Question: give correct answer Q10 in 10 mins i will thumb up On March 1, 2020, Chucky Ltd. purchased land for $270,000 cash, which they intend

give correct answer Q10 in 10 mins i will thumb up

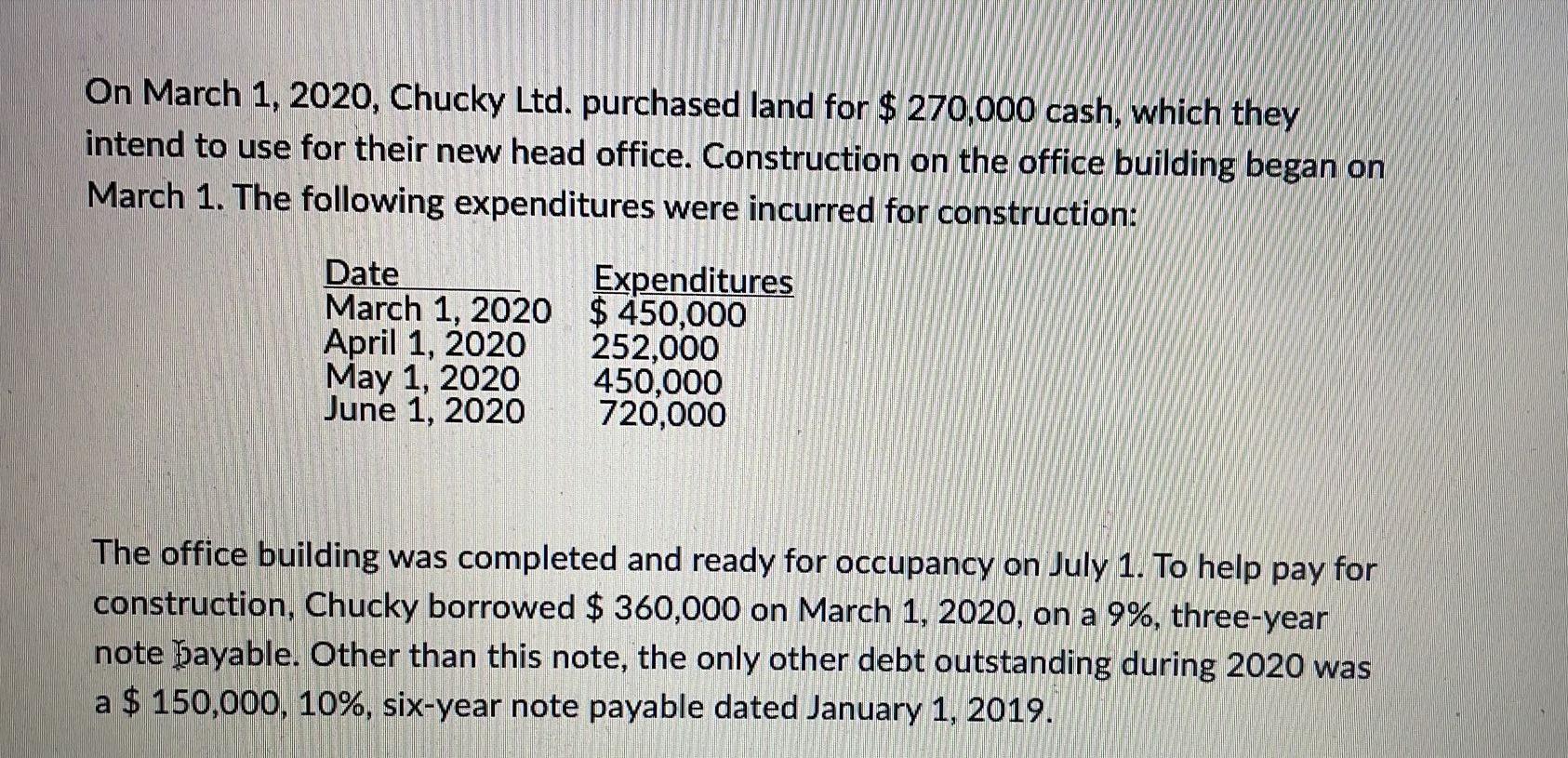

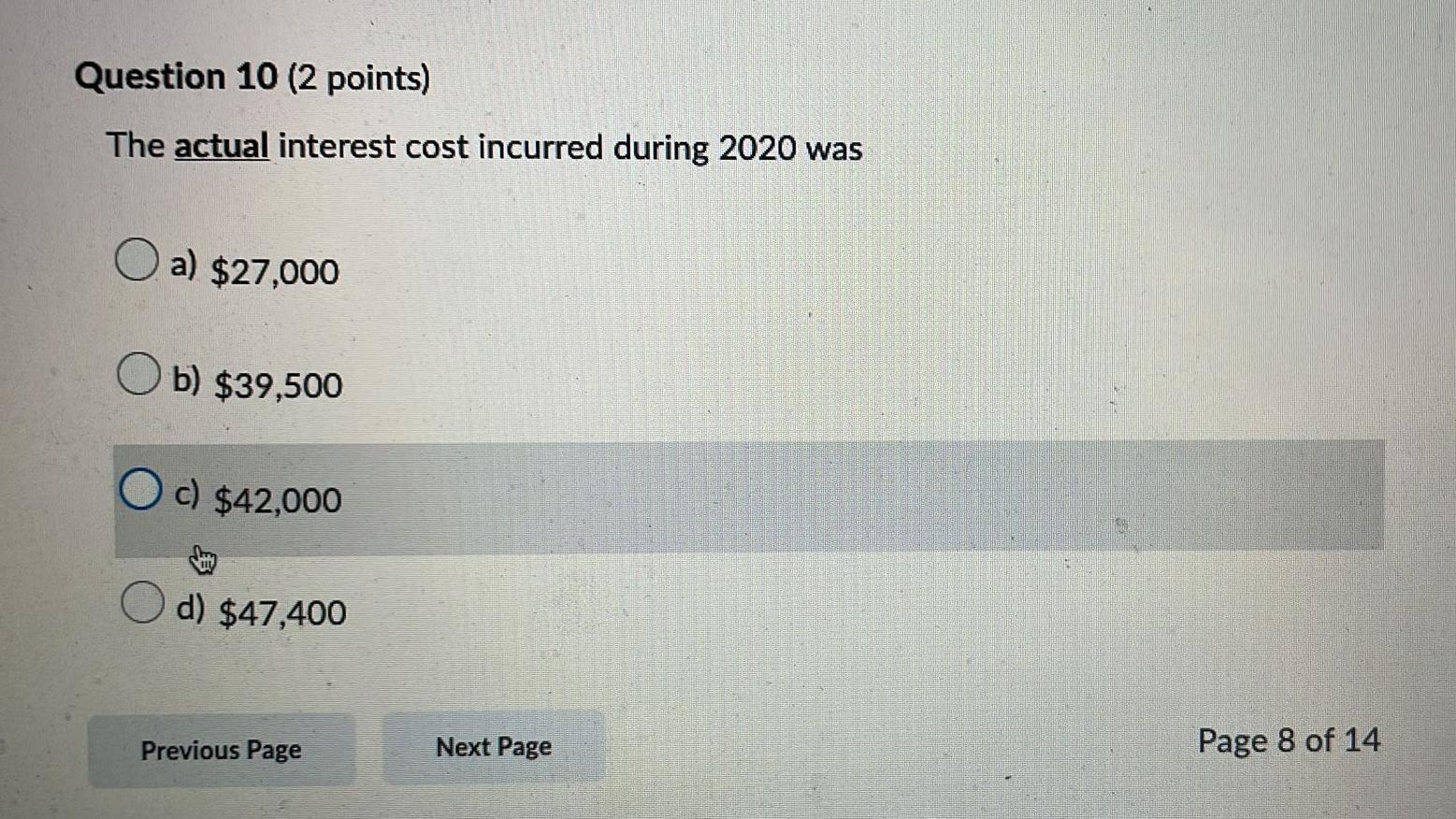

On March 1, 2020, Chucky Ltd. purchased land for $270,000 cash, which they intend to use for their new head office. Construction on the office building began on March 1. The following expenditures were incurred for construction: Date March 1, 2020 April 1, 2020 May 1, 2020 June 1, 2020 Expenditures $450,000 252,000 450,000 720,000 The office building was completed and ready for occupancy on July 1. To help pay for construction, Chucky borrowed $ 360,000 on March 1, 2020, on a 9%, three-year note payable. Other than this note, the only other debt outstanding during 2020 was a $ 150,000, 10%, six-year note payable dated January 1, 2019. Question 10 (2 points) The actual interest cost incurred during 2020 was a) $27,000 b) $39,500 Oc) $42,000 d) $47,400 Previous Page Next Page Page 8 of 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts