Question: give answer in 20 mins I will thumb up 21 A company may choose between the below two investment projects, of which the following information

give answer in 20 mins I will thumb up

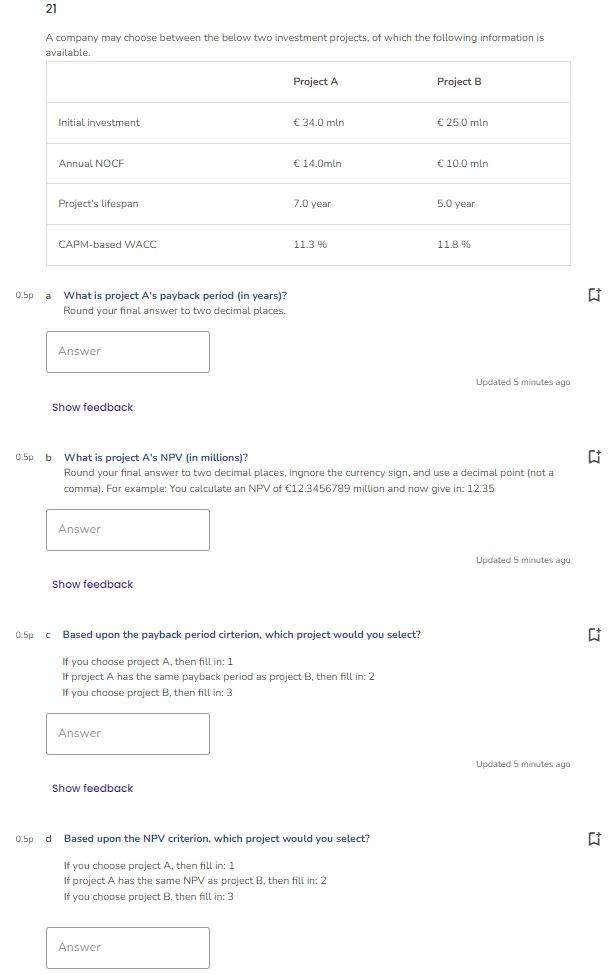

21 A company may choose between the below two investment projects, of which the following information is available. Project A Project B Initial investment 34.0 mln 25.0 mln Annual NOCH 14.0min 10.0 mln Project's lifespan 7.0 year 5.0 year CAPM-based WACC 11.3 % 11.8% . 0.5p a What is project A's payback period (in years)? Round your final answer to two decimal places. w Answer Updated 5 minutes ago 5 Show feedback . 0.5pb b What is project A's NPV (in millions)? Round your final answer to two decimal places, ingnore the currency sign, and use a decimal point (not a comma). For example: You calculate an NPV of 12.3456789 million and now give in: 12.35 Answer Updated 5 minutes ago Show feedback 0.5pc Based upon the payback period cirterion, which project would you select? 3 If you choose project A, then fill in: 1 If project A has the same payback period as project B. then fill in: 2 If you choose project B, then fill in: 3 Answer Updated 5 minutes ago Show feedback 0.5p d Based upon the NPV criterion, which project would you select? +7 If you choose project A, then fill in: 1 If project A has the same NPV as project 8, then fill in: 2 If you choose project B, then fill in: 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts