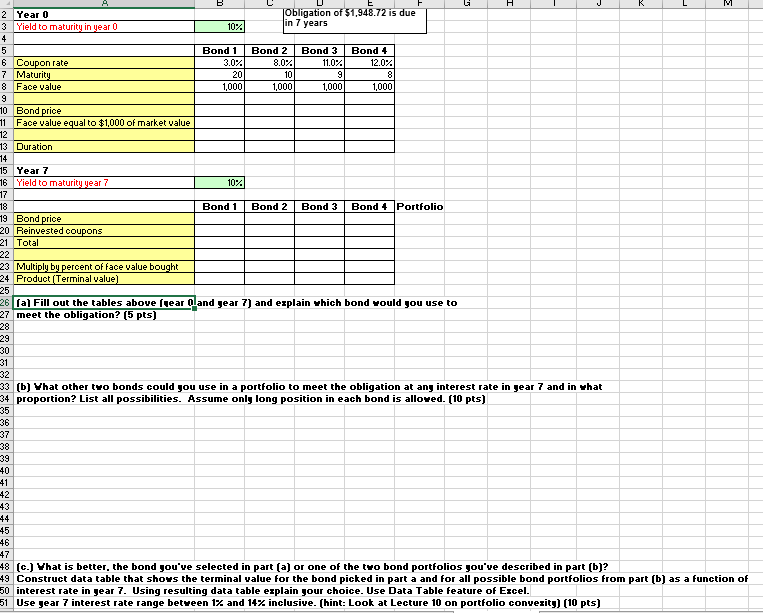

Question: Gi H - J K M E 2 Year 0 Obligation of $1.948.72 is due 3 Yield to maturity in year 0 10% in 7

Gi H - J K M E 2 Year 0 Obligation of $1.948.72 is due 3 Yield to maturity in year 0 10% in 7 years 4 5 Bond 1 Bond 2 Bond 3 Bond 4 6 Coupon rate 3.0% 8.0% 11.0% 12.0% 7 Maturity 20 10 9 8 8 Face value 1,000 1,000 1,000 1,000 9 10 Bond price 11 Face value equal to $1,000 of market value 12 13 Duration 14 15 Year 7 16 Yield to maturity year 7 10% 17 18 Bond 1 Bond 2 Bond 3 Bond 4 Portfolio 19 Bond price 20 Reinvested coupons 21 Total 22 23 Multiply by percent of face value bought 24 Product (Terminal value) 25 26 (a) Fill out the tables above (year oland gear 7) and explain which bond would you use to 27 meet the obligation? (5 pts) 28 29 30 31 32 33 (b) Vhat other tvo bonds could you use in a portfolio to meet the obligation at ang interest rate in gear 7 and in what 34 proportion? List all possibilities. Assume only long position in each bond is allowed. (10 pts) 35 36 37 38 39 40 41 42 43 44 45 46 47 48 (c.) Vhat is better, the bond you've selected in part (a) or one of the two bond portfolios you've described in part (b)? 49 Construct data table that shows the terminal value for the bond picked in part a and for all possible bond portfolios from part (b) as a function of 50 interest rate in year 7. Using resulting data table explain your choice. Use Data Table feature of Excel. 51 Use year 7 interest rate range between 17 and 14% inclusive. (hint: Look at Lecture 10 on portfolio convexity) (10 pts) Gi H - J K M E 2 Year 0 Obligation of $1.948.72 is due 3 Yield to maturity in year 0 10% in 7 years 4 5 Bond 1 Bond 2 Bond 3 Bond 4 6 Coupon rate 3.0% 8.0% 11.0% 12.0% 7 Maturity 20 10 9 8 8 Face value 1,000 1,000 1,000 1,000 9 10 Bond price 11 Face value equal to $1,000 of market value 12 13 Duration 14 15 Year 7 16 Yield to maturity year 7 10% 17 18 Bond 1 Bond 2 Bond 3 Bond 4 Portfolio 19 Bond price 20 Reinvested coupons 21 Total 22 23 Multiply by percent of face value bought 24 Product (Terminal value) 25 26 (a) Fill out the tables above (year oland gear 7) and explain which bond would you use to 27 meet the obligation? (5 pts) 28 29 30 31 32 33 (b) Vhat other tvo bonds could you use in a portfolio to meet the obligation at ang interest rate in gear 7 and in what 34 proportion? List all possibilities. Assume only long position in each bond is allowed. (10 pts) 35 36 37 38 39 40 41 42 43 44 45 46 47 48 (c.) Vhat is better, the bond you've selected in part (a) or one of the two bond portfolios you've described in part (b)? 49 Construct data table that shows the terminal value for the bond picked in part a and for all possible bond portfolios from part (b) as a function of 50 interest rate in year 7. Using resulting data table explain your choice. Use Data Table feature of Excel. 51 Use year 7 interest rate range between 17 and 14% inclusive. (hint: Look at Lecture 10 on portfolio convexity) (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts