Get It Right, CPAs, has been retained to review its client's corporate formation calculations for 20XX....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

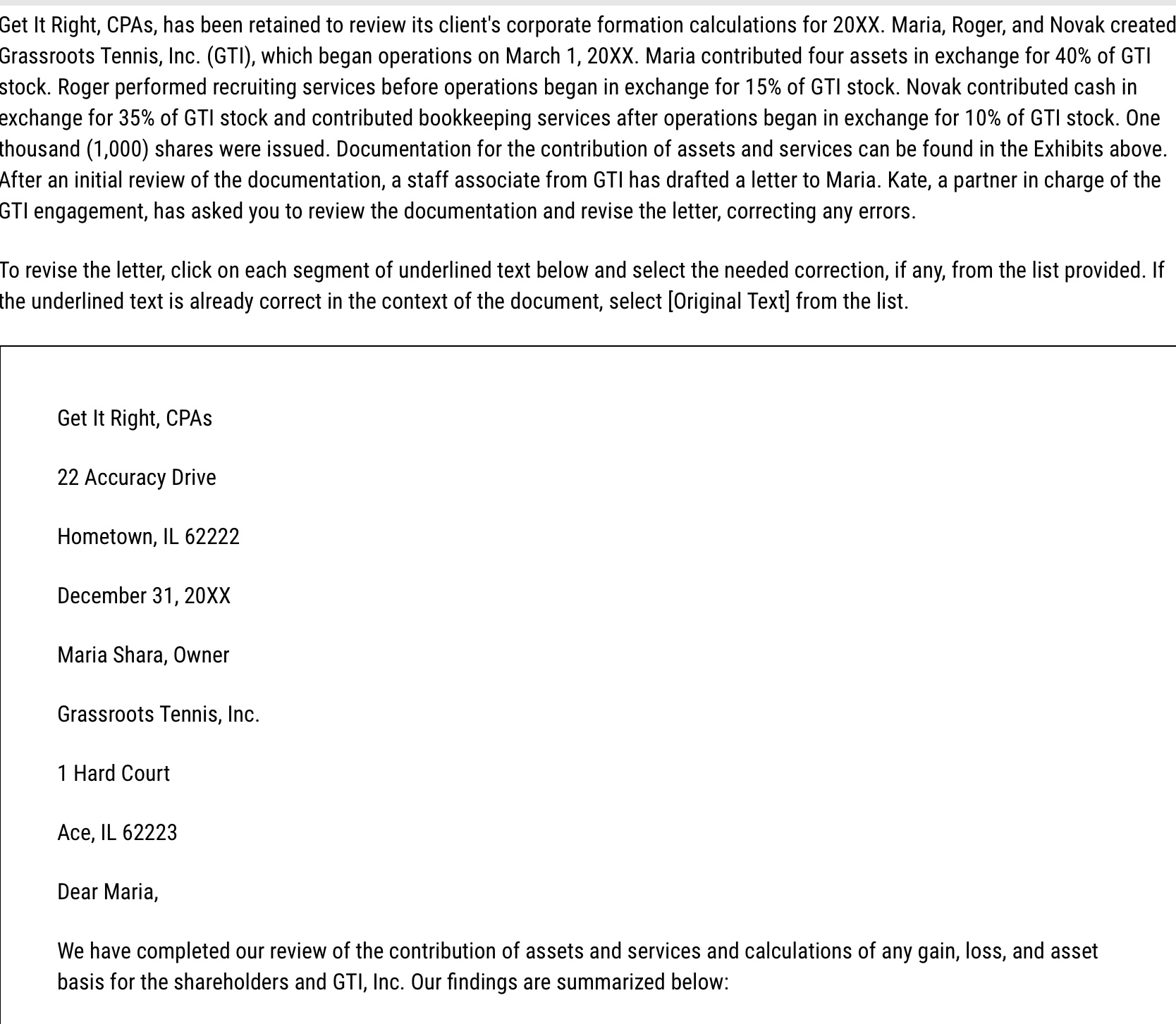

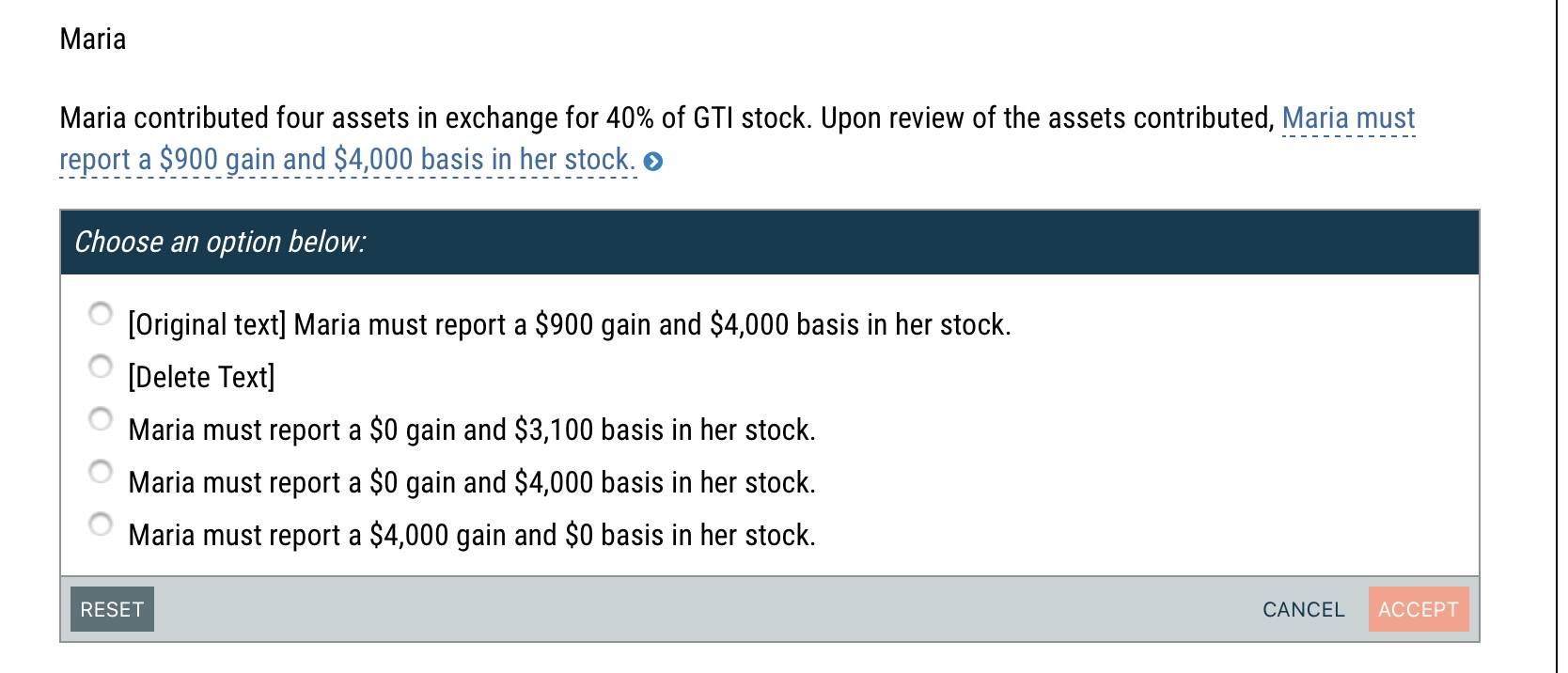

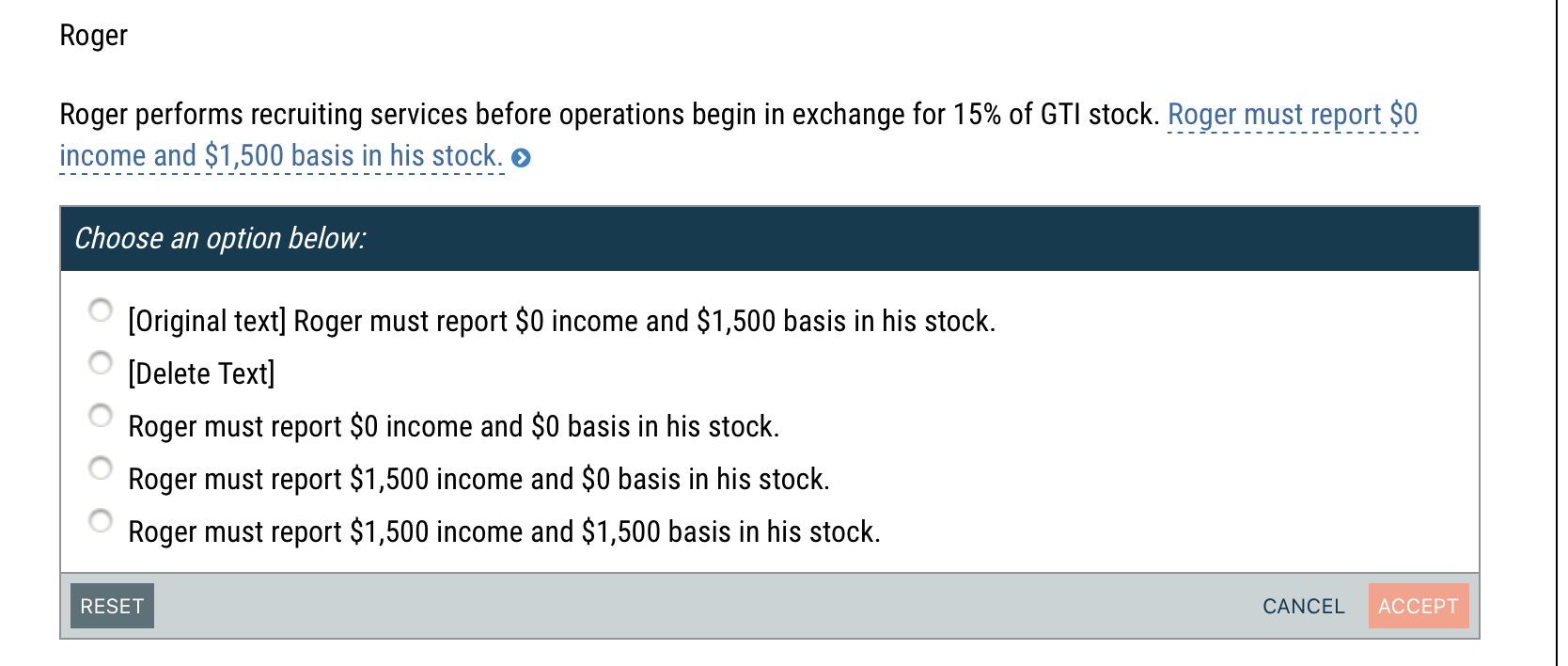

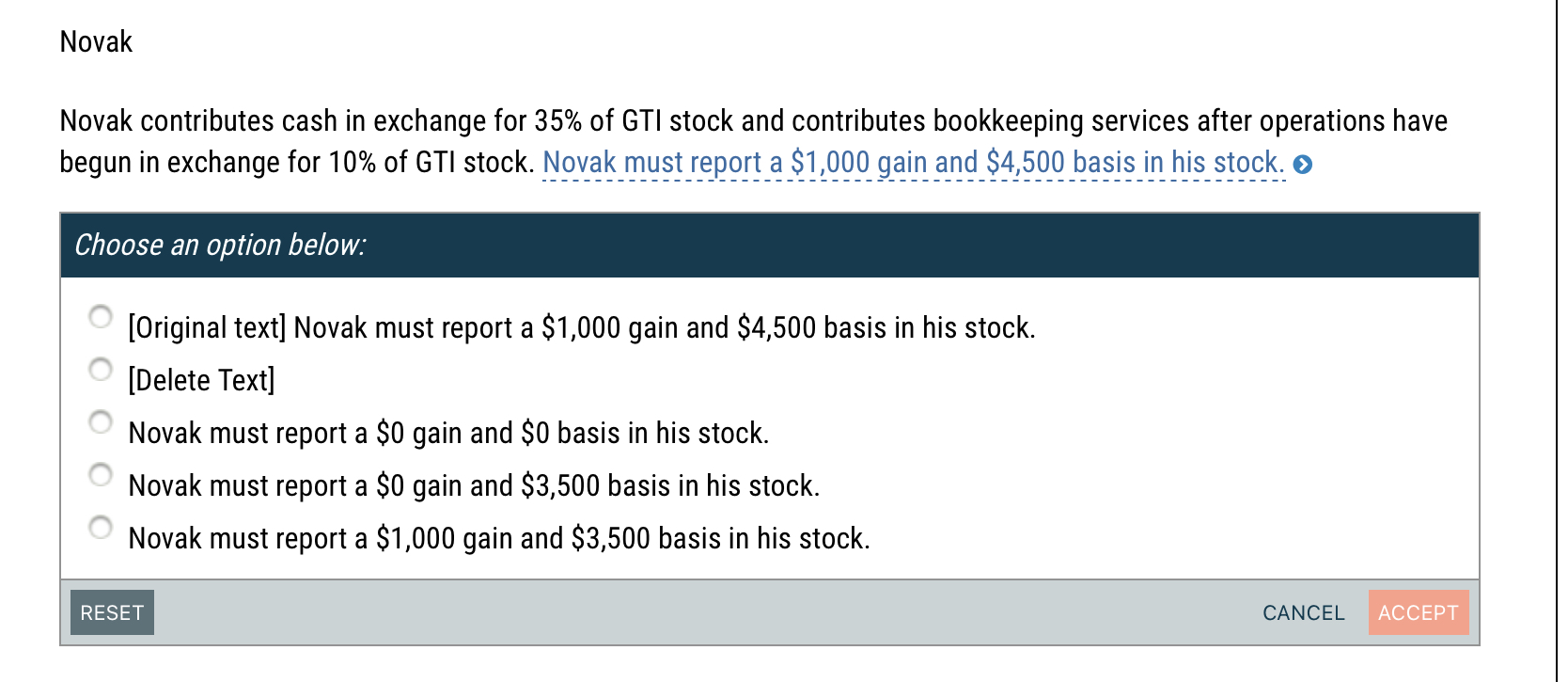

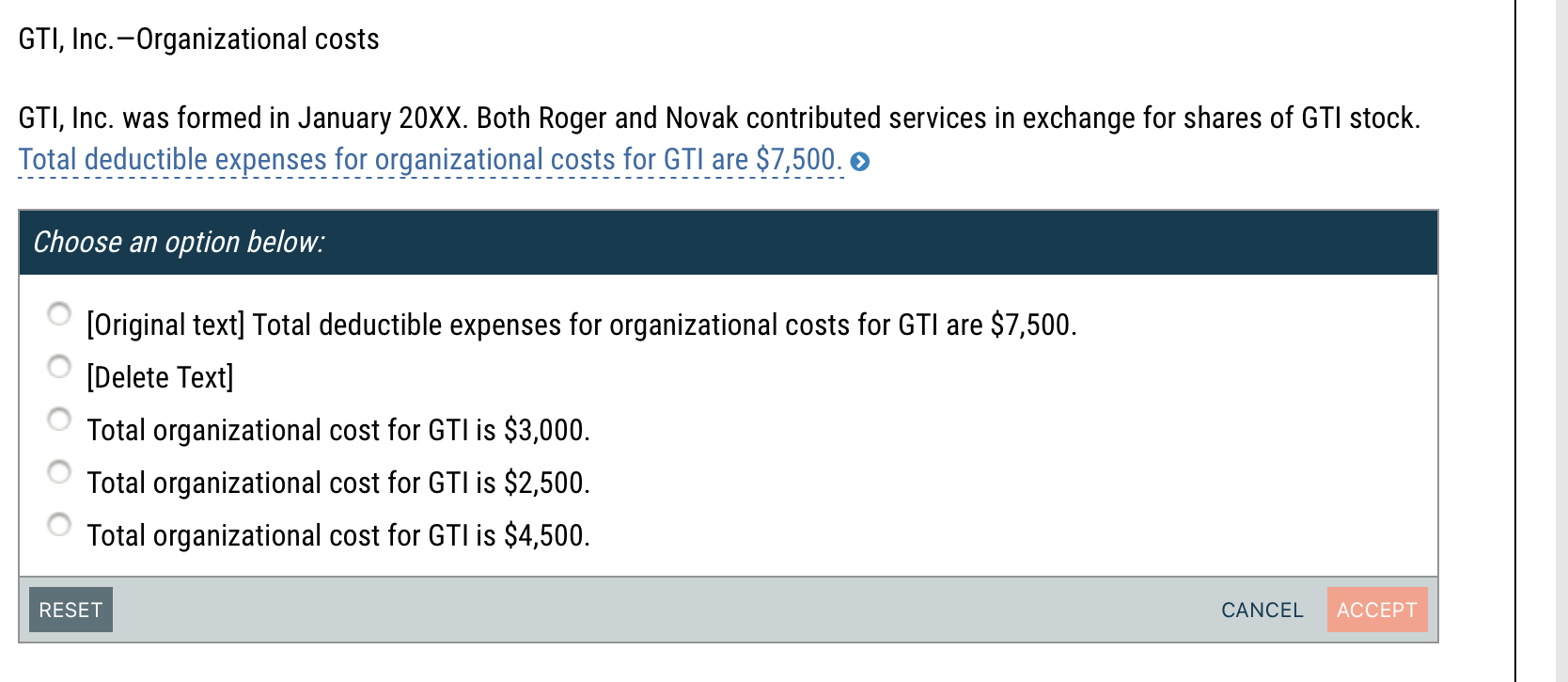

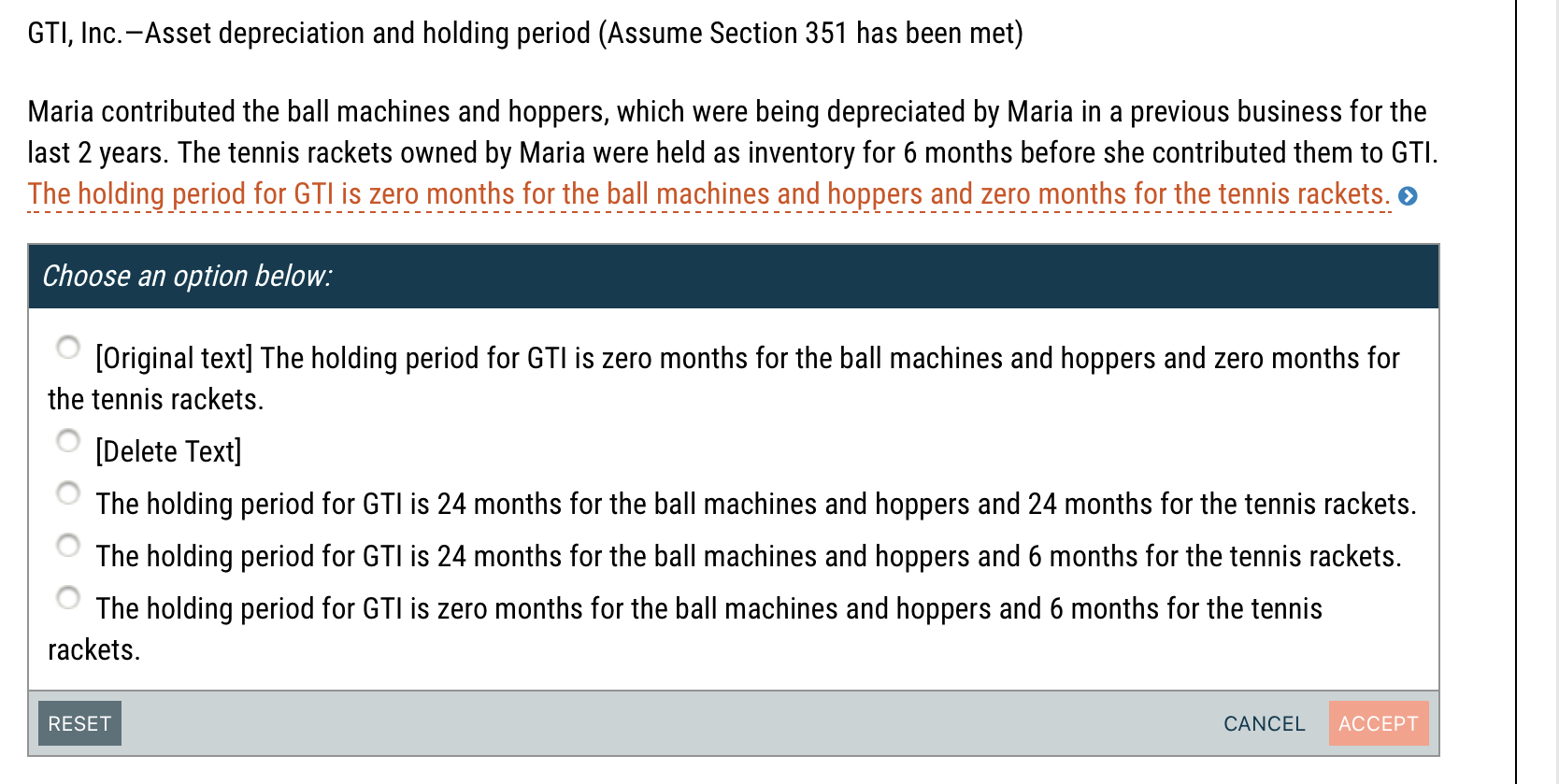

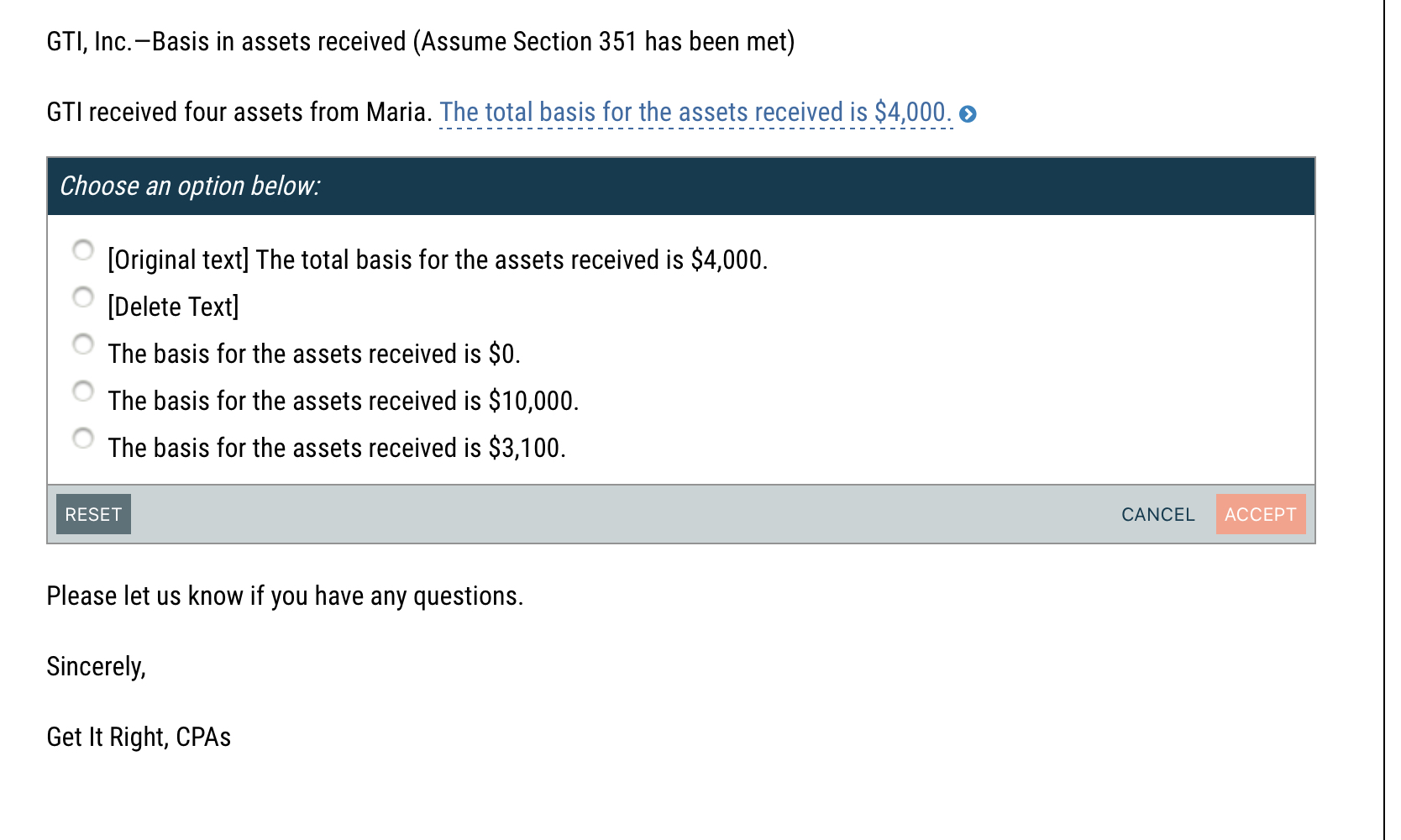

Get It Right, CPAs, has been retained to review its client's corporate formation calculations for 20XX. Maria, Roger, and Novak created Grassroots Tennis, Inc. (GTI), which began operations on March 1, 20XX. Maria contributed four assets in exchange for 40% of GTI stock. Roger performed recruiting services before operations began in exchange for 15% of GTI stock. Novak contributed cash in exchange for 35% of GTI stock and contributed bookkeeping services after operations began in exchange for 10% of GTI stock. One thousand (1,000) shares were issued. Documentation for the contribution of assets and services can be found in the Exhibits above. After an initial review of the documentation, a staff associate from GTI has drafted a letter to Maria. Kate, a partner in charge of the GTI engagement, has asked you to review the documentation and revise the letter, correcting any errors. To revise the letter, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text] from the list. Get It Right, CPAS 22 Accuracy Drive Hometown, IL 62222 December 31, 20XX Maria Shara, Owner Grassroots Tennis, Inc. 1 Hard Court Ace, IL 62223 Dear Maria, We have completed our review of the contribution of assets and services and calculations of any gain, loss, and asset basis for the shareholders and GTI, Inc. Our findings are summarized below: Maria Maria contributed four assets in exchange for 40% of GTI stock. Upon review of the assets contributed, Maria must report a $900 gain and $4,000 basis in her stock. Choose an option below: [Original text] Maria must report a $900 gain and $4,000 basis in her stock. [Delete Text] Maria must report a $0 gain and $3,100 basis in her stock. Maria must report a $0 gain and $4,000 basis in her stock. Maria must report a $4,000 gain and $0 basis in her stock. оооо RESET CANCEL ACCEPT Roger Roger performs recruiting services before operations begin in exchange for 15% of GTI stock. Roger must report $0 income and $1,500 basis in his stock. > Choose an option below: ооо [Original text] Roger must report $0 income and $1,500 basis in his stock. [Delete Text] Roger must report $0 income and $0 basis in his stock. Roger must report $1,500 income and $0 basis in his stock. Roger must report $1,500 income and $1,500 basis in his stock. RESET CANCEL ACCEPT Novak Novak contributes cash in exchange for 35% of GTI stock and contributes bookkeeping services after operations have begun in exchange for 10% of GTI stock. Novak must report a $1,000 gain and $4,500 basis in his stock. Choose an option below: оооо [Original text] Novak must report a $1,000 gain and $4,500 basis in his stock. [Delete Text] Novak must report a $0 gain and $0 basis in his stock. Novak must report a $0 gain and $3,500 basis in his stock. Novak must report a $1,000 gain and $3,500 basis in his stock. RESET CANCEL ACCEPT GTI, Inc.-Organizational costs GTI, Inc. was formed in January 20XX. Both Roger and Novak contributed services in exchange for shares of GTI stock. Total deductible expenses for organizational costs for GTI are $7,500. Choose an option below: [Original text] Total deductible expenses for organizational costs for GTI are $7,500. [Delete Text] Total organizational cost for GTI is $3,000. Total organizational cost for GTI is $2,500. Total organizational cost for GTI is $4,500. RESET CANCEL ACCEPT GTI, Inc.-Asset depreciation and holding period (Assume Section 351 has been met) Maria contributed the ball machines and hoppers, which were being depreciated by Maria in a previous business for the last 2 years. The tennis rackets owned by Maria were held as inventory for 6 months before she contributed them to GTI. The holding period for GTI is zero months for the ball machines and hoppers and zero months for the tennis rackets. Choose an option below: [Original text] The holding period for GTI is zero months for the ball machines and hoppers and zero months for the tennis rackets. [Delete Text] The holding period for GTI is 24 months for the ball machines and hoppers and 24 months for the tennis rackets. The holding period for GTI is 24 months for the ball machines and hoppers and 6 months for the tennis rackets. The holding period for GTI is zero months for the ball machines and hoppers and 6 months for the tennis rackets. RESET CANCEL ACCEPT GTI, Inc.-Basis in assets received (Assume Section 351 has been met) GTI received four assets from Maria. The total basis for the assets received is $4,000. > Choose an option below: [Original text] The total basis for the assets received is $4,000. [Delete Text] The basis for the assets received is $0. The basis for the assets received is $10,000. The basis for the assets received is $3,100. RESET Please let us know if you have any questions. Sincerely, Get It Right, CPAS CANCEL ACCEPT Get It Right, CPAs, has been retained to review its client's corporate formation calculations for 20XX. Maria, Roger, and Novak created Grassroots Tennis, Inc. (GTI), which began operations on March 1, 20XX. Maria contributed four assets in exchange for 40% of GTI stock. Roger performed recruiting services before operations began in exchange for 15% of GTI stock. Novak contributed cash in exchange for 35% of GTI stock and contributed bookkeeping services after operations began in exchange for 10% of GTI stock. One thousand (1,000) shares were issued. Documentation for the contribution of assets and services can be found in the Exhibits above. After an initial review of the documentation, a staff associate from GTI has drafted a letter to Maria. Kate, a partner in charge of the GTI engagement, has asked you to review the documentation and revise the letter, correcting any errors. To revise the letter, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text] from the list. Get It Right, CPAS 22 Accuracy Drive Hometown, IL 62222 December 31, 20XX Maria Shara, Owner Grassroots Tennis, Inc. 1 Hard Court Ace, IL 62223 Dear Maria, We have completed our review of the contribution of assets and services and calculations of any gain, loss, and asset basis for the shareholders and GTI, Inc. Our findings are summarized below: Maria Maria contributed four assets in exchange for 40% of GTI stock. Upon review of the assets contributed, Maria must report a $900 gain and $4,000 basis in her stock. Choose an option below: [Original text] Maria must report a $900 gain and $4,000 basis in her stock. [Delete Text] Maria must report a $0 gain and $3,100 basis in her stock. Maria must report a $0 gain and $4,000 basis in her stock. Maria must report a $4,000 gain and $0 basis in her stock. оооо RESET CANCEL ACCEPT Roger Roger performs recruiting services before operations begin in exchange for 15% of GTI stock. Roger must report $0 income and $1,500 basis in his stock. > Choose an option below: ооо [Original text] Roger must report $0 income and $1,500 basis in his stock. [Delete Text] Roger must report $0 income and $0 basis in his stock. Roger must report $1,500 income and $0 basis in his stock. Roger must report $1,500 income and $1,500 basis in his stock. RESET CANCEL ACCEPT Novak Novak contributes cash in exchange for 35% of GTI stock and contributes bookkeeping services after operations have begun in exchange for 10% of GTI stock. Novak must report a $1,000 gain and $4,500 basis in his stock. Choose an option below: оооо [Original text] Novak must report a $1,000 gain and $4,500 basis in his stock. [Delete Text] Novak must report a $0 gain and $0 basis in his stock. Novak must report a $0 gain and $3,500 basis in his stock. Novak must report a $1,000 gain and $3,500 basis in his stock. RESET CANCEL ACCEPT GTI, Inc.-Organizational costs GTI, Inc. was formed in January 20XX. Both Roger and Novak contributed services in exchange for shares of GTI stock. Total deductible expenses for organizational costs for GTI are $7,500. Choose an option below: [Original text] Total deductible expenses for organizational costs for GTI are $7,500. [Delete Text] Total organizational cost for GTI is $3,000. Total organizational cost for GTI is $2,500. Total organizational cost for GTI is $4,500. RESET CANCEL ACCEPT GTI, Inc.-Asset depreciation and holding period (Assume Section 351 has been met) Maria contributed the ball machines and hoppers, which were being depreciated by Maria in a previous business for the last 2 years. The tennis rackets owned by Maria were held as inventory for 6 months before she contributed them to GTI. The holding period for GTI is zero months for the ball machines and hoppers and zero months for the tennis rackets. Choose an option below: [Original text] The holding period for GTI is zero months for the ball machines and hoppers and zero months for the tennis rackets. [Delete Text] The holding period for GTI is 24 months for the ball machines and hoppers and 24 months for the tennis rackets. The holding period for GTI is 24 months for the ball machines and hoppers and 6 months for the tennis rackets. The holding period for GTI is zero months for the ball machines and hoppers and 6 months for the tennis rackets. RESET CANCEL ACCEPT GTI, Inc.-Basis in assets received (Assume Section 351 has been met) GTI received four assets from Maria. The total basis for the assets received is $4,000. > Choose an option below: [Original text] The total basis for the assets received is $4,000. [Delete Text] The basis for the assets received is $0. The basis for the assets received is $10,000. The basis for the assets received is $3,100. RESET Please let us know if you have any questions. Sincerely, Get It Right, CPAS CANCEL ACCEPT

Expert Answer:

Answer rating: 100% (QA)

The detailed answer for the above question is provided below 1 In the original text it correctly states that Maria contributed four assets in exchange for 40 of GTI Grassroots Tennis Inc stock This me... View the full answer

Related Book For

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Posted Date:

Students also viewed these accounting questions

-

-1 2 -3 7. Let A = M2(R) and B = 3 4 -5 M2,3(R). Compute 6 A-B.

-

It is going to be a long night! First thing this morning, the senior partner of your three-partner firm, Peters, Peters, and Paul (PPP), called you into her office to tell you that she had a...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

On January 1, 2020, Cullumber Industries Ltd. issued 1,780,000 face value, 5%, 10-year bonds at 1,648,990. This price resulted in an effective-interest rate of 6% on the bonds. Cullumber uses the...

-

The graph of a function f is given. x (a) State the value of f ( 1). (b) Estimate the value of f (2) (c) For what values of x is f (x) = 2? (d) Estimate the values of x such that f (x) = 0. (e) State...

-

How does Media Arts integrate emerging technologies such as augmented reality and machine learning to redefine narrative structures and audience engagement ?

-

Saturated steam at \(356 \mathrm{~K}\) condenses on a vertical tube of diameter \(5 \mathrm{~cm}\) whose surface is maintained at \(340 \mathrm{~K}\). Find the height at which the flow becomes wavy....

-

Northern Communications has the following stockholders equity: Requirements 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common...

-

What is the return on an Investment that costs $500 today and will return $800 at the end of 4 years? What long will it take a $100 investment to double to $200 if the interest rate is 6%?

-

To evaluate the quality of its airline service, airline managers want to randomly sample passengers traveling between two large airports. On a particular day, all 578 passengers flying between the...

-

What type of foot protection should you wear around heavy materials that can roll, slip, or fall?

-

Despite the wording of most statutes proscribing the offense of escape, courts increasingly require the prosecution to prove the defendants specific intent to avoid lawful confinement. Are courts...

-

Go to http://www.findlaw.com/casecode/supreme.html. Use this page to locate the Supreme Courts decision in Gonzales v. Raich (2005). Read the decision. Identify the key issue and the Courts holding....

-

Use a standard monopoly firm graph to show and explain how the monopoly power of a team is changed when another team locates nearby.

-

In a bag of assorted candies, there are 13 Almond Joys and 7 Twizzlers left. You sample 5 candies at random. What is the probability that you get 2 or fewer Almond Joys?

-

Jurors are generally selected from among those citizens who have registered to vote or who have registered motor vehicles. Do these methods produce juries drawn from a representative cross-section of...

-

Four people are sitting in a row , facing south. B is sitting two places to the right of C. A is sitting between B and C. What is D's position in the row ? A. four places to the right of b B. three...

-

As long as we can't lose any money, we have a risk-free investment." Discuss this comment. Q2: Both investing and gambling can be defined as "undertaking risk in order to earn a profit." Explain how...

-

Analysts can compare ROCEs across companies but should not compare basic EPSs despite the fact that both ratios use net income to the common shareholders in the numerator. Explain.

-

Analyzing the profitability of restaurants requires consideration of their strategies with respect to ownership of restaurants versus franchising. Firms that own and operate their restaurants report...

-

Refer to the websites and the Form 10-K reports of Home Depot (www.homedepot.com) and Lowes (www.lowes.com). Compare and contrast their business strategies.

-

What is the main difference between a full-service and a limited-service supplier?

-

Discuss an ethical issue in marketing research that relates to each of the following stakeholders: (1) client, (2) the supplier, and (3) the respondent.

-

List two possible limitations when using social media for marketing research.

Study smarter with the SolutionInn App