Question: gi?i thch chi ti?t Transaction PriceVariable Consideration ESTIMATING VARIABLE CONSIDERATION Facts: Peabody Construction Company enters into a contract with a customer to build a warehouse

gi?i thch chi ti?t

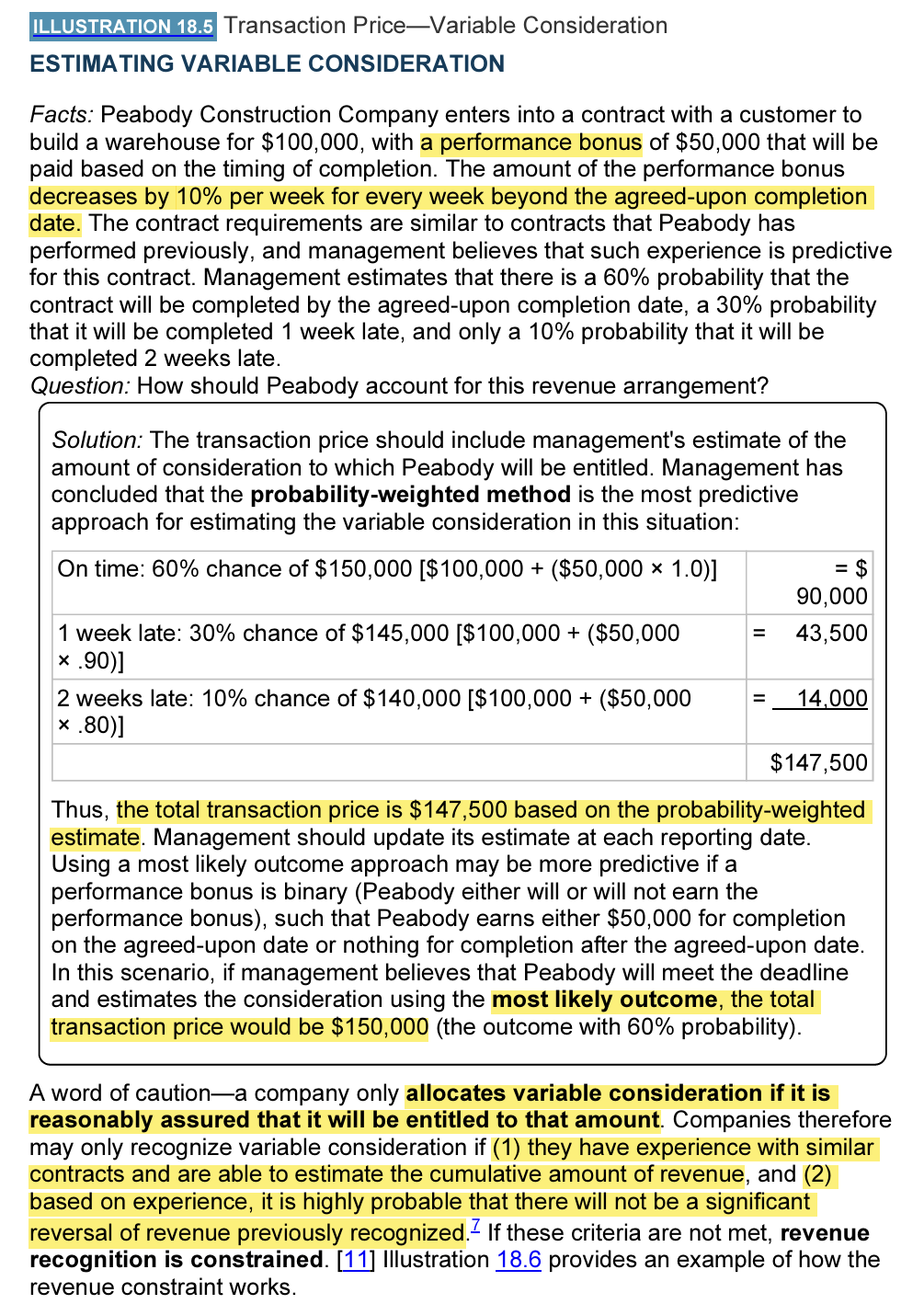

Transaction PriceVariable Consideration ESTIMATING VARIABLE CONSIDERATION Facts: Peabody Construction Company enters into a contract with a customer to build a warehouse for $100,000, with a performance bonus of $50,000 that will be paid based on the timing of completion. The amount of the performance bonus decreases by 10% per week for every week beyond the agreed-upon completion date. The contract requirements are similar to contracts that Peabody has performed previously, and management believes that such experience is predictive for this contract. Management estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 30% probability that it will be completed 1 week late, and only a 10% probability that it will be completed 2 weeks late. Question: How should Peabody account for this revenue arrangement? Solution: The transaction price should include management's estimate of the amount of consideration to which Peabody will be entitled. Management has concluded that the probability-weighted method is the most predictive approach for estimating the variable consideration in this situation: On time: 80% chance of $150,000 [$100,000 + ($50,000 x 1.0)] 1 week late: 30% chance of $145,000 [$100,000 + ($50,000 x .90)] 2 weeks late: 10% chance of $140,000 [$100,000 + ($50,000 = _ 14,000 x .80)] $147,500 Thus, the total transaction price is $147,500 based on the probability-weighted estimate. Management should update its estimate at each reporting date. Using a most likely outcome approach may be more predictive if a performance bonus is binary (Peabody either will or will not earn the performance bonus), such that Peabody earns either $50,000 for completion on the agreed-upon date or nothing for completion after the agreed-upon date. In this scenario, if management believes that Peabody will meet the deadline and estimates the consideration using the most likely outcome, the total transaction price would be $150,000 (the outcome with 60% probability). A word of cautiona company only allocates variable consideration if it is reasonably assured that it will be entitled to that amount. Companies therefore may only recognize variable consideration if (1) they have experience with similar contracts and are able to estimate the cumulative amount of revenue, and (2) based on experience, it is highly probable that there will not be a significant reversal of revenue previously recognized.\" If these criteria are not met, revenue recognition is constrained. [11] lllustration 18.6 provides an example of how the revenue constraint works