Question: Gina, your 54-year-old client, has a modified endowment contract (MEC) with a basis of $25,000 and a cash value of $50,000. Gina needs to withdraw

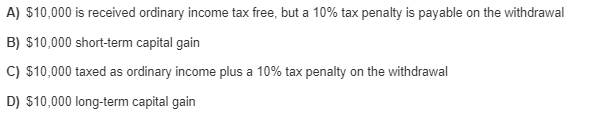

Gina, your 54-year-old client, has a modified endowment contract (MEC) with a basis of $25,000 and a cash value of $50,000. Gina needs to withdraw $10,000 from the MEC to pay the balances of her credit cards. Which of these is a tax consequence of Gina's withdrawal?

A) $10,000 is received ordinary income tax free, but a 10% tax penalty is payable on the withdrawal B) $10,000 short-term capital gain C) $10,000 taxed as ordinary income plus a 10% tax penalty on the withdrawal D) $10,000 long-term capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts