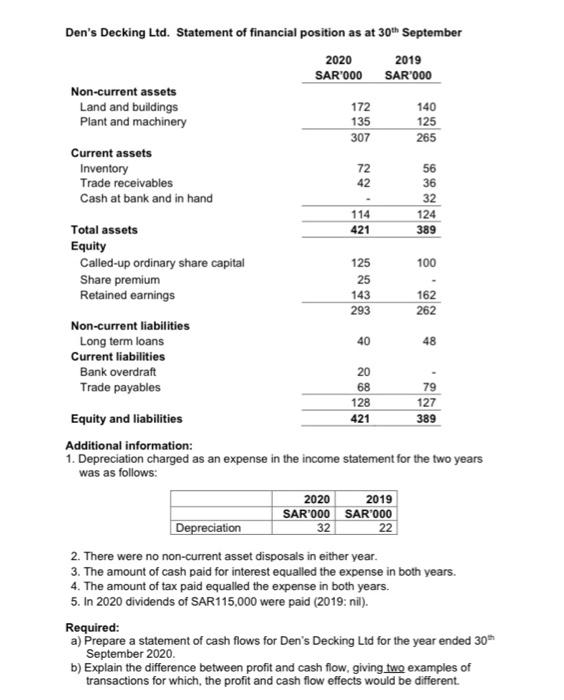

Gestion ! De Donas con for the younded Sember 2000 2018 and the sofandi potember 2010 and 2018 www Den Decking Lind Income statement for the year ended September 2020 2010 BAR BAR 100 454 Coeloe 11 Gros profe 254 Durboch 20 31 46 20 Operating pro 150 1 Westen 14 -13 Prule before tastin 13 Taon 41 47 Protetor the 104 Den's Docking Statement of financial per Setember 2020 2019 SAR SARDO Noncurrent Land and Pur machinery Current nery Trade receive Cintakan 14 21 ET ER 125 Retardan Nancreas Long Current Blank overrat U 19. 2.8 SE 145 Equity and Additional information Depreconceito years 2020 2019 SAR900 SARE 2. There were current disponin her ye The cash for the The sound of the expenser 5 7020 SAR115.000 2012 Red Prepare a statement shows to Der's Deding the year anded 30* September 2000 Dj Esploh ne prodating variation for which the pretend towelle et de Question 1 Den's Decking Ltd's income statements for the years ended 30th September 2020 and 2019 and the statements of financial position as at 30th September 2020 and 2019 are as follows: Den's Decking Ltd. Income statement for the year ended 30th September Sales Cost of sales Gross profit Distribution costs Administration expenses Operating profit Interest expense Profit before taxation Taxation Profit for the year 2020 SAR'000 432 -178 254 -37 -66 151 -14 137 2019 SAR'000 454 -161 293 -46 -82 165 -12 153 -47 106 -41 96 162 48 Den's Decking Ltd. Statement of financial position as at 30th September 2020 2019 SAR'000 SAR'000 Non-current assets Land and buildings 172 140 Plant and machinery 135 125 307 265 Current assets Inventory 72 56 Trade receivables 42 36 Cash at bank and in hand 32 114 124 Total assets 421 389 Equity Called-up ordinary share capital 125 100 Share premium 25 Retained earnings 143 293 262 Non-current liabilities Long term loans 40 Current liabilities Bank overdraft 20 Trade payables 68 79 128 127 Equity and liabilities 421 Additional information: 1. Depreciation charged as an expense in the income statement for the two years was as follows: 2020 2019 SAR'000 SAR'000 Depreciation 32 22 2. There were no non-current asset disposals in either year. 3. The amount of cash paid for interest equalled the expense in both years. 4. The amount of tax paid equalled the expense in both years. 5. In 2020 dividends of SAR115,000 were paid (2019: nil). Required: a) Prepare a statement of cash flows for Den's Decking Ltd for the year ended 30* September 2020. b) Explain the difference between profit and cash flow, giving two examples of transactions for which the profit and cash flow effects would be different 389

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts