Question: Gilmore Ltd. has a cash-settled SARs program for employees. These employees will receive a cash payment after five years of service, calculated as the excess

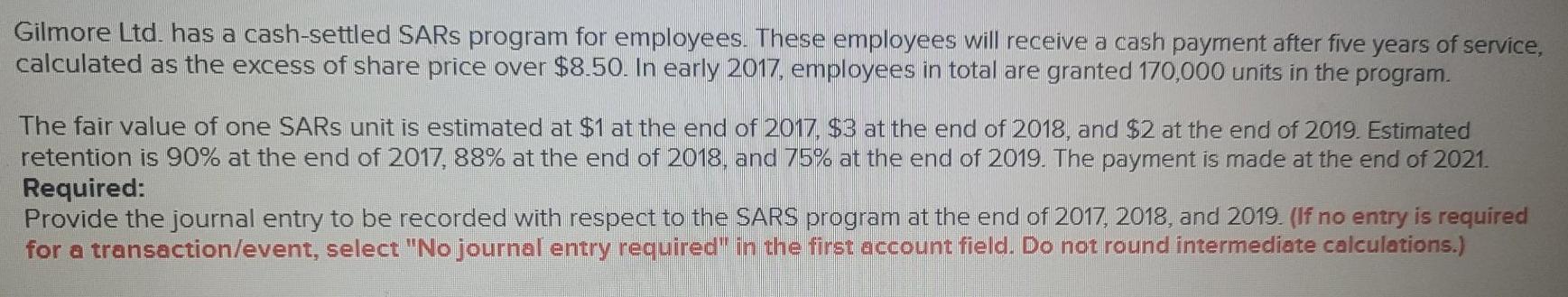

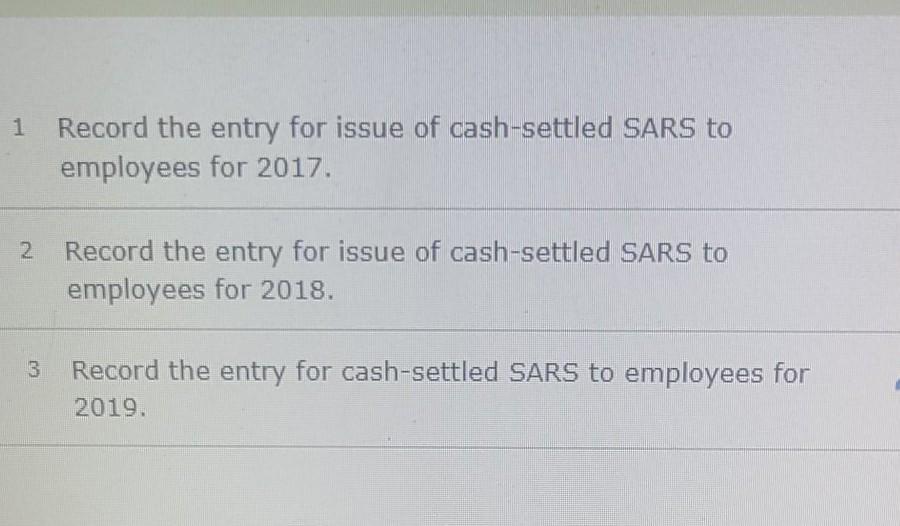

Gilmore Ltd. has a cash-settled SARs program for employees. These employees will receive a cash payment after five years of service, calculated as the excess of share price over $8.50. In early 2017, employees in total are granted 170,000 units in the program The fair value of one SARs unit is estimated at $1 at the end of 2017, $3 at the end of 2018, and $2 at the end of 2019. Estimated retention is 90% at the end of 2017, 88% at the end of 2018, and 75% at the end of 2019. The payment is made at the end of 2021. Required: Provide the journal entry to be recorded with respect to the SARS program at the end of 2017, 2018, and 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) Record the entry for issue of cash-settled SARS to employees for 2017. 2. Record the entry for issue of cash-settled SARS to employees for 2018. 3 Record the entry for cash-settled SARS to employees for 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts