Question: Ginny and Joe Miller opened a small hardware store in 2006, using their own cash savings and borrowing a small sum from Ginnys parents. Nothing

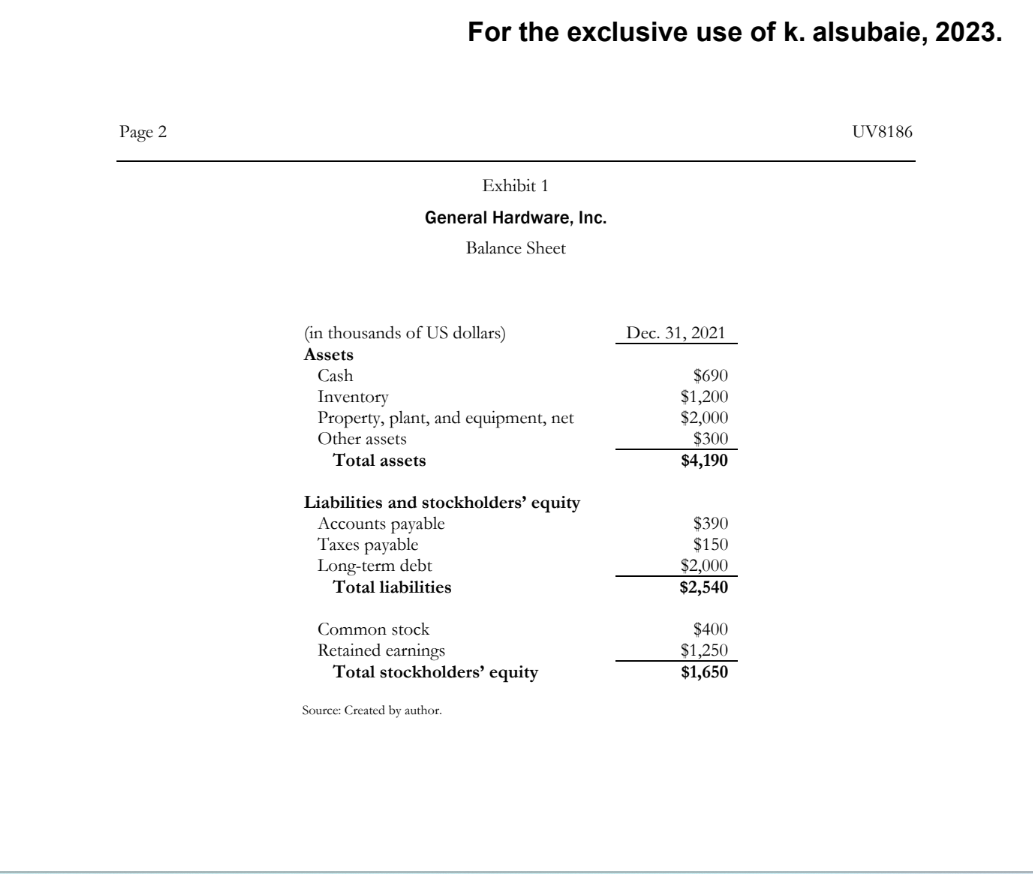

Ginny and Joe Miller opened a small hardware store in 2006, using their own cash savings and borrowing a small sum from Ginnys parents. Nothing gave them more pride than owning and operating a locally owned business, even if it was complicated by the constant pressures placed on them by big-box retailers. But by 2021, business was booming. General Hardware had five locations, and the Millers were considering an even greater expansion in the coming year, perhaps offering their own version of a national franchise model. The drop-off in activity during the first quarter of 2022, however, dampened those plans. The quarter turned out to be a time for retrenchment and planning for a sustained period of contraction. The following is a summary of first quarter activity for the year 2022, along with the final December 31, 2021, balance sheet (see Exhibit 1). Product sales totaled $3 million (all customers paid with cash), and the company had paid $2.2 million for that inventory sold. Inventory purchases totaled $1.5 million during the quarter, all on a credit basis with the companys vendors. The company had repaid its outstanding accounts payable during the quarter in the amount of $1.7 million. Marketing costs of $10,000 had been paid in February, all related to a series of Presidents Day TV advertisements. Wages, rents, and other administrative expenses totaled $373,000. All, except the March rent of $50,000, were paid with cash. The month of March rent payments, totaling $50,000 and due on or before March 15, had not been paid as of March 31. The company paid the balance due for taxes during the first quarter, and the Millers expected to pay any taxes due on their first-quarter profit during the second quarter of 2022. The corporate tax rate was a flat 25%. Depreciation charges for quarter amounted to $81,000. The company acquired $200,000 of fixed assets on the last day of the quarter, March 31, financing the entire amount with a new long-term note. Existing long-term debt carried an average interest charge of 8%. A first-quarter long-term debt payment of $75,000 had been made on March 30, covering both interest and principal for the first quarter of 2022. Using the data provided, prepare a balance sheet and income statement for General Hardware for the first quarter of 2022.

Q1- what is the income statement?

Q2- what is the balance sheet ?

For the exclusive use of k. alsubaie, 2023. UV8186 Exhibit 1 General Hardware, Inc. Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts