Question: GGV Internship Application Task Bearing in mind that Golden Gate invests in startups operating within Southeast Asia, please summarize your view on the investment potential

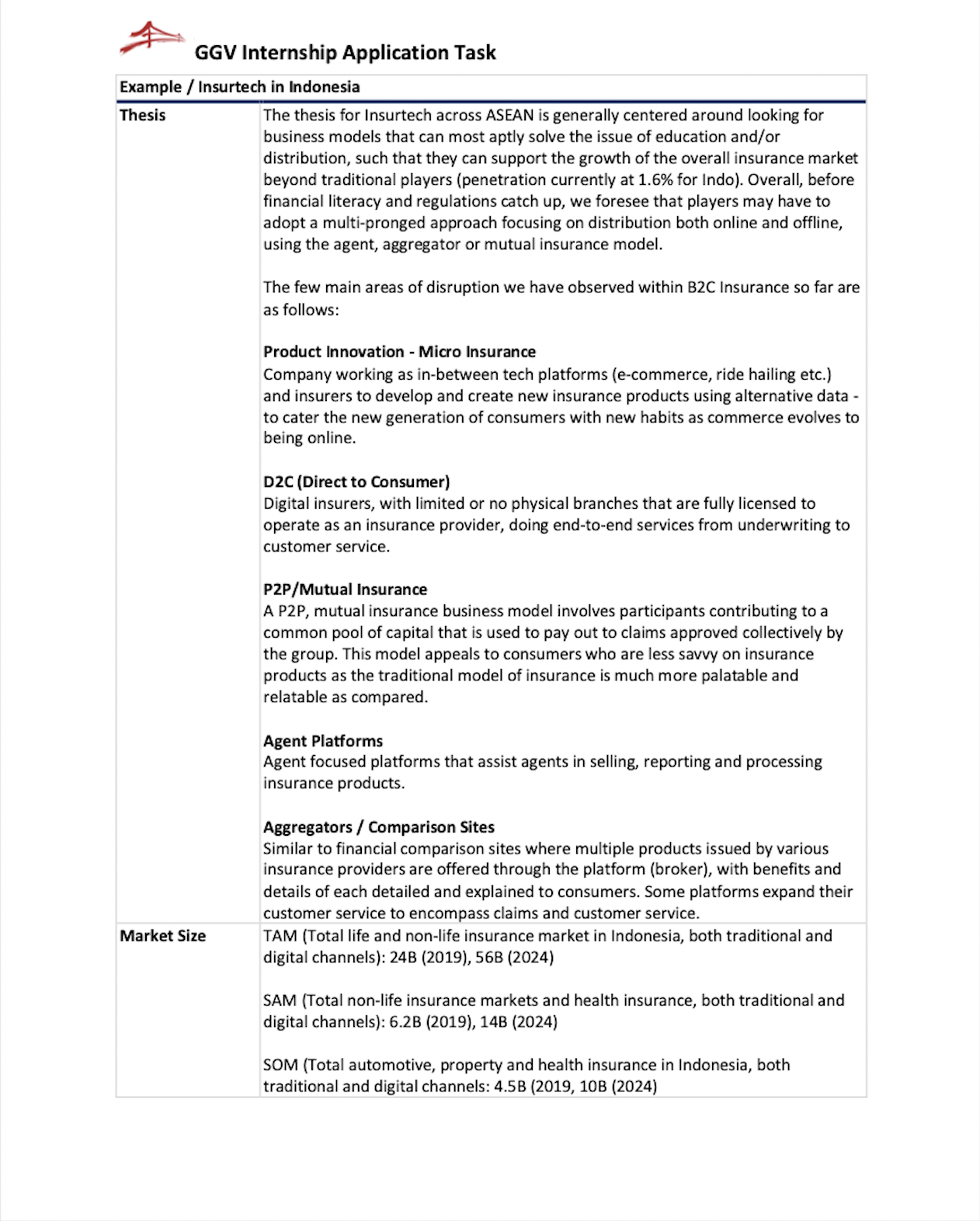

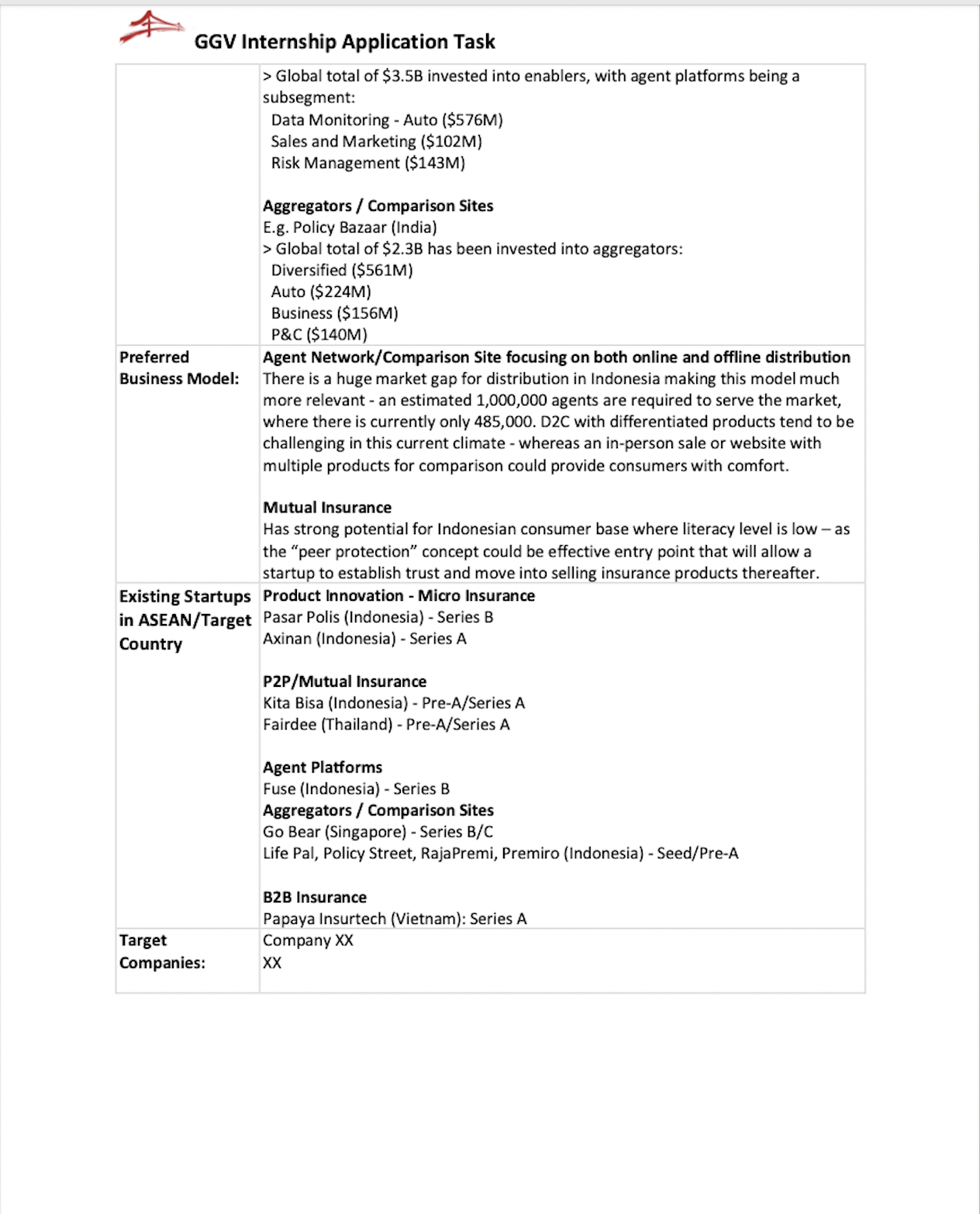

GGV Internship Application Task Bearing in mind that Golden Gate invests in startups operating within Southeast Asia, please summarize your view on the investment potential of the industry/sector provided to you. Fill in the following table - 1) Please clearly include in a simple projection on excel the calculation of respective market sizes; TAM, SAM and SOM accordingly GGV Internship Application Task / Insurtech in Indonesia The thesis for Insurtech across ASEAN is generally centered around looking for business models that can most aptly solve the issue of education and/or distribution, such that they can support the growth of the overall insurance market beyond traditional players (penetration currently at 1.6% for Indo). Overall, before financial literacy and regulations catch up, we foresee that players may have to adopt a multi-pronged approach focusing on distribution both online and offline, using the agent, aggregator or mutual insurance model. The few main areas of disruption we have observed within B2C Insurance so far are as follows: Product Innovation - Micro Insurance Company working as in-between tech platforms (e-commerce, ride hailing etc.) and insurers to develop and create new insurance products using alternative data to cater the new generation of consumers with new habits as commerce evolves to being online. D2C (Direct to Consumer) Digital insurers, with limited or no physical branches that are fully licensed to operate as an insurance provider, doing end-to-end services from underwriting to customer service. P2P/Mutual Insurance A P2P, mutual insurance business model involves participants contributing to a common pool of capital that is used to pay out to claims approved collectively by the group. This model appeals to consumers who are less savvy on insurance products as the traditional model of insurance is much more palatable and relatable as compared. Agent Platforms Agent focused platforms that assist agents in selling, reporting and processing insurance products. Aggregators / Comparison Sites Similar to financial comparison sites where multiple products issued by various insurance providers are offered through the platform (broker), with benefits and details of each detailed and explained to consumers. Some platforms expand their customer service to encompass claims and customer service. TAM (Total life and non-life insurance market in Indonesia, both traditional and digital channels): 24B (2019), 56B (2024) SAM (Total non-life insurance markets and health insurance, both traditional and digital channels): 6.2B (2019), 14B (2024) SOM (Total automotive, property and health insurance in Indonesia, both traditional and digital channels: 4.5B (2019, 10B (2024) GGV Internship Application Task GGV Internship Application Task Bearing in mind that Golden Gate invests in startups operating within Southeast Asia, please summarize your view on the investment potential of the industry/sector provided to you. Fill in the following table - 1) Please clearly include in a simple projection on excel the calculation of respective market sizes; TAM, SAM and SOM accordingly GGV Internship Application Task / Insurtech in Indonesia The thesis for Insurtech across ASEAN is generally centered around looking for business models that can most aptly solve the issue of education and/or distribution, such that they can support the growth of the overall insurance market beyond traditional players (penetration currently at 1.6% for Indo). Overall, before financial literacy and regulations catch up, we foresee that players may have to adopt a multi-pronged approach focusing on distribution both online and offline, using the agent, aggregator or mutual insurance model. The few main areas of disruption we have observed within B2C Insurance so far are as follows: Product Innovation - Micro Insurance Company working as in-between tech platforms (e-commerce, ride hailing etc.) and insurers to develop and create new insurance products using alternative data to cater the new generation of consumers with new habits as commerce evolves to being online. D2C (Direct to Consumer) Digital insurers, with limited or no physical branches that are fully licensed to operate as an insurance provider, doing end-to-end services from underwriting to customer service. P2P/Mutual Insurance A P2P, mutual insurance business model involves participants contributing to a common pool of capital that is used to pay out to claims approved collectively by the group. This model appeals to consumers who are less savvy on insurance products as the traditional model of insurance is much more palatable and relatable as compared. Agent Platforms Agent focused platforms that assist agents in selling, reporting and processing insurance products. Aggregators / Comparison Sites Similar to financial comparison sites where multiple products issued by various insurance providers are offered through the platform (broker), with benefits and details of each detailed and explained to consumers. Some platforms expand their customer service to encompass claims and customer service. TAM (Total life and non-life insurance market in Indonesia, both traditional and digital channels): 24B (2019), 56B (2024) SAM (Total non-life insurance markets and health insurance, both traditional and digital channels): 6.2B (2019), 14B (2024) SOM (Total automotive, property and health insurance in Indonesia, both traditional and digital channels: 4.5B (2019, 10B (2024) GGV Internship Application Task

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts