Question: give answer in 15 mins i will give upvote 9 Assume an efficient capital market. Consider two default risk-free bonds. Both bonds are zero-coupon bonds

give answer in 15 mins i will give upvote

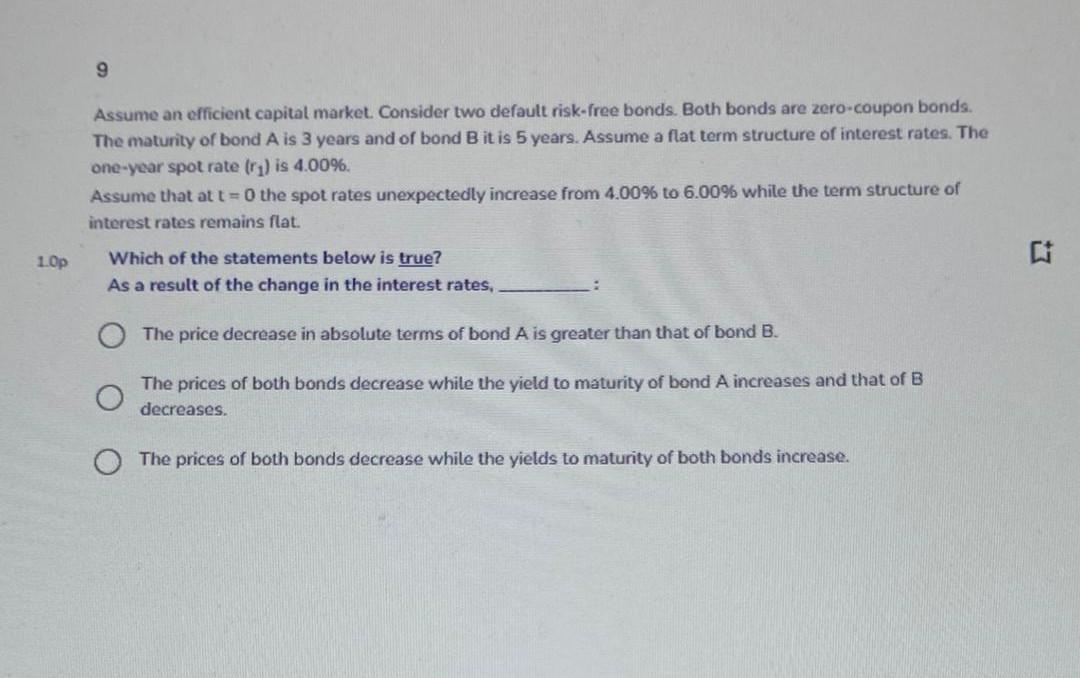

9 Assume an efficient capital market. Consider two default risk-free bonds. Both bonds are zero-coupon bonds The maturity of bond A is 3 years and of bond B it is 5 years. Assume a flat term structure of interest rates. The one-year spot rate (ru) is 4.00%. Assume that at t=0 the spot rates unexpectedly increase from 4.00% to 6.0096 while the term structure of interest rates remains flat. 1.0p Which of the statements below is true? As a result of the change in the interest rates, The price decrease in absolute terms of bond A is greater than that of bond B. The prices of both bonds decrease while the yield to maturity of bond A increases and that of B decreases. O The prices of both bonds decrease while the yields to maturity of both bonds increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts